US Periodontal Therapeutics Market Analysis

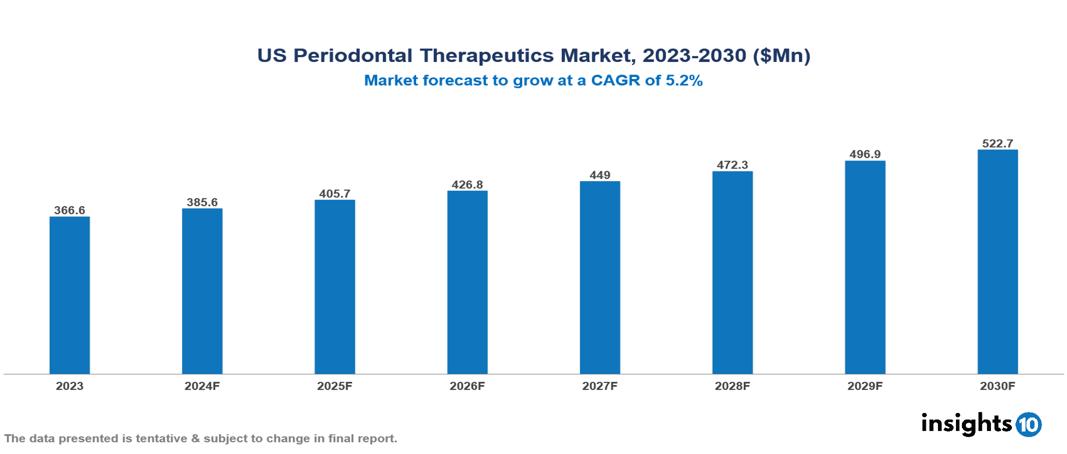

The US Periodontal Therapeutics Market was valued at $366.6 Mn in 2023 and is predicted to grow at a CAGR of 5.2% from 2023 to 2030, to $522.7 Mn by 2030. The US Periodontal Therapeutics Market is growing due to Rise in prevalence of periodontitis, Emphasis on Preventive Oral Care, and Technological Developments. The market is primarily dominated by players such as Pfizer Inc., Lupin Ltd, Teva Pharmaceuticals USA, Sun Pharmaceutical Industries Ltd, Tokyo Chemical Industry Co. Ltd., and Bausch Health Companies Inc.

Buy Now

US Periodontal Therapeutics Market Executive Summary

US Periodontal Therapeutics Market is at around $366.6 Mn in 2023 and is projected to reach $522.7 Mn in 2030, exhibiting a CAGR of 5.2% during the forecast period.

Periodontal disease, commonly known as gum disease, is a major dental health disease associated with inflammation and infection of the gums surrounding the teeth. Periodontitis is a very common condition, usually caused by poor oral hygiene, and can be prevented in most cases by surgical, non-surgical, or therapeutic treatment procedures Periodontal therapeutics include the use of antibiotics alone for the treatment of periodontitis and is relatively a small but lucrative method, gaining promise among patients and dentists. Metronidazole, amoxicillin, and doxycycline are often used antibiotics in periodontal therapy. Adjunctive therapies for reducing gingival inflammation and plaque include a variety of mouthwashes and rinses that contain antimicrobial agents such as hydrogen peroxide, chlorhexidine, and essential oils.

Periodontitis, a prevalent gum disease in the US, affects approximately 40% of adults aged 30 and older, with higher rates in men (50%) compared to women (33%). The prevalence increases significantly with age, impacting 60% of adults aged 65 and older. Demographic factors such as age, gender, socioeconomic status, and access to dental care play a crucial role in the incidence of periodontitis. Lower-income and education levels are associated with higher rates of the disease, reflecting disparities in oral healthcare access and awareness. The healthcare expenses related to periodontitis are substantial, contributing significantly to the overall dental care costs in the US. The market, therefore, is driven by significant factors like Rise in prevalence of periodontitis, Emphasis on Preventive Oral Care, and Technological Developments. However, Stringent Regulatory Requirements, Side Effects, and Complications, High Cost restrict the growth and potential of the market.

Bausch Health Companies Inc. and its oral health care division, OraPharma announced plans to team up with the League of United Latin American Citizens (LULAC), the biggest Hispanic group in the US. Their goal is to spread awareness about gum disease among Hispanic communities. This collaboration aims to help Hispanics better understand how to detect and treat gum disease.

