Vietnam Anemia Therapeutics Market Analysis

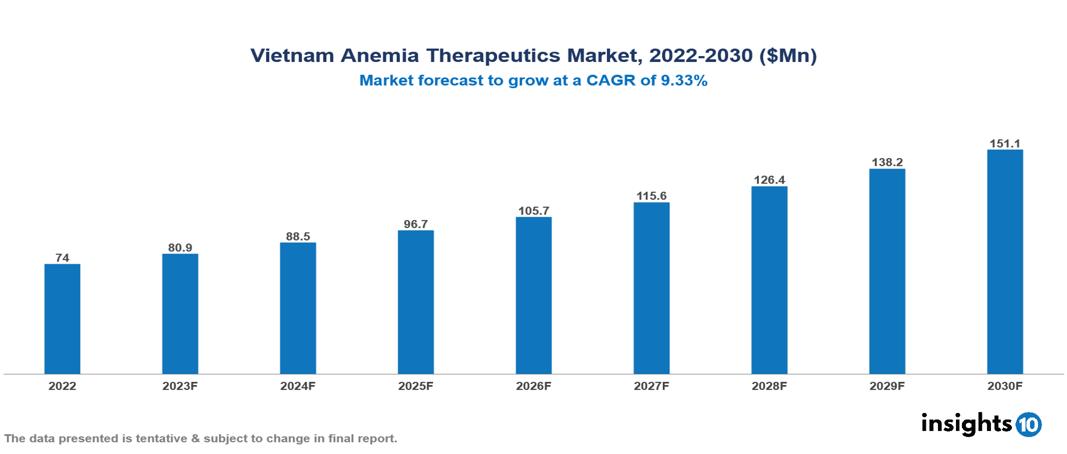

The Vietnam Anemia Therapeutics Market is anticipated to experience a growth from $74 Mn in 2022 to $151 Mn by 2030, with a CAGR of 9.3% during the forecast period of 2022-2030. High anemia prevalence, changing demographic trends and urbanization, and increased government support in the betterment of healthcare access among the population are among some factors that boost Vietnam market. The Vietnam Anemia Therapeutics Market encompasses various players across different segments, including Novartis, Pfizer, Roche, Bayer, Johnson & Johnson, Sanofi, AstraZeneca, Traphaco, Mekophar, Sao Kim Pharmaceutical etc, among various others

Buy Now

Vietnam Anemia Therapeutics Market Analysis Executive Summary

The Vietnam Anemia Therapeutics Market is anticipated to experience a growth from $74 Mn in 2022 to $151 Mn by 2030, with a CAGR of 9.3% during the forecast period of 2022-2030.

Anemia, a blood disorder, occurs when the body does not produce enough healthy red blood cells to supply oxygen to the body's tissues. Hemolytic anemia, sickle cell anemia, Iron-Deficiency Anemia (IDA), and vitamin deficiency anemia are among the several forms of anemia. The underlying cause of anemia determines the course of therapy. For instance, vitamin deficiency anemia is typically treated with vitamin supplements, but IDA is typically treated with iron supplements and dietary modifications. Treatment options for sickle cell anemia include oxygen therapy, analgesics, and intravenous fluids to hydrate the patient and lessen discomfort. In certain cases, bone marrow transplantation or blood transfusions may also be required to increase red blood cell counts. Recombinant human erythropoietin is one of the newer therapies for anemia; it can be used to treat anemia brought on by chemotherapy or chronic renal disease.

In Vietnam, the prevalence of anemia varies by demographic. Anemia prevalence among women of reproductive age who are not pregnant is 29.9%; rates are higher in rural than in urban settings. Anemia affects 11.4% of Vietnamese children between the ages of 6 and 11. High anemia prevalence, changing demographic trends and urbanization, and increased government support in the betterment of healthcare access among the population are among some factors that boost the Vietnam market.

