Vietnam Blood Disorder Therapeutics Market

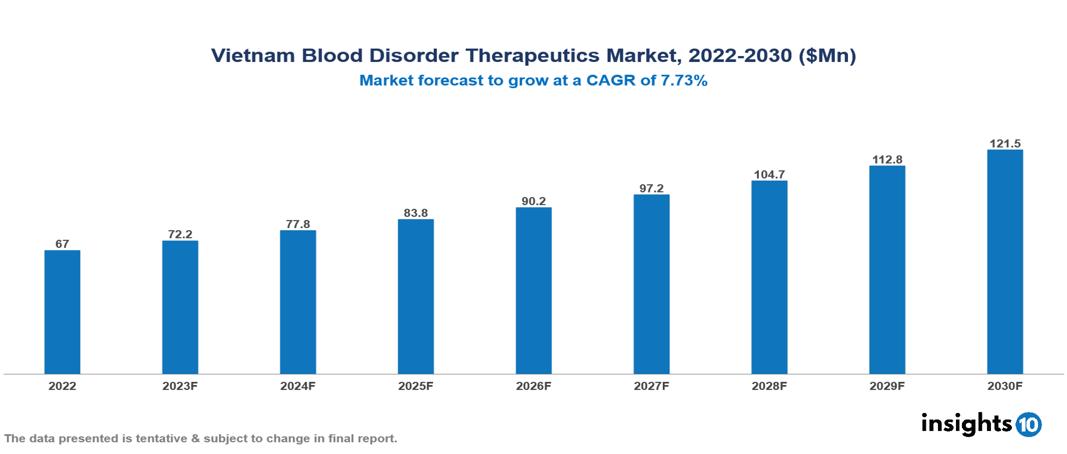

Vietnam Blood Disorder Therapeutics Market valued at $67 Mn in 2022, projected to reach $122 Mn by 2030 with a 7.73% CAGR. The key drivers of the market in Vietnam include the increasing prevalence of diseases such as aplastic anemia, hemophilia, and thalassemia due to advancements in diagnostics, lifestyle changes, and genetic susceptibility, supported by government initiatives prioritizing healthcare improvement in the country. The Vietnam Blood Disorder Therapeutics Market encompasses various players across different segments, including Takeda, Sanofi, Novo Nordisk, CSL Ltd, Pfizer, Bayer, Sun Pharma, Teva, Ha Tay Pharma, Imexpharm, etc, among various others.

Buy Now

Vietnam Blood Disorder Therapeutics Market Executive Summary

Vietnam Blood Disorder Therapeutics Market valued at $67 Mn in 2022, projected to reach $122 Mn by 2030 with a 7.73% CAGR.

A blood disorder refers to a medical condition where there is an issue with either the white blood cells (responsible for fighting infections), red blood cells (which carry oxygen throughout the body), or platelets (essential for clotting). These conditions impact the proper functioning of the blood and can manifest with varied symptoms, including weight loss and unexplained fatigue. The majority of blood disorders either decrease the quantity of nutrients, proteins, platelets, or cells in the blood or affect their optimal functioning. Many blood disorders have a genetic component, often stemming from mutations in specific gene regions. The severity of these disorders can vary, and some may or may not be malignant, depending on their underlying causes. Additionally, certain medical conditions, medications, and lifestyle factors can contribute to the development of blood disorders. Treatment options for blood disorders include pharmacotherapy, such as using medications like romiplostim to stimulate platelet production in platelet disorders. Antibiotics may be prescribed for white blood cell disorders to combat infections. Anemia resulting from deficiencies in iron, vitamin B-9, or B-12 can be addressed with dietary supplements. In more severe cases, treatments like blood transfusion therapy, chemotherapy, radiation therapy, immunotherapy, and stem cell transplantation may be considered.

Although thalassemia gene frequency varies in Vietnam, certain ethnic minority groups exhibit exceptionally high levels of the disease. According to estimates, 7.7 out of 100,000 persons in Vietnam have leukemia, with acute lymphoblastic leukemia (ALL) being the most frequent kind. The claimed prevalence of some blood diseases may be underdiagnosed as a result of limited knowledge and access to sophisticated testing.

