US eHealth Market Analysis

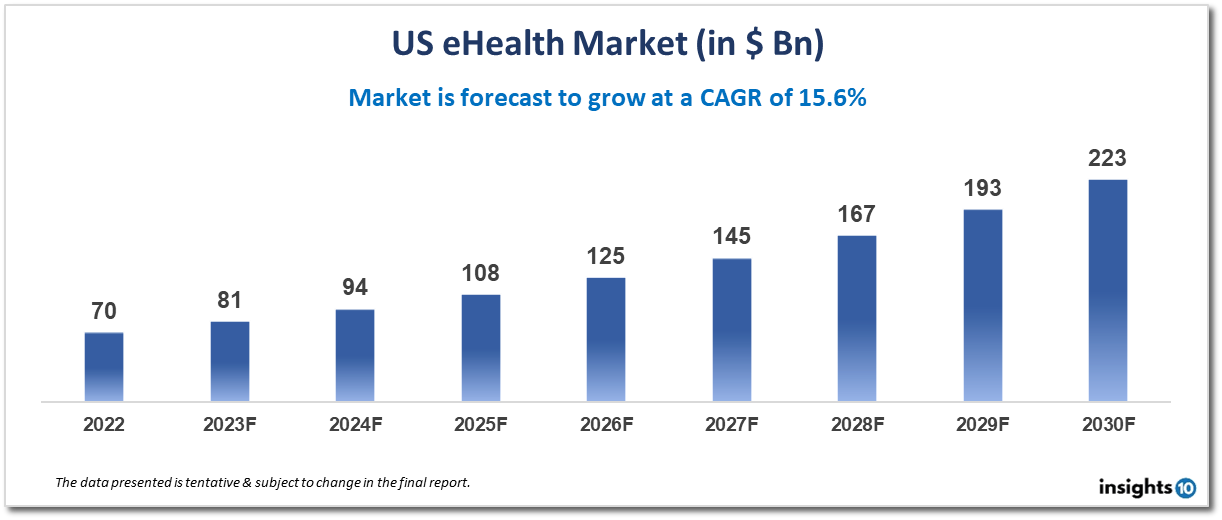

The US eHealth market is projected to grow from $70 Bn in 2022 to $223 Bn by 2030, registering a CAGR of 15.6% during the forecast period of 2022-30. The US eHealth market is driven by factors such as increasing healthcare costs, an aging population, the prevalence of chronic diseases, and the need to improve healthcare outcomes. Digital technologies and services are seen as a way to address these challenges by improving patient engagement, increasing access to care, and reducing healthcare costs. Amazon Pharmacy is a recent entrant to the e-pharmacy market, offering prescription medications and other healthcare products through its online marketplace.

Buy Now

US eHealth Market Executive Summary

The US eHealth market is expected to grow from $70 Bn in 2022 to $223 Bn by the end of the projected period of 2022–2030, representing a CAGR of 15.6%.

The fast-growing US eHealth market includes a wide range of digital services and technologies with the goal of improving healthcare efficiency, accessibility, and quality. The eHealth industry encompasses a variety of technologies, such as electronic health records (EHRs), telemedicine, mHealth (mobile health) apps, remote patient monitoring, and online pharmacy.

Some of the factors driving the US eHealth business are rising healthcare costs, an ageing population, the prevalence of chronic illnesses, and the desire to improve healthcare outcomes. Digital technology and services are being examined as a way to solve these issues by increasing patient engagement, increasing access to treatment, and reducing healthcare expenditures.

One of the key factors driving the expansion of the US eHealth sector is the adoption of EHRs. Healthcare practitioners can access patient medical records stored electronically (EHRs) from a variety of places and circumstances. The US government has promoted EHR use through programs like the Medicare and Medicaid EHR Incentive Programs.

Telemedicine is another part of the US eHealth industry that is growing significantly. Telemedicine is the practice of providing patients with medical advice and cares over great distances while utilizing digital technologies. This may entail using mHealth applications to track and manage chronic diseases, remote monitoring of patients' vital signs, and video consultations with doctors.

The e-pharmacy industry, mostly dominated by a small number of large companies, accounts for a sizeable percentage of the US eHealth market. E-pharmacies are convenient and cost-effective alternatives to traditional brick-and-mortar pharmacies since they let clients buy medications online and have them delivered straight to their doorsteps.

The US eHealth industry is generally expected to grow over the next years, driven by ongoing innovation and the aim to improve healthcare outcomes in the nation. The market must also abide by many federal and state regulations, creating a complex regulatory framework to ensure patient safety and privacy.

Market Dynamics

Market Growth Drivers

- Rising medical expenses: Due to the high cost of healthcare in the US, interest in digital technology and services that can lower costs and boost efficiency is on the rise. Among other advantages, eHealth solutions can aid in lowering administrative expenses, enhancing care coordination, and avoiding needless hospitalizations.

- The growing demand for healthcare services that may be given remotely or through digital channels is being driven by the ageing American population. EHealth technology can enhance the quality of life, lessen the need for in-person visits, and assist older persons in managing chronic diseases.

- Chronic illness prevalence: In the United States, chronic conditions including diabetes, heart disease, and cancer are important cost drivers for healthcare. EHealth technology can assist patients in better managing certain illnesses, avoiding the need for expensive procedures like hospitalization.

