Vietnam Depression Therapeutics Market Analysis

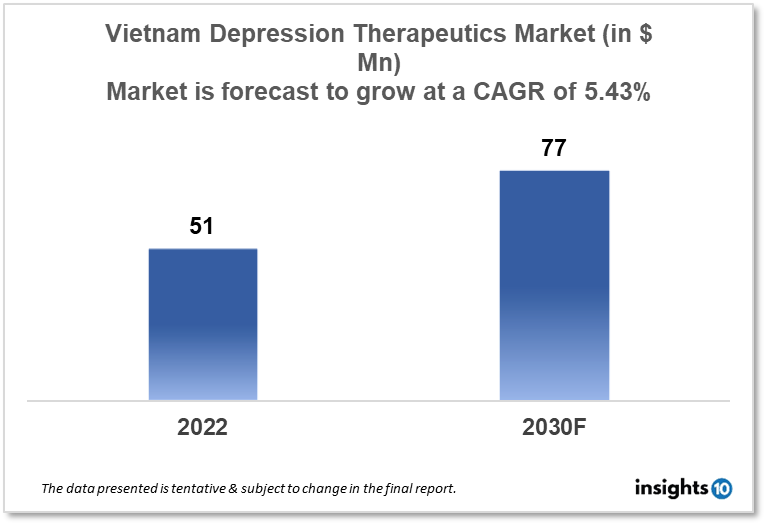

Vietnam's depression therapeutics market is expected to witness growth from $51 Mn in 2022 to $77 Mn in 2030 with a CAGR of 5.43% for the forecasted year 2022-30. The rising awareness about depression and the easy availability of depression treatments in Vietnam are driving the growth of the market. The Vietnam depression therapeutics market is segmented by drug type, therapies, indication, and by end users. Pymepharco, Lam Dong Pharmaceutical, and Allergan are the major players in the Vietnam depression therapeutics market.

Buy Now

Vietnam Depression Therapeutics Market Executive Analysis

Vietnam's depression therapeutics market is expected to witness growth from $51 Mn in 2022 to $77 Mn in 2030 with a CAGR of 5.43% for the forecasted year 2022-30. From $16.1 Bn in 2017 to $20 Bn in 2021, healthcare expenditure in Vietnam increased steadily. It is expected to reach $23.3 Bn in 2025 and $33.8 Bn in 2030. The projections are predicated on a 7.6% cumulative annual growth rate (CAGR). According to the company's October-November survey, pharmaceutical companies reported greater year-over-year revenues and profits in the first nine months of the year in 85.7% and 78.6% of cases, respectively. Among the Southeast Asian nations, Vietnam has the largest healthcare expenditure to gross domestic product (GDP) ratio at 6%. This is greater than other Southeast Asian nations, where the average rate is 4.5%, even though it is still below the global average of 9%.

Estimates of the frequency of symptoms in Vietnam that met the criteria for an anxiety or depression diagnosis were 22.8% and 41.1%, respectively. 26.3% of the students had given significant thought to suicide, 12.9% had devised a plan, and 3.8% had attempted. High scholastic stress and family abuse were two major risk factors associated with anxiety and depression.

Since the 1970s, ketamine has been used as an anesthetic with no known adverse effects in both people and animals. The FDA later authorized its use on troops serving in the Vietnam War. Because it was quick acting and offered hemodynamic stability, which was crucial for the injured, it proved to be a helpful anaesthetic on the battlefield. First used as general anaesthesia, ketamine is still employed in this capacity today. Ketamine has been used in unconventional ways over the past ten years, but its most remarkable use is as a quick-acting, effective treatment for depression and other mood disorders. Ketamine employs a distinct mechanism of action. Glutamate, a significant excitatory chemical in the brain, increases as a result. BDNF (Brain-Derived Neurotrophic Factor), a neurotrophin that encourages neuronal development and connections in the brain, is subsequently elevated through a complex pathway. Once administered intravenously, ketamine reduces depressive symptoms in patients who have not responded to standard antidepressants within hours. As a result, it is highly successful in significantly lowering suicidal thoughts. The neuronal connections in the brain that were once broken down by chronic perpetual depression are quickly restored by ketamine. An exciting new development in the treatment of depression is the quick and effective method by which ketamine treats symptomatology.

Market Dynamics

Market Growth Drivers

More individuals in Vietnam are seeking help for depression as a result of rising awareness and acceptance of mental health problems. This pattern is anticipated to last, which will increase demand for depression therapeutics. The Vietnamese government has been making investments in enhancing mental health services, including raising money for research into mental health and facilitating access to mental health care. The Vietnam depression therapeutics market is anticipated to expand as a result of these initiatives. More cheap and accessible antidepressants are becoming more readily available in Vietnam. The antidepressant market segment of the depression therapeutics market is anticipated to expand as a result.

Market Restraints

In Vietnam, there is a severe lack of qualified mental health professionals, especially in the outlying areas. As a result, patients may not have access to the treatment they require, which can restrict access to Vietnam's depression therapeutics market. In Vietnam, literature is scarce on depression and other mental health issues, may hinder the advancement of innovative and potent depression treatments. In Vietnam, traditional medicine and complementary therapies are common, and some people might favour them over Western-style depression therapies.

Competitive Landscape

Key Players

- Traphaco (VNM)

- Nam Ha Pharmaceutical (VNM)

- DOMESCO (VNM)

- Pymepharco (VNM)

- Lam Dong Pharmaceutical (VNM)

- Allergan

- Takeda Pharmaceutical

- Intellipharmaceutics

- Otsuka Holdings

- H.Lundbeck

- Apotex

Healthcare Policies and Regulatory Landscape

The national health insurance program in Vietnam, which is run by the Vietnam Social Security (VSS) covers mental health services, including those linked to depression. The general health insurance benefits package includes coverage for mental health treatments. People who have been diagnosed with depression may be eligible for reimbursement under the health insurance program for a variety of mental health services, including counselling, psychotherapy, and medication. Depending on the kind of service and the healthcare facility where it is given, different reimbursement rates apply. Nevertheless, based on how severe the depression is, there might be restrictions on how many therapy sessions are covered.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Depression Therapeutics Segmentation

By Drug Type (Revenue, USD Billion):

- Antidepressants

- Anxiolytics

- Anticonvulsants

- Noradrenergic Agents

- Atypical Antipsychotics

By Therapies (Revenue, USD Billion):

- Electroconvulsive Therapy (ECT)

- Cognitive Behaviour Therapy (CBT)

- Psychotherapy

- Deep Brain Stimulation

- Transcranial Magnetic Stimulation (TMS)

- Cranial electrotherapy stimulation (CES)

By Indication (Revenue, USD Billion):

- Major Depressive Disorder (MDD)

- Bipolar Disorder

- Dysthymic Disorder

- Postpartum Depression

- Seasonal Affective Disorder (SAD)

- Premenstrual Dysphoric Disorder (PMDD)

- Others

By End Users (Revenue, USD Billion):

- NGOs

- Asylums

- Hospitals

- Mental Healthcare Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.