US Medical Devices Market Analysis

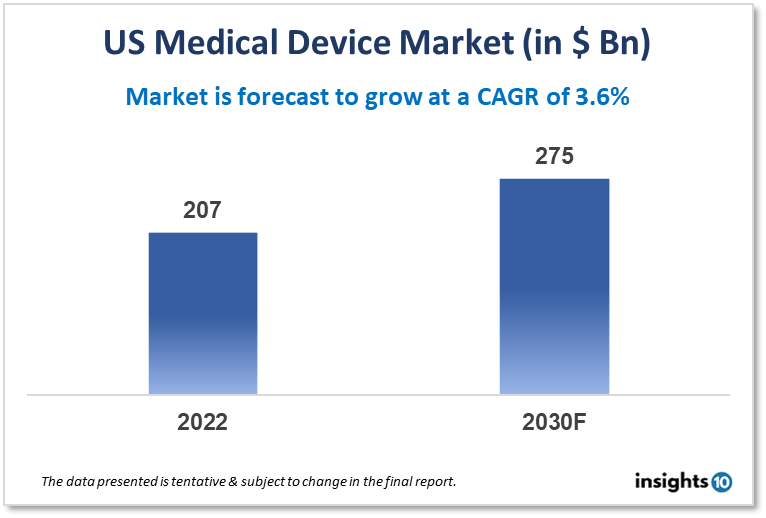

The US medical devices market is projected to grow from $207 Bn in 2022 to $275 Bn by 2030, registering a CAGR of 3.60% during the forecast period of 2022-30. As the US population continues to age, the demand for medical devices is expected to increase. Older adults are more likely to have chronic health conditions that require monitoring and treatment, and medical devices can play a key role in managing these conditions. Some of the key players in the US medical device market include companies like Medtronic, Johnson & Johnson, GE Healthcare, and Abbott Laboratories, among others.

Buy Now

US Medical Devices Market Executive Summary

The US medical devices market is projected to grow from $207 Bn in 2022 to $275 Bn by 2030, registering a CAGR of 3.60% during the forecast period of 2022-30.

The US medical devices market is one of the largest in the world, with a wide range of products used in healthcare settings to diagnose, monitor, and treat patients. The market includes everything from simple tools like stethoscopes and blood pressure cuffs to advanced technologies like implantable devices and robotic surgery systems.

The market is highly competitive, with a large number of companies producing and selling medical devices in the US and around the world. Some of the key segments of the US medical device market include:

- Diagnostic imaging: This segment includes devices like MRI machines, CT scanners, and ultrasound machines, which are used to visualize internal organs and tissues

- In vitro diagnostics: This segment includes tests and devices used to diagnose medical conditions, such as blood glucose meters and pregnancy tests

- Cardiology: This segment includes devices used to diagnose and treat heart conditions, such as pacemakers, stents, and defibrillators

- Orthopedics: This segment includes devices used to treat musculoskeletal conditions, such as joint replacements and orthopedic braces

- Endoscopy: This segment includes devices used for minimally invasive surgeries, such as laparoscopes and bronchoscopes

- Dental: This segment includes devices used in dental procedures, such as dental implants and orthodontic braces

Some of the key players in the US medical device market include companies like Medtronic, Johnson & Johnson, GE Healthcare, and Abbott Laboratories, among others. These companies produce a wide range of medical devices for use in hospitals, clinics, and other healthcare settings, and are constantly innovating to meet the evolving needs of patients and healthcare providers.

The US medical devices market is heavily regulated by the FDA, which ensures the safety and efficacy of medical devices before they are approved for use. This regulatory environment can create challenges for companies operating in the market, but it also provides a level of assurance for patients and healthcare providers.

Market Dynamics

Some of the key drivers of growth in the US medical devices market include:

An aging population: As the US population continues to age, the demand for medical devices is expected to increase. Older adults are more likely to have chronic health conditions that require monitoring and treatment, and medical devices can play a key role in managing these conditions.

Technological advances: Advances in technology are leading to the development of new and innovative medical devices that can improve patient outcomes and streamline healthcare delivery. From robotic-assisted surgeries to wearable devices that monitor vital signs, technology is driving innovation in the medical device industry.

Chronic disease management: Chronic diseases like diabetes, heart disease, and cancer are major public health challenges in the US. Medical devices play a key role in managing these conditions, with devices like insulin pumps and heart monitors helping patients to monitor and manage their health.

Regulatory environment: The US medical devices market is heavily regulated by the FDA, which ensures the safety and efficacy of medical devices before they are approved for use. This regulatory environment can create challenges for companies operating in the market, but it also provides a level of assurance for patients and healthcare providers.