The key drivers of the market in Vietnam include the increasing prevalence of diseases such as aplastic anemia, hemophilia, and thalassemia due to advancements in diagnostics, lifestyle changes, and genetic susceptibility, supported by government initiatives prioritizing healthcare improvement in the country.

There are several local and foreign competitors fighting for market share, causing fragmentation. Leaders in the world of blood disease treatments include Sanofi and Takeda Pharmaceutical Company Limited (Shire Plc). Domestic players Domesco, Ha Tay, and OPC have better positions in particular categories because of things like government assistance for local businesses and pricing competitiveness.

Market Dynamics

Market Growth Drivers

Growing Prevalence of Diseases: Aplastic anemia, hemophilia, and thalassemia are among the blood illnesses that are becoming more common in Vietnam as a result of advancements in diagnostics, lifestyle modifications, and genetic susceptibility. The market has room to grow as a result of the rising demand for therapy.

Government Initiatives: The Vietnamese government places a high priority on enhancing healthcare, approving larger funding allocations, and putting into action programs such as the National Targeted Programs for Non-Communicable Diseases. This opens doors for investors to enter the industry and increases access to medicines for blood disorders.

Growing Interest in Novel Therapies and Early Diagnosis: Early diagnosis lowers healthcare expenses and improves treatment results. Vietnam is seeing a rise in campaigns and public awareness around early blood condition diagnosis. Furthermore, the creation of cutting-edge treatments like gene therapy and customized medicine offers promising options for patients, which in turn drives the market growth.

Market Restraints

Expensive Treatment: Several blood disease treatments, especially those that are novel and imported, are costly. A large section of the population's access to therapy is restricted by this affordability issue, impeding market expansion. Affordability will be an issue for the segment of the population who is uninsured or whose insurance does not cover blood diseases.

Restricted Healthcare Infrastructure: Although making progress, Vietnam's healthcare system still has shortages of staff, cutting-edge diagnostic tools, and treatment facilities, especially in rural regions. This limits the availability of expert care and the best course of therapy for blood problems. Access to the best care may be hampered by a lack of hematologists, oncologists, and other medical professionals with training in blood diseases.

Stringent Regulations and Approvals: The Vietnamese drug approval procedure can be drawn out and complicated, which may cause a delay in the release of novel treatments. Accessing costly therapies is further complicated for patients by intricate payment processes and restricted insurance coverage. International regulatory harmonization may expedite market entry and simplify the approval procedure.

Healthcare Policies and Regulatory Landscape

Vietnam's healthcare policies and regulatory framework play a crucial role in the nation's efforts to improve its healthcare system. The Drug Administration of Vietnam (DAV), operating under the Ministry of Health, is a key player in shaping and enforcing regulations in the pharmaceutical sector. The healthcare policies in Vietnam focus on strengthening primary healthcare services, expanding health insurance coverage, and addressing public health challenges. As the primary regulatory authority, DAV is responsible for developing, implementing, and overseeing policies related to pharmaceuticals, medical devices, and cosmetics. Its responsibilities include the registration, licensing, and quality assurance of drugs, ensuring their safety, effectiveness, and proper usage. DAV, guided by its regulatory role, aims to streamline drug registration processes, monitor compliance with quality standards, and establish a framework for pharmacovigilance. The regulatory landscape, under DAV's guidance, aims to control pharmaceutical pricing and reimbursement, create an environment conducive to research and development, and ensure fair market practices. Collaborating with relevant ministries, healthcare providers, and the pharmaceutical industry, DAV adapts to the changing healthcare landscape. Its robust regulatory framework not only protects public health but also supports the growth of the pharmaceutical sector, encouraging innovation and ensuring the availability of safe and effective medicines for the Vietnamese population.

Competitive Landscape

Key Players:

- Takeda

- Sanofi

- Novo Nordisk

- CSL Ltd

- Pfizer

- Bayer

- Sun Pharma

- Teva

- Ha Tay Pharma

- Imexpharm

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Vietnam Blood Disorder Therapeutics Market Segmentation

By Disorder:

- Anemia

- Hemophilia

- Leukemia

- Myeloma

- Lymphoma

- Rare blood disorders

By Product Type

- Plasma-derived therapeutics

- Recombinant therapeutics

- Gene therapy

- Other therapies

By End User

- Hospitals

- Specialty clinics

- Ambulatory care

- Home healthcare

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.