US Congestive Heart Failure Therapeutics Market Analysis

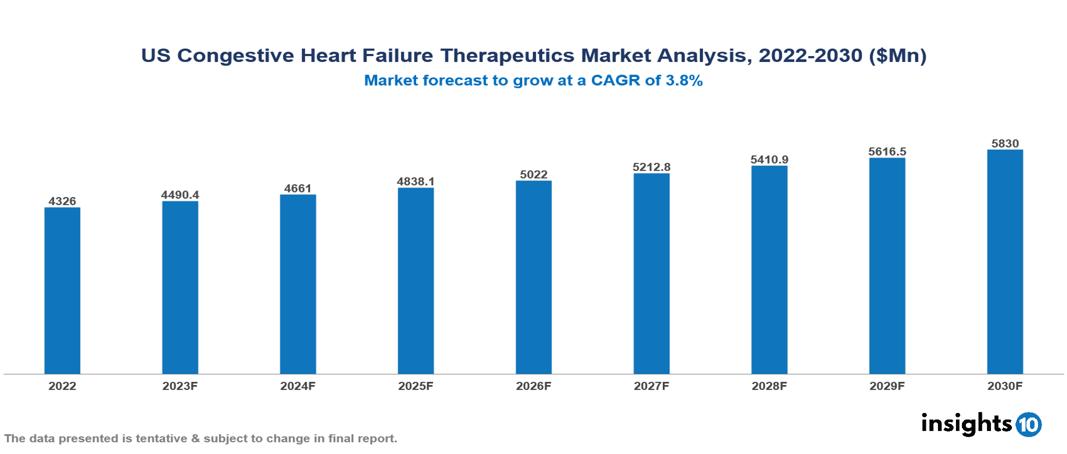

The US Congestive Heart Failure Therapeutics Market is anticipated to experience a growth from $4.326 Bn in 2022 to $5.830 Bn by 2030, with a CAGR of 3.8% during the forecast period of 2022-2030. The key drivers of the market in the US include the increasing prevalence of risk factors, alongside rising investments in healthcare and growing initiatives for patient education and awareness, collectively fueling market expansion. The US Congestive Heart Failure Therapeutics Market encompasses various key players across different therapeutic segments, including AbbVie, Amgen, AstraZeneca, Bayer, Bristol-Myers Squibb, Johnson & Johnson, Merck, Novartis, Pfizer, Sanofi, etc., among various others.

Buy Now

US Congestive Heart Failure Therapeutics Market Analysis Executive Summary

The US Congestive Heart Failure Therapeutics Market is anticipated to experience a growth from $4.326 Bn in 2022 to $5.830 Bn by 2030, with a CAGR of 3.8% during the forecast period of 2022-2030.

Heart failure, also known as congestive heart failure (CHF), is a common but complicated clinical illness marked by ineffective heart pumping blood throughout the body. Any condition affecting blood ejection from the ventricles into the systemic circulation or ventricular filling might lead to CHF. The two types of congestive heart failure are diastolic heart failure, which occurs when the left ventricle cannot relax properly because of tight muscles, and systolic heart failure, which occurs when the left ventricle cannot contract regularly. Treating the CHF risk factors is essential to extending life. Treatment options have changed significantly in recent years due to the emergence of novel pharmaceutical drugs and device-based therapies that may improve patient outcomes. One notable invention is the combination of a neprilysin inhibitor with an angiotensin II receptor blocker, known as an angiotensin receptor-neprilysin inhibitor (ARNI). Research has shown that ARNIs reduce the incidence of heart failure hospitalization and cardiovascular mortality in patients with heart failure who have a reduced ejection fraction (HFrEF). Device-based interventions have also advanced; patients with HFrEF with left bundle branch block, for instance, are now seeing improved outcomes from cardiac resynchronization therapy (CRT).

About 6.2 Mn people in the US suffer from heart failure. Geographically, heart failure prevalence varies, but it is believed to be around 2.5% in the US. Heart failure is a dangerous illness that can result in hospitalization and even death; it causes around 8.5% of all heart disease-related fatalities in the nation.

The key drivers of the market in the US include the increasing prevalence of risk factors, alongside rising investments in healthcare and growing initiatives for patient education and awareness, collectively fuelling market expansion.

