Vietnam Digital Biomarkers Market Analysis

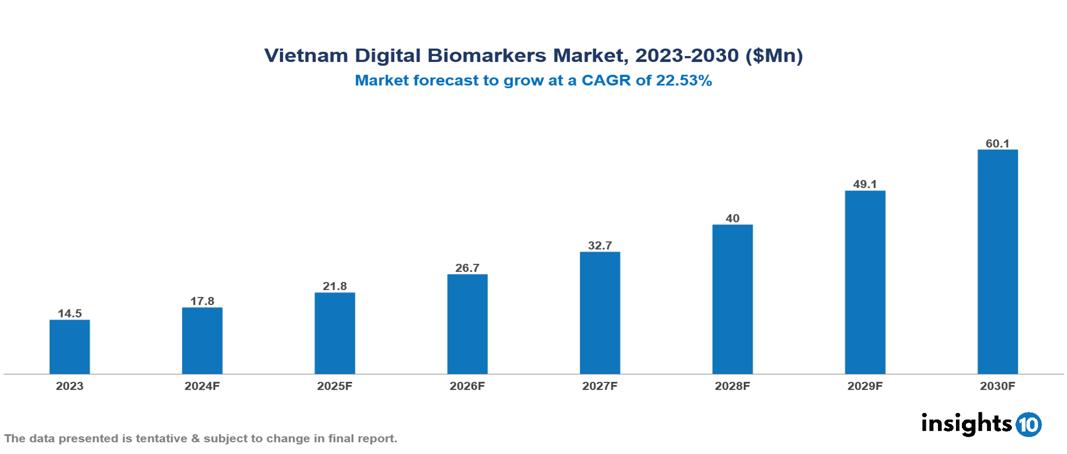

Vietnam Digital Biomarkers Market was valued at $14.50 Mn in 2023 and is predicted to grow at a CAGR of 22.53% from 2023 to 2030, to $60.13 Mn by 2030. The key drivers of this industry include the rising burden of chronic diseases, government initiatives, growing focus on preventative care, and the aging population. The industry is primarily dominated by ActiGraph LLC, AliveCor Inc., Koneksa, and Altoida Inc. among others.

Buy Now

Vietnam Digital Biomarkers Market Executive Summary

Vietnam Digital Biomarkers Market was valued at $14.50 Mn in 2023 and is predicted to grow at a CAGR of 22.53% from 2023 to 2030, to $60.13 Mn by 2030.

Digital biomarkers are quantifiable physiological and behavioral data collected by digital devices like wearables and smartphones. They provide insights into health, including disease progression and treatment response, enabling continuous monitoring and real-time data collection. These biomarkers are used for various health conditions, such as diabetes, cardiovascular disorders, mental health issues, and neurodegenerative diseases. By tracking metrics like physical activity, heart rate, and sleep patterns, digital biomarkers help clinicians make informed decisions and support research with real-world evidence. As technology advances, their potential to transform healthcare and improve patient outcomes grows.

During the COVID-19 pandemic, market players introduced innovative solutions, such as a cost-effective mobile app by Maastricht University (September 2022) to detect COVID-19 via voice changes. Heightened fitness awareness increased wearable usage, driving demand for digital biomarkers. The WHO noted over 59,000 active clinical trials globally in 2020, underscoring the rising demand for digital biomarkers.

The market therefore is driven by significant factors like the rising burden of chronic diseases, government initiatives, growing focus on preventative care, and the aging population. However, limited healthcare infrastructure, data privacy concerns, lack of standardization, and limited integration with healthcare systems restrict the growth and potential of the market.

Prominent players in this field are ActiGraph LLC which specializes in wearable devices and data analytics for physical activity and sleep monitoring, contributing to clinical research through reliable digital biomarkers. AliveCor Inc. excels in portable ECG monitoring and AI-driven cardiac analysis, enhancing early diagnosis and intervention with FDA-cleared devices like KardiaMobile. Other contributors include Koneksa, and Altoida Inc. among others.

