Vietnam Cardiovascular Diseases Therapeutics Market Analysis

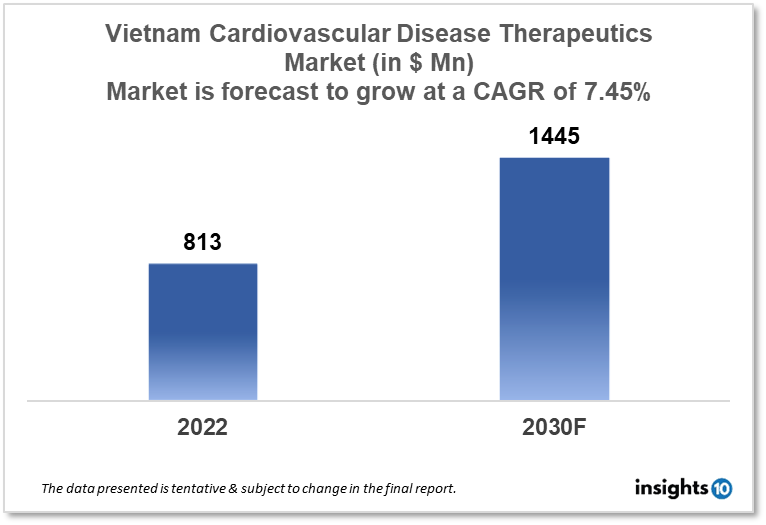

Vietnam's cardiovascular disease therapeutics market is projected to grow from $813 Mn in 2022 to $1,445 Mn in 2030 with a CAGR of 7.45% for the year 2022-2030. The rising incidence of cardiovascular diseases in Vietnam and increases governmental efforts in improving Vietnam's health infrastructure have resulted in the expansion of the market. The Vietnam cardiovascular disease therapeutics market is segmented by disease indication, drug type, route of administration, drug classification, mode of purchase, and by end user. Ha, Tay Pharmaceutical, OPC Pharmaceutical, and F. Hoffmann-La Roche are the major players in the Vietnam cardiovascular disease therapeutics market.

Buy Now

Vietnam Cardiovascular Disease Therapeutics Market Executive Analysis

Vietnam's cardiovascular disease therapeutics market is at around $813 Mn in 2022 and is projected to reach $1,445 Mn in 2030, exhibiting a CAGR of 7.45% during the forecast period. Among the Southeast Asian nations, Vietnam has the largest healthcare expenditure to gross domestic product (GDP) ratio at 6%. This is greater than other Southeast Asian nations, where the average rate is 4.5%, even though it is still below the global average of 9%. From $16.1 Bn in 2017 to $20 Bn in 2021, healthcare expenditure in Vietnam increased steadily. It is expected to reach $23.3 Bn in 2025 and $33.8 Bn in 2030. According to a November report published by Vietnam Report, a Vietnamese business ranking firm, the estimates are based on a compound annual growth rate (CAGR) of 7.6%.

In Vietnam, 49% of individuals with Atherosclerotic cardiovascular disease in the age range of 15 to 64 suffer from atherosclerosis. One of the main dangers of cardiovascular diseases is dyslipidemia (fatty blood). The government, pharmaceutical companies, healthcare facilities, and the entire society must work together on a multilateral basis to control and manage the disease given the increasing prevalence of cardiovascular disease in Vietnam.

Statins are a type of drug that decreases cholesterol concentration through the inhibition of the HMG-CoA reductase enzyme. Statins are included in a group of medications regarded as the so-called best buys for the prevention and management of non-communicable diseases in high-risk individuals and are thought to be cost-effective for basic healthcare systems. Bempedoic acid therapy for high-risk patients who cannot take statin therapy (Nexletol; Esperion) reduces the chance of serious cardiovascular problems. Bempedoic acid use decreased the relative risk of the main endpoint of death from cardiovascular causes, nonfatal MI, nonfatal stroke, or coronary revascularization by 13% compared to placebo in patients who were unable to take a statin due to intolerable side effects.

Market Dynamics

Market Growth Drivers

In Vietnam, CVDs are a significant cause for concern due to the rising prevalence of risk factors like smoking, diabetes, obesity, and hypertension. The need for CVD medicines has increased across the nation as a result. Another factor boosting the Vietnam cardiovascular disease therapeutics market is Vietnam's ageing population. Age-related increases in the likelihood of cardiovascular disease also result in an increase in the need for therapeutic interventions. The Vietnamese government is implementing a number of measures to upgrade the country's healthcare system and expand access to healthcare services. This includes increasing investment in healthcare facilities, promoting health insurance coverage, and giving subsidies for necessary medicines. Such efforts are anticipated to accelerate the development of the Vietnam cardiovascular disease therapeutics market.

Market Restraints

The prevalence of cardiovascular diseases in Vietnam is still poorly understood, both in terms of its causes and its dangers. This could lead to a decline in the demand for CVD therapeutics and sluggish market expansion. Some patients may struggle to pay for CVD therapeutics due to the high expense of the medications and procedures involved. This might restrict Vietnam's use of CVD medicines, which would have an effect on the Vietnam cardiovascular disease therapeutics market's expansion. As the CVD therapeutics industry in Vietnam grows, competition among pharmaceutical companies and healthcare providers is anticipated to increase. Price pressure and profit margin restrictions could result from this, possibly slowing the market's expansion.

Competitive Landscape

Key Players

- ImexPharm (VNM)

- Domesco Medical (VNM)

- Binh Dinh Pharmaceutical (VNM)

- Ha Tay Pharmaceutical (VNM)

- OPC Pharmaceutical (VNM)

- F. Hoffmann-La Roche

- Fresenius Kabi

- Bayer

- Sun Pharmaceutical

- Novartis

- Mylan

- Teva Pharmaceutical

Healthcare Policies and Regulatory Landscape

To ensure that every citizen has access to healthcare, the Vietnamese government established a national health insurance program. This program aims to guarantee that everyone has access to fundamental healthcare services, regardless of their ability to pay and includes a variety of medical services, including cardiovascular care. The Cardiovascular Disease Prevention Program, put into place by the Ministry of Health, emphasizes the promotion of healthy lifestyles, and early detection, and treatment of CVDs. By encouraging healthy behaviours, increasing knowledge of CVDs, and offering screening and treatment services, the program seeks to lower their incidence and mortality. In Vietnam, private health insurance is an option that some individuals choose to supplement their national health insurance plan with. Access to extra services and advantages, such as high-quality cardiovascular care, may be made possible by private health insurance.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cardiovascular Disease Therapeutics Segmentation

By Disease Indication (Revenue, USD Billion):

- Hypertension

- Coronary Artery Disease

- Hyperlipidaemia

- Arrhythmia

- Others

By Drug Type (Revenue, USD Billion):

- Antihypertensive

- Anticoagulants

- Antihyperlipidemic

- Antiplatelet Drugs

- Others

By Route of Administration (Revenue, USD Billion):

- Oral

- Parenteral

- Others

By Drug Classification (Revenue, USD Billion):

- Branded Drugs

- Generic Drugs

By Mode of Purchase (Revenue, USD Billion):

- Prescription-Based Drugs

- Over-The-Counter Drugs

By End Users (Revenue, USD Billion):

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.