US ENT Devices Market Analysis

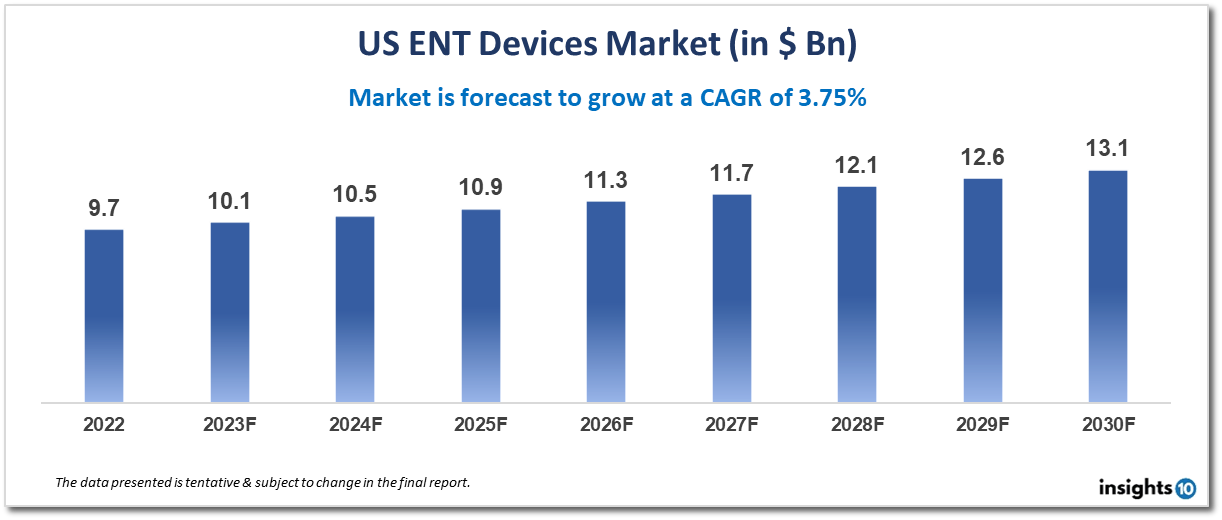

The US ENT devices market is projected to grow from $9.7 Bn in 2022 to $13.1 Bn by 2030, registering a CAGR of 3.75% during the forecast period of 2022-30. The rising prevalence of ENT disorders, such as hearing loss, sinusitis, and tonsillitis, is a major driver of the ENT device market. According to the National Institute on Deafness and Other Communication Disorders, approximately 15% of American adults (37.5 million) aged 18 and over report some trouble hearing. The market is highly competitive, with a large number of players operating in the space, ranging from small, specialized companies to large multinational corporations. Some of the key players in the market include Cochlear Limited, William Demant Holding A/S, Medtronic plc, Stryker Corporation, and Olympus Corporation.

Buy Now

US ENT Devices Market Executive Summary

The US ENT devices market is anticipated to increase from $9.7 billion in 2022 to $13.1 billion in 2030, showing a CAGR of 3.75% from 2022 to 2030.

Devices used to diagnose, treat, and manage disorders affecting the ear, nose, and throat fall under the wide category of ENT (ear, nasal, and throat) devices. Many of the typical ENT device kinds include:

- Hearing aids are devices that assist those who have hearing loss. Hearing aids increase sound volume and enhance speech and other sound clarity.

- Cochlear implants are medical devices that help people with profound hearing loss. An external sound processor and an internal implant that is surgically inserted in the ear make up cochlear implants.

- Diagnostic Tools: Otoscopes, rhinoscopes, and laryngoscopes are just a few of the diagnostic devices that are used to check the ear, nose, and throat.

- Surgical equipment Tonsillectomies, septoplasties, and sinus operations are just a few of the treatments that ENT surgeons conduct using a range of specialized equipment.

- Implants are used to treat problems including chronic sinusitis, ear infections, and hearing loss. Such implants include nasal implants and ear tubes.

- ENT equipment is a vital component of the healthcare sector and is key in assisting patients in managing and treating ear, nose, and throat diseases. The need for ENT devices is anticipated to rise as the frequency of these disorders rises.

