US ePharmacy Market Analysis

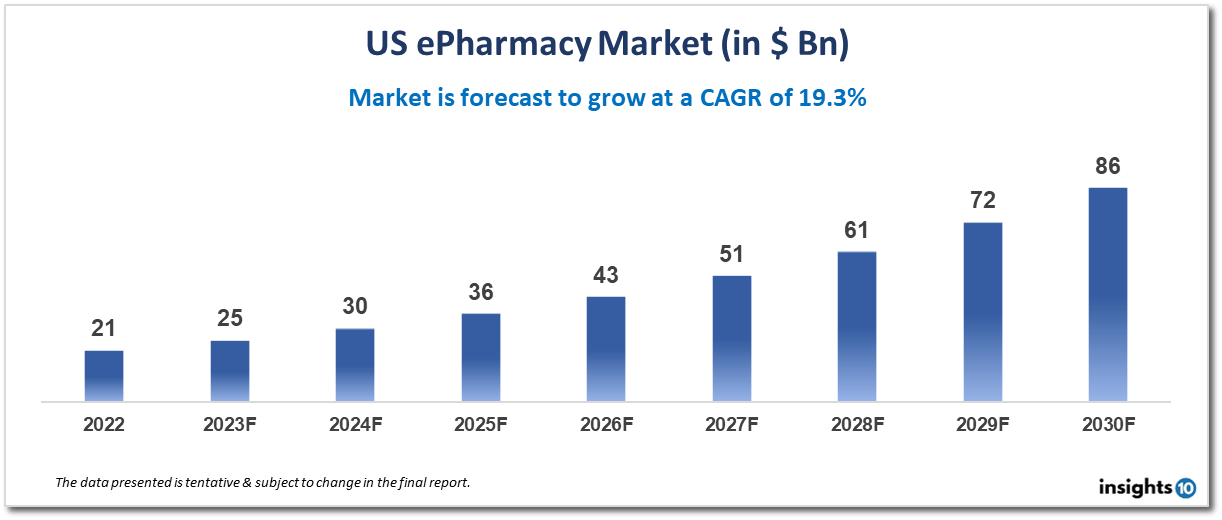

The US ePharmacy Market is projected to grow from $21 Bn in 2022 to $86 Bn by 2030, registering a CAGR of 19.3% during the forecast period of 2022-2030. The US ePharmacy market is driven by a number of factors, including the increasing demand for convenient and cost-effective healthcare solutions, the rise in chronic diseases and the aging population, and the growing adoption of technology in the healthcare industry. CVS Health is one of the largest ePharmacy players in the United States, with a market share of around 25%. The company offers a range of services, including prescription fulfillment, mail-order delivery, and specialty pharmacy services.

Buy Now

US ePharmacy Market Executive Summary

The term "ePharmacy," commonly referred to as "online pharmacy" or "internet pharmacy," describes the marketing and delivery of prescription drugs and other healthcare items via online channels. ePharmacies allow patients to buy prescriptions from the comfort of their homes and have them delivered right to their doorsteps, making them a practical and affordable alternative to conventional brick-and-mortar pharmacies.

Prescription fulfillment, mail-order delivery, and telemedicine consultations with medical experts are just a few of the services that ePharmacies often provide. Specialty pharmacy services, such as drugs for long-term disorders like diabetes, cancer, or autoimmune diseases, are also provided by several online pharmacies.

The US ePharmacy Market is anticipated to expand from $21 Bn in 2022 to $86 Bn in 2030, showing a CAGR of 19.3% from 2022 to 2030.

The sale and distribution of pharmaceutical items via online channels is a component of the US ePharmacy business, a segment of the healthcare industry that is expanding quickly. The COVID-19 epidemic has sped up the expansion of the US ePharmacy sector as more people choose to buy their prescription medications and healthcare products online.

The US ePharmacy business is fiercely competitive, with many firms active in different market areas. A variety of reasons, including the rising prevalence of chronic illnesses and the aging population, the expanding acceptance of technology in the healthcare sector, and the rising desire for accessible and affordable healthcare solutions, are driving the US ePharmacy market. Nevertheless, the industry also has to deal with a number of difficulties, including legal and regulatory problems, worries about patient privacy and safety, and the possibility of cyberattacks and data breaches.

In general, it is anticipated that the US ePharmacy industry will maintain its upward trend as more people choose online shopping choices for their prescription medication and healthcare requirements. Technology advancements, alterations in consumer behavior, and the growing demand for practical and affordable healthcare solutions are all predicted to contribute to this trend.

Market Dynamics

Market Growth Drivers

There are a number of important variables driving the US ePharmacy market, including:

- Convenience: One of the key factors propelling the US ePharmacy industry is the ease of use that it provides to consumers. Customers may purchase prescription prescriptions from ePharmacies without leaving the comfort of their homes or going to a traditional pharmacy. Those who live in remote regions or have restricted mobility will find this to be very appealing.

