US Cardiac Pacemakers Market Analysis

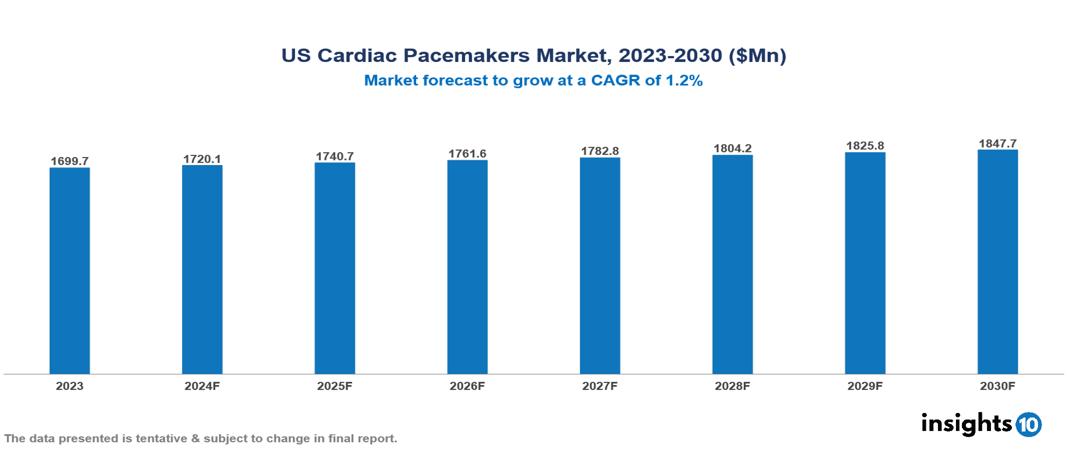

The US Cardiac Pacemakers Market was valued at $1699.7 Mn in 2023 and is predicted to grow at a CAGR of 1.20% from 2023 to 2030, to $1847.72 Mn by 2030. The key drivers of this industry include the increasing aging population, the rising incidence of chronic disease, and technological advancements. The industry is primarily dominated by players such as Abbott Laboratories, Biotronik, Boston Scientific, and Medtronic among others.

Buy Now

US Cardiac Pacemakers Market Executive Summary

The US Cardiac Pacemakers Market was valued at $1699.7 Mn in 2023 and is predicted to grow at a CAGR of 1.20% from 2023 to 2030, to $1847.72 Mn by 2030.

A pacemaker is a small device used to manage certain types of arrhythmias, which can cause the heart to beat too fast (tachycardia), too slow (bradycardia), or irregularly. When the heart beats too slowly, it can lead to insufficient oxygen supply to the body and brain, resulting in symptoms like dizziness, fatigue, fainting, and breathlessness. Pacemakers function by delivering electrical pulses to regulate and stabilize the heart rate and rhythm. They also help coordinate the pumping action of the heart chambers, enhancing the efficiency of blood circulation, particularly beneficial for individuals with heart failure.

Each day, approximately 2,552 deaths are attributed to cardiovascular disease (CVD) based on data from 2021. This translates to an average of one death from CVD every 34 seconds in the US. Specifically, there are about 1,905 daily deaths related to heart disease, which includes fatalities from heart attacks. The market is driven by significant factors like increasing aging population, the rising incidence of chronic disease, and technological advancements. However, cost constraints, risk of complications, and, regulatory challenges restrict the growth and potential of the market.

Prominent players in this field include Abbott Laboratories, Biotronik, Boston Scientific, and Medtronic among others.

Market Dynamics

Market Growth Drivers

Increasing Aging Population: The rapid aging of the U.S. population, with the number of adults aged 65 and older projected to more than double by 2040 and those aged 85 and older nearly quadrupling, drives demand for cardiac pacemakers due to increased prevalence of cardiovascular diseases and arrhythmias associated with older age.

Rising Incidence of Chronic Disease: The prevalence of multiple chronic conditions among over 29 million US adults in 2022, and the CDC's estimate that six out of ten adults in the United States have chronic diseases like cancer, heart disease, or diabetes, drive the cardiac pacemaker market by increasing the need for advanced medical devices to manage cardiovascular conditions effectively, thereby expanding the market demand.

Technological Advancements: Ongoing advancements in pacemaker technology, including smaller dimensions, extended battery life, and enhanced sensing capabilities, drive the cardiac pacemaker market in the US by improving device effectiveness and enhancing patient outcomes, thereby fostering increased adoption and demand.

Market Restraints

Cost constraints: The significant expenses associated with pacemaker devices and procedures can restrict access for patients and create financial burdens on healthcare budgets, thereby impeding market expansion in the US.

Risk of Complications: Despite technological progress, the inherent risks of complications associated with pacemaker implantation impact the decisions of both patients and physicians, serving as a constraint to market growth in the US cardiac pacemaker sector.

Regulatory Challenges: The stringent FDA regulations necessitating thorough approval processes for new devices delay their market entry and escalate manufacturing costs, posing a market restraint for the cardiac pacemaker industry in the US.

Regulatory Landscape and Reimbursement Scenario

In the US, the regulation of cardiac pacemakers is primarily overseen by the Food and Drug Administration (FDA). Classified as Class III medical devices, pacemakers are subject to stringent regulatory control. Manufacturers must obtain premarket approval (PMA) from the FDA, which involves proving the device's safety and effectiveness before it can be marketed in the US. Reimbursement for pacemaker procedures is mainly managed by the Centers for Medicare & Medicaid Services (CMS) and private insurance providers. Medicare reimburses pacemaker implantation and related procedures through the Physician Fee Schedule and Hospital Outpatient Prospective Payment System.

Competitive Landscape

Key Players

Here are some of the major key players in the Cardiac Pacemaker Market:

- Abbott Laboratories

- Biotronik

- Boston Scientific

- Medtronic

- Cardinal Health

- MicroPort Scientific Corporation

- LivaNova

- OSYPKA Medical

- Lepu Medical

- Oscor Inc.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

US Cardiac Pacemakers Market Segmentation

By Product Type

- Single chamber

- Dual chamber

- Bi ventricular

By Application

- Bradycardia

- Tachycardia

- Other Arrhythmia

By End Users

- Hospitals

- Ambulatory Surgical Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.