US Cardiac Surgery Instruments Market Analysis

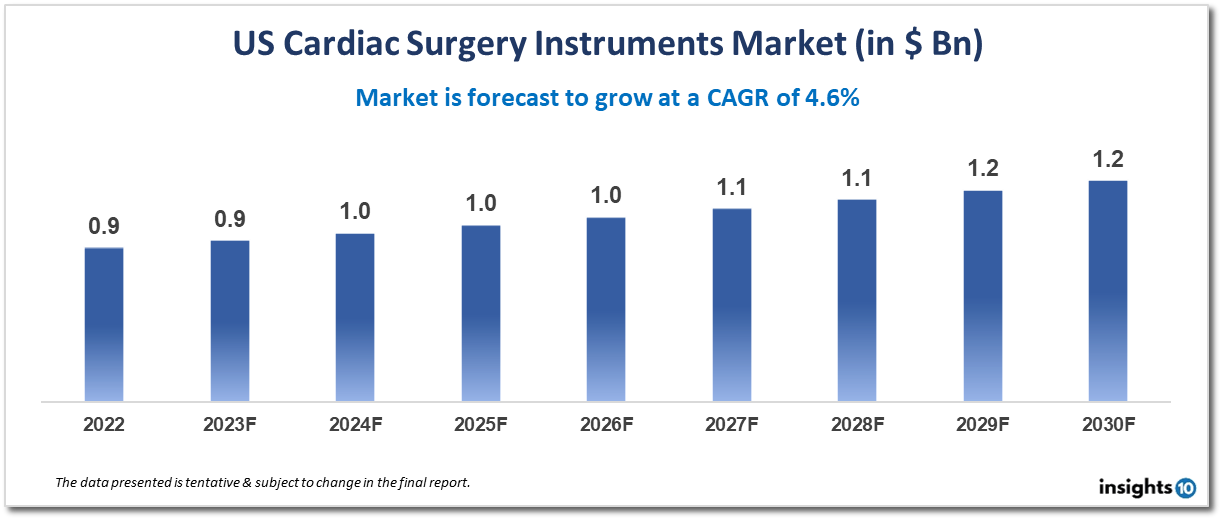

The US cardiac surgery instruments market is projected to grow from $0.9 Bn in 2022 to $1.2 Bn by 2030, registering a CAGR of 4.6% during the forecast period of 2022-30. This growth is primarily due to an increasing number of cardiac surgeries, especially in the elderly population, and the adoption of advanced surgical instruments. The market is highly competitive, with several established players including B. Braun Melsungen AG, CONMED Corporation, Johnson & Johnson Services, Inc., Medline Industries, Inc., and Stryker Corporation. These companies offer a wide range of cardiac surgery instruments and compete on the basis of product quality, innovation, and pricing.

Buy Now

US Cardiac Surgery Instruments Market Executive Summary

Over the forecast period of 2022–30, the US Cardiac Surgery Instruments Market is anticipated to expand from $0.9 billion in 2022 to $1.2 billion, recording a CAGR of 4.6%.

The market for surgical tools used in heart operations is the focus of the US market for cardiac surgery instruments, a part of the wider medical device sector. The introduction of cutting-edge surgical devices and an increase in cardiac procedures, particularly in the older population, are the main causes of this expansion.

B. Braun Melsungen AG, CONMED Corporation, Johnson & Johnson Services, Inc., Medline Industries, Inc., and Stryker Corporation are a few of the well-known companies that compete fiercely in this industry. These businesses compete on the basis of product quality, innovation, and cost and provide a variety of heart surgery devices.

In conclusion, the US market for tools used in cardiac surgery is anticipated to develop over the next years as a result of technical and demographic trends. The need for cutting-edge surgical devices created to enhance patient outcomes and reduce risk will increase along with the demand for cardiac procedures.

Market Dynamics

Growth Drivers

The market for cardiac surgical tools in the US is primarily driven by various factors, including:

- Heart disease is a primary cause of mortality in the United States, where millions of people suffer from different kinds of cardiovascular disease. The incidence of heart disease is anticipated to rise, fueling demand for cardiac procedures and related equipment as the population continues to age and lifestyles grow more sedentary.

- Technical developments: The accuracy and safety of cardiac procedures have grown thanks to improvements in surgical equipment design, such as the creation of minimally invasive surgical methods and the use of robotic-assisted surgery. As a result, there is an increasing need for surgical tools and equipment that are increasingly sophisticated.

- Increasing geriatric population: As the US population becomes older, there is a greater need for cardiac procedures since older people are more likely to have heart disease and need surgery. The need for heart surgical equipment will increase along with the country's ageing population.

- Rising healthcare costs: Since patients depend on insurance coverage and government assistance to pay for expensive surgical treatments, the US healthcare system is a significant driver of the market for cardiac surgery tools. The need for cardiac surgical devices will increase if American healthcare expenditure does so.