Market Dynamics

Market Growth Drivers

Rising Burden of Chronic Diseases: Vietnam faces a growing prevalence of chronic diseases like diabetes, heart disease, and cancer. Digital biomarkers offer valuable tools for early detection, monitoring, and management of these conditions, driving market growth.

Government Initiatives: The Vietnamese government is increasingly focusing on digital health initiatives. Policies like the National Digital Transformation Strategy to 2025 promote the adoption of digital technologies in healthcare, including digital biomarkers.

Growing Focus on Preventative Care: There's a growing shift towards preventative healthcare in Vietnam. Digital biomarkers can empower individuals to take a more proactive approach to their health by tracking health indicators and identifying potential risks early on.

Aging Population: Vietnam's population is aging, leading to a greater demand for solutions that can manage chronic conditions associated with aging. Digital biomarkers can play a significant role in addressing this need.

Market Restraints

Limited Healthcare Infrastructure: Disparities exist in healthcare infrastructure across different regions of Vietnam. This can limit access to digital biomarker technologies in some areas, particularly in rural regions.

Data Privacy Concerns: Data security and privacy are major concerns in Vietnam. Building trust with users regarding data collection, storage, and usage practices is crucial for market growth.

Lack of Standardization: Standardization in data collection, analysis, and interpretation of digital biomarker data is still under development. This inconsistency can limit the usability and interoperability of these technologies across different healthcare settings.

Limited Integration with Healthcare Systems: Seamless integration of digital biomarker data with existing healthcare information systems in Vietnam is necessary for optimal utilization by healthcare professionals. Currently, this integration might be limited.

Regulatory Landscape and Reimbursement Scenario

In Vietnam, the Ministry of Health (MOH) is the primary authority regulating medical devices, including digital biomarkers. The MOH may classify digital biomarkers under software as a medical device (SaMD) or other specific categories based on their functionality. Additionally, the Vietnam National Institute of Medicinal Materials (NIHE) plays a role in the technical evaluation of these devices. Understanding the classification by the MOH is crucial for determining the appropriate regulatory pathway for approval. Clinical trial requirements for digital biomarkers may differ from those for traditional medical devices, so it is essential to investigate specific MOH guidelines. Compliance with Vietnam's data privacy regulations, particularly the Law on Personal Data Protection (PDPL), is also vital for ensuring legal handling of data collection, storage, and usage.

Reimbursement for digital biomarkers in Vietnam is currently limited. The Social Health Insurance (SHI) program, a government-funded initiative, provides coverage for a limited range of medical services and devices. Digital biomarkers demonstrating strong clinical evidence and cost-effectiveness might be considered for future inclusion in the SHI coverage. Meanwhile, private health insurance is gaining popularity in Vietnam, and some insurers may offer coverage for specific digital health solutions that integrate digital biomarkers, depending on the plan and technology.

Competitive Landscape

Key Players

Here are some of the major key players in the Vietnam Digital Biomarkers Market

- ActiGraph LLC

- AliveCor Inc.

- Koneksa

- Altoida Inc.

- Amgen Inc.

- Biogen Inc.

- Empatica Inc.

- Vivo Sense

- IXICO plc

- Adherium Limited

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Vietnam Digital Biomarkers Market Segmentation

By Type

- Wearable

- Mobile-based Applications

- Sensors

- Others

By Clinical Practice

- Diagnostic digital biomarkers

- Monitoring digital biomarkers

- Predictive and Prognostic digital biomarkers

- Other's (Safety, Pharmacodynamics/ Response, Susceptibility)

By Therapeutic Area

- Cardiovascular and metabolic disorders (CVMD)

- Respiratory disorders

- Psychiatric disorders

- Sleep & Movement Disease

- Neurological disorders

- Musculoskeletal disorders

- Others (Diabetes, Pain Management)

By End-Use

- Healthcare companies

- Healthcare Providers

- Payers

- Others (Patients, caregivers)

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.