Large market shares are possessed by multinational corporations because of their well-known brands and product lines. Their dominance may differ in different segments. For example, Novartis and Roche lead in ESAs, whereas Pfizer is superior in oral iron. Domestic companies with a strong local presence and reasonable pricing, such as Traphaco and Mekophar, are formidable competitors, especially in the oral iron market. The increasing popularity of generic iron supplements puts branded competitors' market share under pressure, providing more cost-effective choices and changing the dynamics of the industry as a whole.

Market Dynamics

Market Growth Drivers

Shifting Demographics and Lifestyle Patterns: The rising proportion of the elderly population, susceptible to anemia-related conditions such as chronic kidney disease is fueling an increased need for specific treatments. Urbanization-induced changes in dietary habits and lifestyles may contribute to deficiencies in micronutrients and iron, impacting the demand for related therapeutics.

Changes in Government Policies and Regulations: Government initiatives aimed at preventing and managing anemia, as manifested in national anemia control programs, create a conducive environment for the growth of relevant therapeutics. Policies influencing drug pricing and reimbursement can affect the accessibility and market adoption of various anemia treatments.

Increasing Anemia Prevalence: Vietnam grapples with a substantial burden of anemia, particularly among vulnerable groups such as pregnant women, children under five, and individuals with chronic illnesses. Multiple factors, including malnutrition, parasitic infections, chronic kidney disease, and micronutrient deficiencies, contribute to this high prevalence, fostering significant demand for anemia treatments and propelling market expansion.

Market Restraints

Insufficient Knowledge and Education: Insufficient knowledge of anemia and its treatment options among the general public may make it more difficult to diagnose and treat this illness in a timely manner. The problem is exacerbated by the lack of comprehensive educational initiatives and public health campaigns, which may cause anemia to be recognized later and result in postponed medical measures.

Inadequate Financial Resources: Financial barriers, especially the high incidence of poverty in some populations, make it difficult to obtain necessary medical care and raise serious questions about the cost-effectiveness of anemia therapies. For those who are struggling to make ends meet, the higher prices of more sophisticated treatment choices provide a significant obstacle that prevents them from receiving the best possible medical care.

Inadequacies in Healthcare Infrastructure: Inadequate medical facilities and resources in different parts of Vietnam pose a serious challenge to the timely and efficient identification and management of anemia. This insufficiency might make it more difficult to administer prompt medicinal measures, which would make controlling anemia more difficult. Another degree of complication is added by the limited availability of specialist healthcare providers, such as hematologists, which may lower the standard of anemia treatment provided overall.

Healthcare Policies and Regulatory Landscape

Vietnam is working hard to improve its healthcare system, and a key part of that work is modifying its healthcare laws and regulations. Functioning under the Ministry of Health, the Drug Administration of Vietnam (DAV) plays a crucial role in establishing and implementing laws pertaining to the pharmaceutical industry. Vietnam's healthcare policies seek to improve public health issues, increase access to basic healthcare, and broaden the scope of health insurance. As the primary regulatory body, DAV is in charge of developing, putting into effect, and supervising regulations relating to drugs, devices, and cosmetics. Its responsibilities include licensing, registration, and quality control for pharmaceuticals, guaranteeing their efficacy, safety, and appropriate usage. Under the direction of DAV, the regulatory environment aims to provide a framework for pharmacovigilance, monitor adherence to quality standards, and expedite the drug registration process. DAV keeps an eye on things like pharmaceutical payment and price, promotes an atmosphere that supports R&D, and ensures that fair market practices are followed.

Competitive Landscape

Key Players:

- Novartis

- Pfizer

- Roche

- Bayer

- Johnson & Johnson

- Sanofi

- AstraZeneca

- Traphaco

- Mekophar

- Sao Kim Pharmaceutical

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Vietnam Anemia Therapeutics Market Segmentation

By Type of Disease

- Iron Deficiency Anemia

- Megaloblastic Anemia

- Pernicious Anemia

- Hemorrhagic Anemia

- Hemolytic Anemia

- Sickle Cell Anemia

By Population

- Pediatrics

- Adults

- Geriatrics

By Therapy Type

- Oral Iron Therapy

- Parenteral Iron Therapy

- Red Blood Cell Transplantation

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.