US Coronary Stents Market Analysis

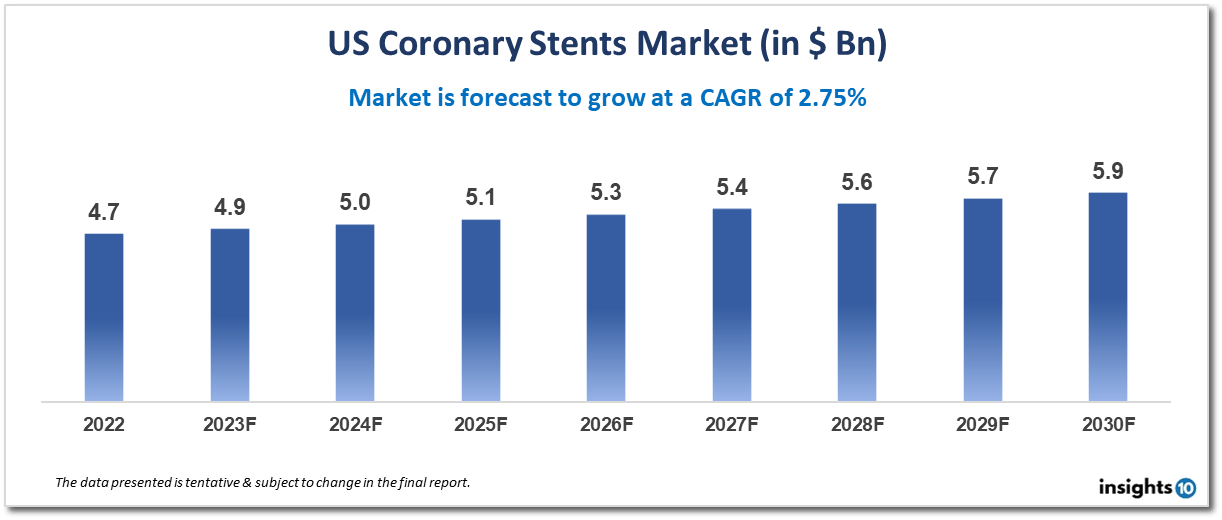

The US coronary stents market is projected to grow from $4.7 Bn in 2022 to $5.9 Bn by 2030, registering a CAGR of 2.75% during the forecast period of 2022-30. The US coronary stents market is driven by several factors, including the high prevalence of coronary artery disease (CAD) in the US, advances in stent technology, and increasing demand for minimally invasive procedures. The market is highly competitive, with several major players such as Abbott Laboratories, Boston Scientific Corporation, and Medtronic dominating the market. These companies invest heavily in research and development to develop innovative stent technologies that provide better outcomes for patients.

Buy Now

US Coronary Stents Market Executive Summary

According to projections, the US Coronary Stents Market would increase from $4.7 Bn in 2022 to $5.9 Bn in 2030, exhibiting a CAGR of 2.75% from 2022 to 2030.

A significant portion of the US medical device market is made up of coronary stents. Coronary stents are minuscule mesh tubes that are put into constrictive or closed coronary arteries in order to maintain their openness and enhance blood flow to the heart muscle. Bare metal stents and drug-eluting stents are the two major varieties of coronary stents.

Some of the factors driving the US coronary stent market are:

- High incidence of Coronary Artery Disease (CAD) in the US

- Developments in stent technology, and

- Rising desire for less invasive treatments

The market is quite cutthroat, with a number of significant businesses dominating it, including Abbott Laboratories, Boston Scientific Company, and Medtronic. These businesses make significant investments in R&D to create cutting-edge stent technologies that improve patient outcomes.

Drug-eluting stents, which are coated with drugs to assist prevent restenosis (re-narrowing of the artery) after the stent is placed, has become more popular in recent years. It has been shown that drug-eluting stents lessen the need for follow-up treatments and enhance patient outcomes.

The FDA oversees the regulatory environment for coronary stents in the US and requires manufacturers to undergo clinical studies to show their stents are safe and effective before they can be authorized for use there. The FDA also keeps an eye on the security of stents after they have been authorized and has the power to order manufacturers to recall stents if security issues are discovered.

Overall, it is anticipated that the US coronary stents market would expand over the coming years, propelled by factors including rising demand for less invasive treatments and developments in stent technology.

