US Palliative Care Market Analysis

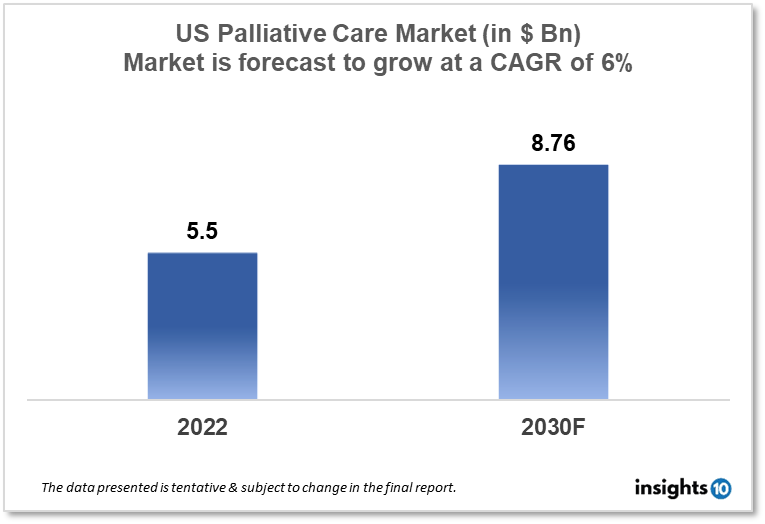

The US Palliative care market is projected to grow from $5.5 Bn in 2022 to $8.76 Bn by 2030, registering a CAGR of 6% during the forecast period of 2022 - 2030. The main factors driving the growth would be the aging population, growing demand for comfort and quality of life, integration with other healthcare facilities, and government support. The market is segmented by service type and by the end user. Some of the major players include Amedisys, Vitas Healthcare, Golden Living Centers, Genesis Healthcare, Home Instead, Kindred hospice, Sunrise Living Centers, and UCLA Health.

Buy Now

US Palliative Management Market Executive Summary

The US Palliative care market is projected to grow from $5.5 Bn in 2022 to $8.76 Bn by 2030, registering a CAGR of 6% during the forecast period of 2022 - 2030. In terms of a percentage of GDP, US national healthcare spending in 2021 was 18.3% or $12,914 per person. Of all industrialized countries, the US spends the most on healthcare relative to GDP in terms of both public and private healthcare spending.

Palliative care is a specialist medical treatment for patients with life-threatening illnesses. Relief from the illness's symptoms and stress is the main goal of this kind of care. The objective is to enhance the patient's and the family's quality of life. A specifically trained group of physicians, nurses, and other professionals who collaborate with a patient's medical clinicians to offer an additional layer of support provides palliative care. Palliative care is based on the patient's needs rather than their prognosis. At any age or stage of a serious illness, it is suitable, and it can be given in addition to curative care. Due to growing market rivalry, North America is now leading the palliative care industry in terms of revenue and is predicted to expand quickly in the years to come.

Market Dynamics

Market Growth Drivers

The US palliative care market is expected to be driven by factors such as the aging population, growing demand for comfort and quality of life, and integration with other healthcare facilities. Moreover, through programs like the Affordable Care Act, which incentivizes hospitals to offer palliative care services to patients, the government is also helping to promote palliative care in the country.

Market Restraints

The factors that are limiting the growth of the palliative care market in the US are the high cost of treatment and fragmented delivery models. Palliative care services are frequently provided in a fragmented manner, which can result in poor care coordination and provide patients with less-than-ideal outcomes and limit the growth of the market.

Competitive Landscape

Key Players

- Amedisys (USA)

- Vitas Healthcare (USA)

- Golden Living Centers (USA)

- Genesis Healthcare (USA)

- Home Instead (USA)

- Kindred Hospice (USA)

- Sunrise Living Centers (USA)

- UCLA Health (USA)

Notable Recent Deals

April 2022: Amedisys acquired Evolution Health, a provider of home health services. In 15 locations in Texas, Oklahoma, and Ohio, Evolution Health, LLC, a branch of Envision Healthcare, operates as Guardian Healthcare, Gem City, and Care Connection of Cincinnati. All of Evolution Health's ownership interests have been acquired by Amedisys.

September 2022: Vitas Healthcare has launched a de novo location in Florida, extending its reach to three more counties. In the Florida city of Clewiston, the business has its newest location. Due in part to the skyrocketing valuations in the industry, VITAS has chosen to concentrate on de novos for geographic growth as opposed to acquisitions, unlike some of its rivals.

Healthcare Policies and Regulatory Landscape

The regulatory environment for the US palliative care market is primarily defined by numerous federal and state laws and regulations. National Coalition for Hospice and Palliative Care provides guidelines for quality palliative care through a National Consensus Project (NCP). The Medicare Hospice Benefit, the Physician Quality Reporting System (PQRS), the Hospice Quality Reporting Program (HQRP), the Patient Protection and Affordable Care Act (PPACA), and state-specific statutes are among them. The ACA increased access to palliative care by mandating that all hospices accepting Medicare offer interdisciplinary team care, which includes medical services, nursing care, social services, and counseling for both spirituality and psychology. For people who have chosen hospice care over curative therapy and have a life expectancy of six months or less, the Medicare Hospice Benefit covers palliative care.

The PQRS and HQRP programs offer financial incentives to hospices that achieve particular quality performance criteria, such as the provision of bereavement services, prompt assessment and management of pain and other symptoms, and patient/caregiver satisfaction.

Reimbursement Scenario

Depending on the payer and the facility where care is delivered, different palliative care reimbursement policies exist in the US. Palliative care is covered by Medicare as a part of the hospice benefit, which is provided to people with a life expectancy of at least six months. The patient's home, a hospice center, or a nursing home are just a few locations where hospice care might be delivered. Palliative care services may or may not be covered by private insurance. Palliative care is covered by some private insurance plans' medical benefits, but not all of them do.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Palliative Care Market Segmentation

By Service Type (Revenue, USD Billion):

Based on service type, the US palliative care market is divided into the following:

- Private residence care

- Hospice inpatient care

- Hospital inpatient care

- Nursing home and residential facility care

- Others

By End User (Revenue, USD Billion):

Based on end-user type, the US palliative care market is divided into the following:

- Hospitals

- Home Care Settings

- Palliative Care Centers

- Long-Term Care Centers & Rehabilitation Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.