- Convenience is something that patients are increasingly searching for in healthcare services, as well as flexibility. EHealth innovations give patients access to treatment anytime, anywhere, making it simpler for them to maintain their health and wellness.

- Government incentives: To encourage the adoption of eHealth technologies, the US government has put in place a variety of incentives, such as the Medicare and Medicaid EHR Incentive Programs and the 21st Century Cures Act, which has provisions to encourage interoperability and patient access to health data.

- Technological developments: New potential to enhance healthcare outcomes is being opened up by developments in technology like artificial intelligence, machine learning, and blockchain.

As healthcare providers, patients, and policymakers increasingly realize the advantages of digital technology and services for enhancing healthcare outcomes and cutting costs, the US eHealth industry is anticipated to expand over the next years.

Competitive Landscape

Key Players

Several businesses are competing fiercely for customers in the US eHealth industry, which offers a wide range of goods and services. The following are some of the major market participants:

- Epic Systems: In the US, many healthcare providers rely on Epic Systems, a top supplier of electronic health record (EHR) systems. The business also provides a variety of additional eHealth products, such as telemedicine services, population health management software, and tools for patient interaction.

- Another significant competitor in the EHR industry is Cerner Corporation, which provides a full range of healthcare IT solutions. EHRs, revenue cycle management software, clinical decision support tools, and telehealth services are among the company's goods and services.

- EHR systems and a variety of other eHealth solutions are provided by Allscripts. Software for population health management, tools for managing the revenue cycle, and platforms for patient involvement are among the company's goods and services.

- Teladoc Health: Teladoc Health is a well-known telehealth service provider that offers online consultations with medical professionals in many different disciplines. Several healthcare providers and payers in the US utilize the company's services.

- Athenahealth: Athenahealth offers a variety of different eHealth options in addition to cloud-based EHR systems. Software for population health management, patient engagement tools, and revenue cycle management are among the company's goods and services.

- A variety of AI-powered eHealth solutions are available from IBM Watson Health, including platforms for predictive analytics, population health management software, and clinical decision support tools.

These businesses rank among the most well-known and significant participants in the US eHealth industry overall. Yet, there are a lot of other businesses and startups working in the market, and the level of competition is always changing.

Healthcare Policies and Regulatory Landscape

The regulatory and healthcare policy environment in the US eHealth sector is intricate and dynamic. Key laws and regulations that have an effect on the market include:

- HIPAA: Health Insurance Portability and Accountability Act National guidelines for the security of people's health information are established under the federal statute known as HIPAA. The law mandates the adoption of specific security and privacy measures by healthcare providers and other covered organizations to safeguard patient health information.

- Programs for Medicaid and Medicare: Millions of Americans are covered by Medicare and Medicaid, two significant government-funded healthcare programs. Several eHealth solutions are created to meet the regulations and specifications that these programs have for the usage of eHealth technology.

- ACA: The Affordable Care Act The federal statute known as the Affordable Care Act, or Obamacare, has had a profound effect on the American healthcare system. The law contains provisions pertaining to the adoption and utilization of eHealth technology, such as EHR adoption mandates and meaningful use incentives.

- Rules set out by the Food and Drug Administration (FDA) govern the use of medical equipment, including several eHealth technology. Several eHealth enterprises are required to abide by the agency's strict standards regarding the creation and application of medical devices.

- Rules of the Federal Trade Commission (FTC): The FTC is in charge of upholding consumer protection and antitrust laws. The organization has published instructions for using eHealth technology and has taken legal action against businesses that utilize dishonest or unfair business practices.

Overall, these laws and rules have a significant impact on how the US eHealth industry is developed. Businesses that operate in the market must traverse a complicated regulatory environment and guarantee that their goods and services abide by all pertinent laws and standards.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

US eHealth Market Segmentation

Product (Revenue, USD Billion):

This substantial growth in eHealth can be attributed to transforming consumer preferences on account of increasing consumption and demand for data services coupled with the rapidly growing penetration of smartphones. In addition, 3G and 4G enabled services such as high-speed data transfer and video calling assist in fast healthcare delivery.

- Big Data for Health

- Electronic Health Record (EHR)

- Health Information Systems (HIS)

- mHealth

- Telemedicine

Service (Revenue, USD Billion):

Growing demand for self-monitoring devices that automatically monitors various physical activities and vital signs and generates a database, is expected to propel the growth of this segment.

- Monitoring Services

- Vital Signs Monitoring

- Specialty Monitoring

- Adherence Monitoring

- Accessories

- Sensors

- Others

- Diagnostic Services

- Healthcare Strengthening

- Others

End-use (Revenue, USD Billion):

eHealth Market offers great convenience to healthcare professionals in terms of patient workflow and data management. This is expected to contribute to the growth of the segment in the forthcoming years.

- Providers

- Insurers

- Government

- Healthcare consumers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

The US eHealth Market is projected to grow from $70 Bn in 2022 to $223 Mn by 2030, registering a CAGR of 15.6% during the forecast period of 2022 - 2030.

The US eHealth market is highly competitive, with numerous companies offering a wide range of products and services. Some of the key players in the market include:

Epic Systems

Cerner Corporation

Allscripts

Teladoc Health

Athenahealth

IBM Watson Health

Overall, these companies are among the most prominent and influential players in the US eHealth market. However, there are many other companies and startups operating in the market, and the competitive landscape is constantly evolving.