Market Dynamics

Market Growth Drivers

Rise in prevalence of periodontitis: Periodontitis affects approximately 40% of adults aged 30 and older, with higher rates in men (50%) compared to women (33%). This leads to increased demand for treatments and products. Consequently, oral health awareness rises, resulting in more professional care visits. Additionally, persistent risk factors ensure ongoing market needs.

Emphasis on Preventive Oral Care: The future of periodontal care lies in precision prevention. Genetic testing will identify susceptibility to periodontal diseases. Biomarker analysis will enable ultra-early detection of inflammation. Personalized probiotics will optimize oral microbiomes. Nanotechnology-enhanced oral care products will provide targeted plaque control.

Technological Developments: Workflows in periodontal practices are streamlined by technological integration. Traditional molding procedures are eliminated by using digital impressions, which save time. Treatment planning is expedited with AI-assisted diagnosis. Dental doctors and team members can easily share data thanks to cloud-based technology. Online scheduling and automated appointment reminders enhance patient care.

Market Restraints

Stringent Regulatory Requirements: FDA rigorous approval process poses a substantial barrier to market entry for new periodontal treatments in the US. Additionally, varying state regulations and insurance coverage inconsistencies complicate nationwide adoption and reimbursement, deterring investment in advanced periodontal care technologies.

Side Effects and Complications: Potential side effects like post-operative pain and swelling can deter patients from seeking comprehensive periodontal care. These concerns arise particularly with invasive treatments such as periodontal surgery or dental implants, where discomfort and recovery time are significant considerations. Fear of pain and swelling may lead patients to delay or avoid necessary procedures, compromising their oral health and exacerbating existing periodontal conditions. However, advancements in minimally invasive techniques, improved anaesthesia, and post-operative care protocols aim to mitigate these side effects.

High cost: High costs, combined with socioeconomic disparities, result in delayed treatments and worsened oral health outcomes, particularly in low-income and uninsured populations. This financial barrier significantly impacts the growth of the periodontal market. Currently, approximately 40% of Americans face challenges in accessing comprehensive periodontal care due to financial constraints, underscoring the widespread impact of cost on oral health outcomes and market dynamics.

Regulatory Landscape and Reimbursement scenario

The regulatory landscape of the US dental periodontics market is governed by multiple entities, including the American Dental Association (ADA) and the American Academy of Periodontology (AAP), which set professional standards and guidelines. The Food and Drug Administration (FDA) oversees the approval and regulation of dental devices, materials, and drugs. State dental boards enforce licensure requirements, practice standards, and continuing education mandates for periodontists. The regulatory environment aims to ensure patient safety, high-quality care, and the ethical practice of periodontics.

In the US dental periodontics market, reimbursement plays a crucial role in shaping treatment patterns and patient access to care. Dental insurance policies often cover periodontal treatments such as scaling, root planning, and periodontal maintenance, though coverage specifics can vary widely. Reimbursement rates from insurance companies or government programs like Medicaid impact the financial viability of dental practices and influence the choice of treatment modalities recommended by periodontists. Providers navigate a landscape where balancing patient needs with financial considerations is essential, often requiring clear communication with patients regarding coverage limitations and out-of-pocket expenses for comprehensive periodontal care.

Competitive Landscape

Key Players

Here are some of the major key players in US Periodontal Therapeutics Market:

- Pfizer Inc.

- Lupin Ltd

- Teva Pharmaceuticals USA, Inc.

- Sun Pharmaceutical Industries Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Bausch Health Companies Inc.

- Melinta Therapeutics LLC

- Cipla, Inc.

- Chartwell Pharmaceuticals LLC.

- ASA Dental S.p.A.

- Steris-Hu-Friedy

- Carl Martin GmBH

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

US Periodontal Therapeutics Market Segmentation

By Disease

- Gingivitis

- Chronic Periodontal Disease

- Aggressive Periodontal Disease

- Others

By Drug Type

- Doxycycline

- Minocycline

- Chlorhexidine

- Metronidazole

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Channel

By Treatment procedures

- Scaling And Root Planing

- Gum Grafting

- Regenerative Therapy

- Dental Crown Lengthening

- Periodontal Pocket Procedures

- Single Tooth Dental Implants

- Multiple Tooth Dental Implants

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.