Vietnam Bioinformatics Market Analysis

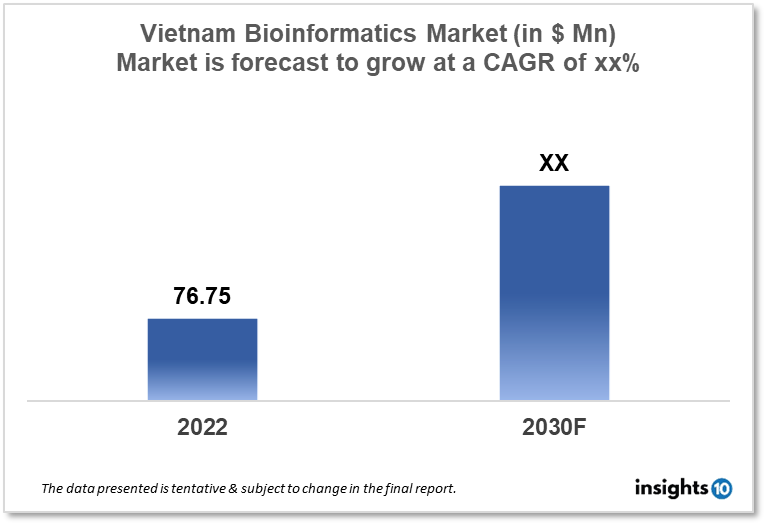

Vietnam's Bioinformatics market is projected to grow from $ 76.75 Mn in 2022 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2022-30. The main factors driving the growth would be advancements in technology, the growing healthcare sector, and investment in research and development. The market is segmented by technology and by application. Some of the major players include LOBI Vietnam (VNM), Agilent Technologies, IBM Life Sciences, and ThermoFisher Scientific.

Buy Now

Vietnam Bioinformatics Market Executive Summary

Vietnam's Bioinformatics market is projected to grow from $ 76.75 Mn in 2022 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2022-30. In 2019, healthcare spending in Vietnam as a percentage of its GDP increased to 5.25% from 5.03% in 2018. Vietnam is currently undergoing economic and demographic changes that provide the country's healthcare sector with huge opportunities.

Bioinformatics is a field of research that combines biology and information technology. The techniques utilized in bioinformatics include data production, data warehousing, data mining, data management, and others. For applications like next-generation sequencing, modeling of genomic and proteomic structure, and three-dimensional drug discovery, bioinformatics software, and tools are employed as integrated solutions to provide statistical approaches and data processing algorithms. In the upcoming years, the bioinformatics market in the Asia Pacific is expected to rise significantly. Vietnam's bioinformatics market is a relatively new and emerging market.

Market Dynamics

Market Growth Drivers

The Vietnam bioinformatics market is expected to be driven by factors such as advancements in technology, the growing healthcare sector, and investment in research and development. Vietnam ranked 44/132 in the Global Innovation Index in 2021 with approximately 18,500 scientific and technological advancements. Further, for foreign investment in the bioinformatics industry, particularly in the fields of medication research and discovery, Vietnam is becoming more alluring.

Market Restraints

The bioinformatics sector in Vietnam is still in its early stages of development, and as a result, it lacks the infrastructure required to enable its expansion. This includes a lack of sophisticated software and tools, insufficient data storage, and poor data processing capabilities which hinders the growth of the bioinformatics market. Additionally, the bioinformatics market in Vietnam's lack of clear norms and guidelines, as well as the shortage of skilled workers, are also impeding expansion.

Competitive Landscape

Key Players

- LOBI Vietnam (VNM)

- Agilent Technologies

- IBM Life Sciences

- ThermoFisher Scientific

Healthcare Policies and Regulatory Landscape

Vietnamese bioinformatics market regulations and healthcare policies are still in the early phases of development. However, the Vietnamese government has worked to support the growth of the bioinformatics sector by putting in place laws and policies that encourage both domestic and foreign investment and R&D.

The Vietnamese government has been encouraging foreign investment in the bioinformatics sector by offering monetary aid and tax breaks to businesses that make investments in the sector. The government has also been sponsoring programs and activities targeted at enhancing the effectiveness and efficiency of healthcare delivery, including research and development in the bioinformatics sector. However, there are still regulatory issues that the Vietnamese bioinformatics sector must deal with, such as the absence of precise rules and regulations.

Reimbursement Scenario

The reimbursement policies for bioinformatics services in Vietnam are still in the early stages of development and patients may be required to pay out of pocket for many bioinformatics services. Vietnam's National Health Insurance (NHI) program covers a variety of medical services. The government, employers, and people all contribute to the program's funding, which is available to all citizens. In Vietnam, there are also private insurance firms that offer healthcare coverage. These plans, however, frequently cost more than the NHI and could come with more limitations.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Bioinformatics Market Segmentation

By Technology (Revenue, USD Billion):

- Knowledge Management Tools

- Bioinformatics Platforms

- Bioinformatics Services

By Application (Revenue, USD Billion):

- Metabolomics

- Molecular phylogenetics

- Transcriptomics

- Chemoinformatic & drug design

- Genomics

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.