Vietnam Alcohol Addiction Therapeutics Market Analysis

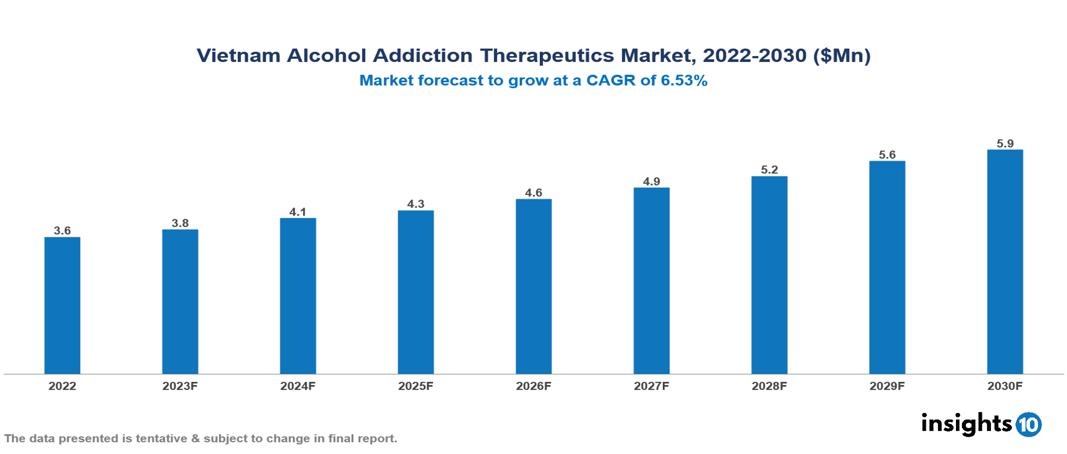

The Vietnam Alcohol Addiction Therapeutics Market is valued at around $4 Mn in 2022 and is projected to reach $6 Mn by 2030, exhibiting a CAGR of 6.53% during the forecast period. The market drivers in the Vietnam Alcohol Addiction Therapeutic Market include factors like rising harmful alcohol use among the 18–29 age group, increased recognition of alcohol addiction as a treatable mental health issue, and growing demand for therapeutic innovation in addiction therapy. The key players involved in the research, development, and distribution of Alcohol Addiction Therapeutics in Vietnam are Abbott, Pfizer, AstraZeneca, Roche, Lundbeck, Traphaco, Hau Giang Pharmaceuticals, Bidipharm Pharmaceuticals, Stada Vietnam, Mylan Laboratories, etc., among others.

Buy Now

Vietnam Alcohol Addiction Therapeutics Market Executive Summary

The Vietnam Alcohol Addiction Therapeutics Market is valued at around $4 Mn in 2022 and is projected to reach $6 Mn by 2030, exhibiting a CAGR of 6.53% during the forecast period.

Alcohol addiction, also referred to as alcohol use disorder (AUD), is more complicated than an irrational fondness for drinking. An intense need for alcohol persists despite the disease's chronicity and complexity, causing substantial emotional, bodily, and social consequences. Although getting this sickness isn't a choice, recovery is achievable. Alcohol's addictive properties, stress, and genetics can all play a role in the development of this illness. Thankfully, there are several treatment choices available, each specifically designed to meet the unique requirements of those battling alcoholism. Drugs can help control cravings and symptoms of withdrawal, but treatment addresses underlying psychological problems and provides constructive coping skills. Support groups are a great source of support and encouragement for people going through recovery.

Approximately 3% of Vietnamese women and 12% of Vietnamese men suffer from alcoholism or alcohol dependency. These numbers exceed the global averages, which are 2% for women and 5% for men. When compared to earlier age groups, the younger generation (aged 18–29) exhibits a particularly alarming trend: greater rates of dangerous alcohol intake. The market drivers in the Vietnam Alcohol Addiction Therapeutic Market include factors like rising harmful alcohol use among the 18–29 age group, increased recognition of alcohol addiction as a treatable mental health issue, and growing demand for therapeutic innovation in addiction therapy.

Various firms lead the therapeutic market, depending on the drug sector. Abbott is the leading manufacturer of branded drugs, whereas Traphaco specializes in generics and Vinmec offers comprehensive programs. An organization by the name of CED promotes mental health and aids in community outreach in Vietnam.

Market Dynamics

Market Drivers

Growing Incidence: Dangerous alcohol use is on the rise in Vietnam, surpassing global statistics, especially among men in the 18-29 age range. Accepting social cues and adapting the “cooler” lifestyle, the young population is driven by increased consumption of alcohol. The growing need for efficient treatments as a result of this demographic shift presents a great opportunity for market growth.

Mental Health Ascending: A greater awareness of alcohol addiction as a curable mental health disease is being brought about by the increasing emphasis on mental well-being in Vietnamese culture. As a result, those seeking recovery are given greater empathy and assistance, which makes the climate more favourable for market participants. Increased urbanization and shifting minds from traditional, stigmatised mindsets, lead to an increased demand for mental health in Vietnam.

Rising Therapeutic Innovation: Innovative and practical solutions are always being developed in addiction therapy due to the ongoing evolution of treatment modalities. Novel treatment approaches such as cognitive-behavioural therapy and state-of-the-art pharmacological drugs are opening up new avenues for market development and investment.

Market Restraints

Lack of Specialists: Particularly in rural locations, the severe lack of qualified experts, notably addiction counsellors and psychotherapists, creates a bottleneck that restricts patient access to specialized care. This lack of knowledge possibly impedes patients' progress toward recovery by limiting market expansion and compromising the quality of service.

Affordability: Good treatment plans are investments in a life that has been altered, not merely a medical intervention. However, this investment may appear like an impossible jump across a financial abyss for many Vietnamese who are battling alcoholism. Many people cannot afford the life-altering resources that drugs, therapy sessions, and rehabilitation centers provide because of their exorbitant costs. In addition to being a barrier to the market, this affordability gap keeps people in addictive cycles by preventing them from accessing appropriate treatment.

Insurance Coverage: Patients and their families are left to bear the financial burden of addiction treatment expenses since the existing system frequently does not cover these costs adequately. In addition to limiting market penetration, this lack of funding from both public and private insurance makes individuals in need of assistance feel forlorn and depressed.

Healthcare Policies and Regulatory Landscape

The Ministry of Health (MOH), which is in charge of managing the creation and application of health initiatives, directs Vietnamese healthcare policy. The government has worked hard to make healthcare more accessible, emphasizing infrastructure development, preventative treatment, and increasing the number of people who can obtain health insurance. As the nation's drug regulating body, the Drug Administration of Vietnam (DAV) is in charge of guaranteeing the security, effectiveness, and calibre of medications. DAV is essential to the licensing, registration, and post-marketing supervision of drugs. Vietnam has made efforts in recent years to bring its regulatory standards into line with global norms, which has helped to create a pharmaceutical industry that is more trustworthy and transparent. The MOH and DAV's partnership shows a dedication to improving public health and making sure that the Vietnamese people have access to safe and efficient pharmaceuticals.

Competitive Landscape

Key Players

- Abbott

- Pfizer

- AstraZeneca

- Roche

- Lundbeck

- Traphaco

- Hau Giang Pharmaceuticals

- Bidipharm Pharmaceuticals

- Stada Vietnam

- Mylan Laboratories

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.