With Entresto as the top drug, Novartis leads the market in the US, highlighting its expertise in CHF medicines. With the help of Pfizer and Bristol-Myers Squibb, their joint anticoagulant Eliquis gains a sizable market share and boosts the companies' revenue. While larger businesses such as Johnson & Johnson, AbbVie, AstraZeneca, and others have diversified portfolios, significant revenue influence, and a global reach, smaller players such as Bayer, with their specialist offers, are important players in particular CHF sectors.

Market Dynamics

Market Growth Drivers

Increased Prevalence: The increasing prevalence of risk factors like obesity, diabetes, and hypertension in the US is driving up the incidence of CHF, which in turn is fuelling demand for CHF treatment devices. This expanding landscape provides a ground for the implementation of preventive measures and therapeutic interventions tailored to address the rising incidence of CHF.

Increasing investments in healthcare: Rising healthcare spending in the country is providing more resources for CHF medications, treatments, and healthcare services, propelling the growth of the CHF treatment market. As healthcare spending continues to rise, the demand for innovative and effective CHF therapeutics experiences a concurrent upsurge.

Growing patient education and awareness initiatives: With heightened awareness regarding heart health and the critical importance of early detection and management of CHF, there is a notable impact on diagnostic rates. The increasing demand for therapeutics is driven not only by the increased prevalence of CHF but also by the proactive efforts of patient education programs and awareness campaigns.

Market Restraints

High Cost of Treatment: New and innovative CHF medications can be extremely expensive, placing a significant burden on public healthcare budgets as well as on individual patients. This can significantly limit access to potentially life-saving treatments, particularly for vulnerable populations with smaller or no insurance coverages.

Complex Reimbursement Policies: Navigating reimbursement policies from government agencies and private insurers can be challenging for both patients and manufacturers. Complex approval processes and varying coverage limitations can hinder access to crucial medications.

Competition from Generics and Alternative Therapies: The presence of a saturated market with pre-established players is a very big challenge for a new entrant. Also, complementary and alternative therapies, while not proven replacements, can sometimes attract patients, creating competition for established treatments.

Healthcare Policies and Regulatory Landscape

The United States Food and Drug Administration (USFDA) serves as a crucial regulatory entity dedicated to upholding public health by ensuring the safety and effectiveness of various products, including food, drugs, and medical devices. Operating under the Department of Health and Human Services, the USFDA holds a central role in overseeing and regulating the pharmaceutical and healthcare sectors. Its key functions encompass the approval of new drugs and medical devices, vigilant monitoring of product safety, and supervision of manufacturing processes. By establishing and enforcing stringent standards, the USFDA guarantees the quality of consumer goods, conducting comprehensive reviews of scientific data and clinical trials before granting market authorization. Through robust inspections and regulatory oversight, the agency strives to prevent foodborne illnesses, ensure drug safety, and foster advancements in medical technologies. The USFDA's unwavering dedication to public health and consumer protection has positioned it as a globally influential regulatory authority, contributing significantly to upholding the integrity of the healthcare system and instilling public confidence in the safety and efficacy of market-released products.

Notable Recent Updates

December 2023, Zydus Lifesciences, an Indian pharmaceutical company announced that it has received final approval from the USFDA for its generic version of Ivabradine tablets indicated for the treatment of heart failure.

November 2023, BioCardia, a developer of cellular and cell-derived therapeutics for the treatment of cardiovascular and pulmonary diseases, announced the USFDA approval of the Phase III clinical trial of its CardiAMP autologous cell therapy for the treatment of patients with heart failure.

August 2023, Lupin Limited, an Indian pharmaceutical company, has received approval from the USFDA for its Abbreviated New Drug Application for Pirfenidone for the treatment of Heart Failure. These generic versions will be marketed as a substitute for Esbriet®, a Hoffmann La Roche-branded product.

Competitive Landscape

Key Players:

- AbbVie

- Amgen

- AstraZeneca

- Bayer

- Bristol-Myers Squibb

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Sanofi

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

US Congestive Heart Failure Therapeutics Market Segmentation

By Stage of Heart Failure

- Acute Heart Failure

- Chronic Heart Failure

By Drug Class

- ACE Inhibitors

- Beta Blockers

- Angiotensin 2 Receptor Blockers

- Diuretics

- Aldosterone Antagonists

- Others

By Route of Administration

- Oral

- Parenteral

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End User

- Hospitals

- Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.