- Cost savings: ePharmacies frequently charge less for prescription drugs than traditional pharmacies. This is so that they may offer clients reduced pricing since they have lesser overhead expenses. Also, customers may compare costs among many ePharmacies to select the one that gives the greatest value.

- ePharmacies give clients access to a greater selection of pharmaceuticals than they could get at their neighborhood pharmacy. This is crucial for those with chronic diseases who require frequent access to medications that might not be offered by their neighborhood pharmacy

- Increasing Demand for Chronic Disease Management: In the US, chronic disorders including diabetes, hypertension, and heart disease are on the rise, and ePharmacies provide practical and affordable solutions to treat them

- Usage of telemedicine has increased as a result of the COVID-19 epidemic, and ePharmacies are crucial in supplying patients with the prescription drugs they require as part of their telehealth sessions

In general, ePharmacies' convenience, cost savings, and improved access to drugs are fueling this market's expansion in the US. The industry is anticipated to maintain its development trajectory in the next years as more customers become accustomed to obtaining their prescriptions online.

Competitive Landscape

Key Players

The ePharmacy market is fiercely competitive in the United States, where a few major competitors dominate the industry. The following are a few of the top businesses in the US ePharmacy market:

- One of the biggest ePharmacy businesses in the US is CVS Health, which has a market share of about 25%. Prescription fulfillment, mail-order delivery, and specialized pharmacy services are just a few of the services that the business provides.

- Walgreens Boots Alliance: With a market share of about 18%, Walgreens is another significant player in the US ePharmacy sector. Prescription fulfillment, mail-order delivery, and specialized pharmacy services are just a few of the services that the business provides.

- Walmart: With a market share of about 5% in the US ePharmacy business, Walmart is a significant player. Prescription fulfillment, mail-order delivery, and in-store pickup are just a few of the services the business provides.

- Amazon: With its 2018 acquisition of PillPack, Amazon joined the US ePharmacy sector. The business delivers pharmaceutical packets that have been pre-sorted to consumers' doors.

- Capsule: Capsule is a more recent entrant into the US ePharmacy industry and provides a full-service online pharmacy experience with prescription fulfillment, delivery, and consulting services.

- Ro: Ro is an additional up-and-coming participant in the US ePharmacy industry. It provides a variety of online healthcare services, such as prescription fulfillment and delivery, telemedicine consultations, and at-home diagnostic testing.

- All things considered, these major companies in the US ePharmacy industry are consistently innovating and growing their product lines to satisfy changing customer demands. As the market expands, we may anticipate the entry of new competitors, which will increase competition and innovation.

Healthcare Policies and Regulatory Landscape

As they are created to safeguard the safety and efficacy of drugs and other healthcare items, healthcare laws and regulations play a vital role in the US ePharmacy business. The following are some of the main laws and rules that have an effect on the American ePharmacy market:

Regulations of the Drug Enforcement Administration (DEA) Prescription opioids, which are often dispensed through ePharmacies, are among the prohibited drugs that are handled and distributed in accordance with DEA regulations. Regulations set out by the DEA must be followed by ePharmacies in order to verify and fill prescriptions for restricted medications.

Regulations of the Food and Drug Administration (FDA): The FDA is in charge of policing the efficacy and safety of pharmaceuticals, medical devices, and other healthcare items. For the handling and dispensing of prescription pharmaceuticals, including the requirements for labelling, storage, and record-keeping, EPharmacies are subject to FDA rules.

Rules for Telemedicine: State and federal laws governing the practice of telemedicine must be followed by ePharmacies that provide telemedicine services. These rules may include those for licensure, informed consent, and patient privacy, and they can differ by state.

Health Insurance Portability and Accountability Act (HIPAA): HIPAA laws, which set national standards for the privacy and security of PHI, must be followed by ePharmacies that handle protected health information (PHI).

Drug Pricing Regulations: The US government controls drug prices using a number of different methods, such as the Medicaid Drug Rebate Program, which requires pharmaceutical companies to give rebates to state Medicaid programs, and the 340B Drug Pricing Program, which gives certain healthcare providers discounts on outpatient medications.

Overall, the regulatory environment for ePharmacies in the United States is complicated and continuously changing as new laws and rules are put in place to guarantee the security and efficacy of medical supplies and services. To achieve compliance and preserve customer trust, ePharmacies must remain current with these laws and modify its business practices accordingly.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

ePharmacy Market Segmentation

Drug type

- Prescription drug

- OTC

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

The US ePharmacy Market is projected to grow from $21 Bn in 2022 to $86 Mn by 2030, registering a CAGR of 19.3% during the forecast period of 2022 - 2030.

The ePharmacy market in the United States is highly competitive, with several key players dominating the market. Here are some of the leading companies in the US ePharmacy market:

CVS Health

Walgreens Boots Alliance

Walmart

Amazon

Capsule

Ro.