- Patients are increasingly looking for less invasive treatments that provide speedier recovery periods, fewer problems, and less scarring. New, less invasive, smaller, and more accurate cardiac surgical devices are being created as a result of this trend.

Competitive Landscape

Key Players

The US market for cardiac surgical devices is dominated by a number of major companies, including:

- Medtronic: A leader in medical technology, Medtronic provides a variety of implanted devices, surgical tools, and high-tech imaging systems for cardiac operations.

- Edwards Lifesciences: Edwards Lifesciences is a manufacturer of medical devices with a focus on heart valves and other items used in cardiac operations. The business provides a variety of surgical tools for heart valve treatments, including chordae tendineae repair devices and annuloplasty rings.

- Terumo Company: Terumo Corporation is a Japanese manufacturer of medical technology that provides a variety of cardiac surgery supplies, such as surgical tools, perfusion systems, and cardiovascular catheters.

- B. Braun Melsungen AG: This German medical technology firm manufactures a variety of tools for cardiac surgery, including forceps, scissors, and needle holders. The business also provides a variety of implanted cardiac surgery equipment, including pacemakers and heart valves.

- Boston Scientific Corporation: A leader in the field of medical technology, Boston Scientific Corporation provides a variety of surgical tools, catheters, and implantable devices for use during cardiac procedures. The business is renowned for its assortment of cutting-edge electrophysiology tools, including mapping systems and catheters for ablation.

- Snares, forceps, and retractor are just a few of the surgical tools that Teleflex Incorporated, a leader in medical technology, supplies for cardiac procedures. The business is renowned for its assortment of vascular access devices, including introducers and sheaths.

These businesses, which provide a broad variety of goods and services to satisfy the requirements of medical professionals and clients, are important participants in the US market for cardiac surgery tools.

Healthcare Policies and Regulatory Landscape

The research, production, and distribution of cardiac surgical tools are impacted by a variety of healthcare policies and regulatory requirements in the US market for such devices. Key laws and regulations that have an effect on this market include:

- FDA regulations: The US Food and Drug Administration (FDA) controls the design, evaluation, and approval of devices used in cardiac surgery. Before items are permitted to be used in cardiac procedures, manufacturers must provide comprehensive evidence on the safety and effectiveness of their offerings.

- Medicare payment guidelines: The payment rates for cardiac operations and associated treatments are established by Medicare, a US government-funded healthcare programme for seniors and individuals with disabilities. These rates may have an influence on both the demand for cardiac surgical equipment and the financial success of healthcare organisations.

- Affordable Care Act (ACA): Often known as Obamacare, the Affordable Care Act contains rules pertaining to the delivery and funding of healthcare services in the US. This contains clauses governing the payment for heart operations and associated procedures, which may have an influence on the demand for cardiac surgery equipment.

- State-level restrictions: State-level laws may have an influence on the market for cardiac surgical tools since certain jurisdictions have more stringent guidelines for the creation, production, and distribution of medical equipment.

- Health technology assessment (HTA) is a procedure for assessing the efficacy, cost-effectiveness, and safety of healthcare technologies, including the equipment used in heart surgery. The acceptance and funding of these technologies may be impacted by HTA.

Overall, the regulatory environment and healthcare policies in the US may have a big influence on how quickly and how well the market for cardiac surgical equipment grows and develops, with regulatory requirements and reimbursement policies being crucial in determining market trends and opportunities.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cardiac Surgery Instruments Market Segmentation

By Type (Revenue, USD Billion):

The market is divided into segments in this study based on the goods, applications, end users, and geographical areas. The market is divided into forceps, scissors, needle holders, clamps, and other cardiac surgery instruments based on the product. In 2017 the forceps category led the market, and it is anticipated that it will increase at the fastest rate going forward. The rise in heart surgeries and the frequent usage of forceps in most cardiac procedures are credited with the segment's strong growth.

- Forceps

- Vascular Forceps

- Grasping Forceps

- Other Forceps

- Needle Holders

- Scissors

- Clamps

- Other Cardiac Surgical Instruments

By Application (Revenue, USD Billion):

The market is further segmented by application into paediatric cardiac surgery, heart valve surgery, coronary artery bypass graft (CABG), and other applications. The US market's largest and fastest-growing application segment is CABG. This is mostly explained by the increased prevalence of heart illnesses and the consequent rise in surgical treatments. The second-largest category is heart valve surgery.

- Coronary Artery Bypass Graft (CABG)

- Heart Valve Surgery

- Pediatric Cardiac Surgery

- Other Applications

By End User (Revenue, USD Billion):

Based on the end user, the market is segmented into hospitals and cardiac centers, and ambulatory surgery centers. The hospitals and cardiac centers segment is expected to dominate the market for cardiac surgery instruments. Growth in this end-user segment can be attributed to the increasing incidence of cardiac and heart valve diseases and the subsequent increase in the number of cardiac surgery procedures.

- Hospitals and Cardiac Centers

- Ambulatory Surgery Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.