Market Dynamics

Market Growth Drivers

- High incidence of coronary artery disease (CAD): Demand for coronary stents is fueled by the high prevalence of CAD, which is a significant cause of morbidity and death in the US. 18.2 million adult Americans have CAD, according to the American Heart Association.

- Newer and more sophisticated stent designs have been created that provide patients with better results as a result of ongoing research and development activities in the area of stent technology. Drug-eluting stents, bioresorbable stents, and next-generation stents are some of these developments.

- Growing demand for minimally invasive operations: Compared to typical open surgeries, minimally invasive techniques, including stenting, have a decreased risk of complications, a quicker recovery period, and a cheaper cost.

- Favorable reimbursement practices: The majority of commercial and public health insurance companies pay for coronary stent treatments, which has helped to raise demand for these procedures.

Competitive Landscape

Key Players

The market for coronary stents in the US is very competitive, with a few key firms controlling the industry. Some of the major companies in the US market for coronary stents are:

- Abbott Laboratories: A leader in the healthcare industry, Abbott Laboratories provides a variety of cardiovascular devices, including coronary stents. The Xience, Promus, and Absorb bioresorbable stents are among the company's selection of stents.

- Boston Scientific Corporation: Boston Scientific is a manufacturer and distributor of cardiovascular devices, such as coronary stents. The Promus, Synergy, and Eluvia stents are all part of the company's line of stents.

- Medtronic: A leading provider of cardiovascular goods, including coronary stents, the corporation operates on a worldwide scale. The Resolute, Integrity, and Promus stents are among the company's selection of stents.

- Terumo Company: A Japanese manufacturer of medical devices, Terumo Corporation provides a variety of cardiovascular goods, including coronary stents. The Ultimaster and Nobori drug-eluting stents are part of the company's line of stents.

- MicroPort Scientific Company: A Chinese manufacturer of medical devices, MicroPort Scientific Corporation provides a variety of cardiovascular products, including coronary stents. The Firehawk drug-eluting stent is part of the company's line of stents.

- Biosensors International Group: Based in Singapore, Biosensors International Group manufactures a variety of cardiovascular devices, including coronary stents. The BioFreedom drug-coated stent is one of the company's available stent options.

These businesses make significant investments in R&D to create cutting-edge stent technologies that improve patient outcomes. To preserve and increase their market share, they also compete on criteria including product performance, price, and distribution tactics.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Coronary Stents Market Segmentation

By Type (Revenue, USD Billion):

The three main categories of coronary stents are bare-metal, drug-eluting, and bioabsorbable, depending on their nature. The segment for bioabsorbable stents is anticipated to increase at the fastest rate over the forecast period. The benefits that are encouraging the use of bioabsorbable stents include a decrease in problems including thrombosis and inflammation, the cUSity to restore normal vasomotion, and an improvement in aberrant endothelial function. However, in the upcoming years, the expansion of this market segment is anticipated to be constrained by the high cost of bioabsorbable stents.

- Bare-metal Stents

- Drug-eluting Stents

- Bioabsorbable Stents

By Mode of Delivery (Revenue, USD Billion):

The market is divided into self-expanding and balloon-expandable stents according to delivery method. Because of the high use of these stents, rising research initiatives to advance the technology, and rising regulatory approvals for balloon-expandable stents, the balloon expandable stents segment is anticipated to increase at the greatest CAGR over the projection period.

- Balloon-expandable Stents

- Self-expanding Stents

By Materials (Revenue, USD Billion):

The coronary stent market is divided into metallic (cobalt chromium, platinum chromium, nickel-titanium, and stainless steel) and other stents according to the material. The market for other stents is anticipated to experience the largest CAGR growth during the projection period. The rapid expansion of this market can be ascribed to the increased use of polymers and copolymers in the production of bioabsorbable stents.

- Metallic Stents

- Cobalt-Chromium

- Platinum Chromium

- Nickel Titanium

- Stainless Steel

- Other Stents

By End User (Revenue, USD Billion):

The coronary stent market is divided into hospitals, cardiac centres, and ambulatory surgical centres based on the end user. According to predictions, the hospital sector will control the market in 2016. This is primarily caused by hospitals using a lot of coronary stents.

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.