In the US, there is a large and expanding market for ENT (ear, nose, and throat) devices, which include a variety of tools for managing, diagnosing, and treating a range of disorders that affect the ears, nose, and throat. The market is made up of several different product categories, such as implants, diagnostic tools, cochlear implants, and hearing aids.

The market is influenced by a number of variables, such as the rising frequency of ear, nose, and throat problems, the aging population, technological advancements, and an increase in healthcare expenditure.

The market is quite competitive, and many competitors are working there, from tiny, niche businesses to significant global enterprises. Cochlear Limited, William Demant Holding A/S, Medtronic plc, Stryker Corporation, and Olympus Corporation are a few of the market's major participants.

Overall, it is anticipated that the US ENT device market will expand over the next years due to factors such as technological advancements, growing awareness of and interest in diagnosing ear, nose, and throat ailments, and rising healthcare costs.

Market Dynamics

Growth Drivers

All major insurance companies in the US provide payment for sinus dilation operations. For instance, balloon sinus dilation is covered by Anthem, Inc., the second-largest health benefits provider in the US with policies that cover more than 40 million individuals. This procedure is used to treat chronic and recurrent acute sinusitis. In addition to these top payers, Medicare, United Healthcare, Aetna, Anthem, Cigna, Humana, Kaiser, TRICARE, and Health Net also cover solo balloon sinus dilation operations. The XprESS Multi-Sinus Dilation System (XprESS) has been positively recommended for use in the treatment of chronic sinusitis by the Medical Technologies Advisory Committee of the National Institute for Health and Care Excellence (NICE) in the UK. The committee also suggested that the NHS take the device into consideration for reimbursement. In important countries like the UK, such advancements are anticipated to drive demand for and adoption of sinus dilation devices.

Competitive Landscape

Key Players

Some of the key players in the US ENT devices market include:

- Medtronic PLC

- Johnson & Johnson

- Stryker Corporation

- Smith & Nephew plc

- Olympus Corporation

- Cochlear Limited

- Sonova Holding AG

- GN Store Nord A/S

- William Demant Holding A/S

- Starkey Hearing Technologies

Healthcare Policies and Regulatory Landscape

The following healthcare laws and regulations apply to the US ENT devices market:

- In the US, medical devices, including ENT devices, should be approved before they are manufactured or marketed. Before they can be marketed and sold to healthcare professionals and consumers, ENT devices must go through a rigorous regulatory procedure.

- Affordable Care Act: The Affordable Care Act (ACA) is a federal statute that seeks to increase all Americans people's access to quality, cheap healthcare also the medical device excise tax, which levies a 2.3% tax on the sale, which is one of the ACA's provisions that has an impact on the market for ENT devices.

- HIPAA: The Health Insurance Portability and Accountability Act (HIPAA) is a federal statute that establishes universal guidelines for the security of private medical data. To guarantee that patient information is kept private and safe, ENT device manufacturers are required to adhere to HIPAA standards.

- The US ENT device market is generally very tightly regulated to guarantee the patient safety and efficacy of these devices. To put their goods on the market and make sure they qualify for payment by insurance programs like Medicare, manufacturers of these devices must go by a number of laws and standards.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

ENT Device Market Segmentation

The ENT Device Market is segmented as mentioned below:

By Product Type (Revenue, USD Billion):

- Diagnostic Devices

- Surgical Devices

- Hearing Aids

- Hearing Implants

- Co2 Lasers

- Image-Guided Surgery Systems

By Diagnostic Devices (Revenue, USD Billion):

- Endoscopes

- Hearing Screening Devices

By Surgical Device (Revenue, USD Billion):

- Powered Surgical Instruments

- Radiofrequency (RF) Handpieces

- Handheld Instruments

- Balloon Sinus Dilation Devices

- ENT Supplies

- Ear Tubes

- Voice Prosthesis Devices

By End Users (Revenue, USD Billion):

- Hospitals and Ambulatory Settings

- Home Use

- ENT Clinics

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.