Developments in US Medical Devices Market

The US medical devices market is constantly evolving, with new developments and innovations emerging on a regular basis. Here are a few recent developments in the US medical device market:

Remote patient monitoring (RPM) devices - With the rise of telemedicine, remote patient monitoring devices are becoming more prevalent. These devices allow patients to monitor their own vital signs, such as blood pressure and glucose levels and transmit the data to healthcare providers for analysis and follow-up.

Wearable medical devices - Wearable medical devices, such as smartwatches and fitness trackers, are becoming increasingly popular among consumers. These devices can track various health metrics, such as heart rate and activity levels, and provide insights into a patient's health and wellness.

3D printing - 3D printing technology is being used to develop customized medical implants and devices that are tailored to individual patients. This technology has the potential to revolutionize the field of medical device manufacturing.

Artificial intelligence (AI) - AI is being used to develop medical devices that can analyze large amounts of data and provide insights into patient health. For example, AI-powered medical imaging systems can help identify abnormalities and diagnose diseases more accurately.

Nanotechnology - Nanotechnology is being used to develop medical devices that are smaller and more precise than ever before. For example, Nano-sensors can be used to detect and monitor diseases at the molecular level.

These are just a few examples of the many new developments and innovations in the US medical device market. As technology continues to advance, we can expect to see even more exciting developments in the years ahead.

Competitive Landscape

Key Players

- 3M Healthcare - is a subsidiary of the 3M Company and offers a wide range of medical products and solutions, including wound care dressings, surgical drapes, and infection prevention products.

- Abbott - is a global healthcare company that offers a range of medical devices, diagnostics, and pharmaceutical products. Its medical device division offers products in areas such as cardiovascular devices, neuromodulation, and diabetes care.

- Baxter International, Inc. - is a leading manufacturer of medical devices, pharmaceuticals, and biotechnology products. Its products include intravenous solutions, renal therapy products, and medical devices for critical care and surgery.

- B. Braun Melsungen AG - is a German medical and pharmaceutical device company that offers products and services for anesthesia, infusion therapy, and pain management. Its product portfolio includes intravenous solutions, vascular access devices, and drug delivery systems.

- GE Healthcare - is a subsidiary of the General Electric Company and offers a range of medical technologies, including medical imaging and diagnostic equipment, patient monitoring systems, and healthcare IT solutions.

- Johnson & Johnson Services, Inc. - is a multinational corporation that operates in the pharmaceutical, medical device, and consumer health markets. Its medical device division includes a broad range of products, such as orthopedic implants, cardiovascular devices, and surgical instruments.

- Medtronic PLC - is a global medical technology company that develops and manufactures a wide range of medical devices, including cardiac and vascular devices, neurological devices, and diabetes management solutions.

- Boston Scientific Corp. - is a global medical device company that develops and manufactures innovative medical technologies in the areas of cardiology, endoscopy, urology, and neuromodulation.

These companies are among the largest and most influential players in the US medical device market, offering a wide range of innovative medical technologies and solutions to healthcare providers and patients.

Healthcare Policies and Regulatory Landscape

The US medical device market is subject to a complex set of policies and regulations designed to ensure the safety and effectiveness of medical devices. Here are a few key policies and regulatory agencies that impact the US medical devices market:

Food and Drug Administration (FDA) - The FDA is responsible for regulating medical devices in the US. The agency reviews and approves medical devices before they can be marketed in the US, and it also monitors devices after they have been approved to ensure their ongoing safety and effectiveness.

Center for Medicare and Medicaid Services (CMS) - CMS is responsible for administering the Medicare and Medicaid programs, which are major purchasers of medical devices in the US. CMS sets reimbursement rates for medical devices and other healthcare products and services, which can impact the demand for these products.

Affordable Care Act (ACA) - The ACA, also known as Obamacare, includes a number of provisions related to medical devices, such as the imposition of a medical device tax and the establishment of a regulatory pathway for the approval of biosimilar devices.

Medical Device User Fee Amendments (MDUFA) - MDUFA is a program that allows the FDA to collect fees from medical device manufacturers to help fund the agency's device review process. The program was established to help expedite the device review process and improve the FDA's device review capabilities.

Unique Device Identification (UDI) - The UDI system is a new FDA requirement that requires medical device manufacturers to assign a unique identifier to each medical device they produce. The UDI system is designed to improve the traceability and safety of medical devices.

These are just a few examples of the many policies and regulations that impact the US medical device market. The healthcare policies and regulatory landscape in the US are complex and constantly evolving, and medical device manufacturers must stay up-to-date on these developments in order to remain compliant and competitive in the marketplace.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Medical Device Market Segmentation

The Medical Device Market is segmented as mentioned below:

By Product Type (Revenue, USD Billion):

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- IVD

- MIS

- Wound Management

- Diabetes Care

- Ophthalmic

- Dental

- Nephrology

- General Surgery

- Others?

By End User (Revenue, USD Billion):

- Hospitals and ASCs

- Clinics

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.