US Car T-Cell Therapy Market

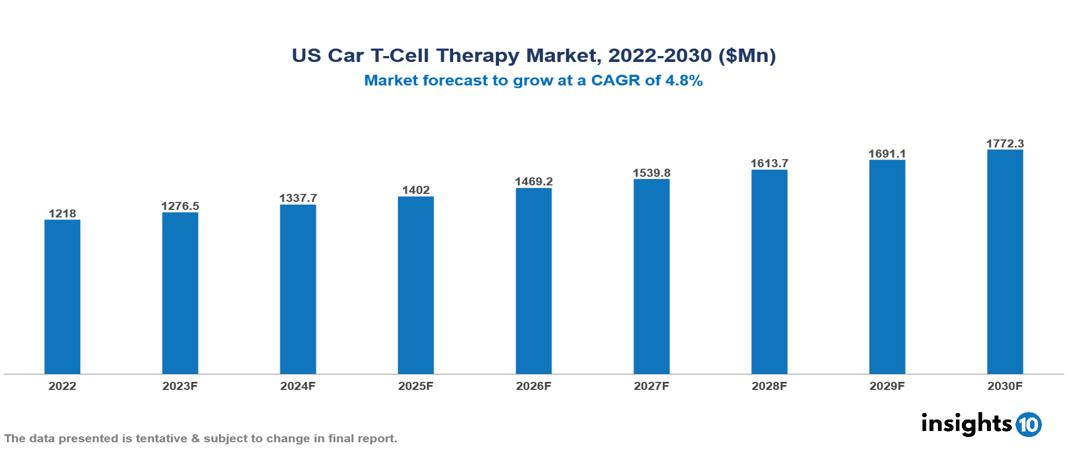

US Car T-Cell Therapy Market valued at $1,218 Mn in 2022, projected to reach $1,772 Mn by 2030 with a 4.8% CAGR. The rising global cancer incidence, driven by aging populations, unhealthy lifestyles, and environmental factors, fuels an expanding population eligible for CAR T-Cell therapy, contributing to the growth of its market. Currently, leading pharmaceutical companies in this market include Gilead Sciences, Novartis, Bristol Myers Squibb, Johnson & Johnson, Kite Pharma, Legend Biotech, Celgene, Cellectis, Atara Biotherapeutics, and UCAR-T.

Buy Now

US Car T-Cell Therapy Market Executive Summary

US Car T-Cell Therapy Market valued at $1,218 Mn in 2022, projected to reach $1,772 Mn by 2030 with a 4.8% CAGR.

CAR T-cell therapy is an innovative immunotherapy used for specific cancers. It involves extracting T cells from the patient, modifying them in the lab to express a chimeric antigen receptor (CAR) targeting cancer cells, and reintroducing these modified T cells. Once infused, CAR T cells identify and destroy cancer cells with the targeted antigen. Successful in blood cancers like leukemia and lymphoma, ongoing research seeks to expand its use and enhance effectiveness for various cancers. The process takes weeks, involving T cell collection, genetic modification, and reintroduction into the patient's bloodstream.

Axicabtagene ciloleucel (axi-cel) and tisagenlecleucel (tisa-cel), both chimeric antigen receptor T-cell (CAR-T) therapies, have gained approval in the United States (US) for treating relapsed or refractory large B-cell lymphoma (R/R LBCL). Given that nearly half of all cancer patients in the US receive treatment in community-based oncology practices, the utilization of CAR T-cell therapies has notably increased. By 2022, global estimates indicate that over 50,000 patients have undergone CAR T-Cell therapy, with a substantial proportion in the US. These therapies demonstrate a success rate of 80%, achieving complete remission in 58% of recipients. Remarkably, relapse-free survival rates at 12 months stand at 84% for CAR-naive cohorts and 74% for those undergoing retreatment.

Significant FDA clearance was obtained by Bristol Myers Squibb in December 2023 for Abecma (idecabtagene vicleucel), extending its indication beyond its original approval for multiple myeloma to cover the treatment of relapsed or refractory large B-cell lymphoma (LBCL) in adults. A similar approval was given by the FDA in August 2023 to Johnson & Johnson's Carvykti (ciltacabtagene autoleucel), extending its existing indication for patients who had previously received therapy that included a BCMA-targeted medication, to treat adults with relapsed or refractory multiple myeloma. Significant progress has been made in increasing the therapy choices available for some hematologic malignancies with these recent approvals.

Market Dynamics

Market Growth Drivers

Expanding FDA Approvals and Clinical Trials: The ongoing approval of diverse CAR T-cell therapies for various cancers is driving market expansion. Bristol Myers Squibb's Abecma (idecabtagene vicleucel) recently obtained FDA approval for addressing relapsed or refractory large B-cell lymphoma (LBCL) in adults. Furthermore, multiple clinical trials exploring the effectiveness of these therapies in wider applications generate optimism for future growth.

Rising Prevalence of Cancer: As outlined in the American Cancer Society's Cancer Statistics 2023 report, it is anticipated that 1,958,310 new cancer cases and 609,820 cancer-related deaths will occur in the US in 2023. The growing prevalence of cancer in the US expands the potential beneficiary pool for CAR T-Cell Therapy, thereby fostering heightened market demand.

Technological Advancements: Novartis reported favorable outcomes from a Phase 2 study of their Kymriah (tisagenlecleucel) CAR T-cell therapy targeting acute myeloid leukemia (AML) in adults, with intentions to submit a Biologics License Application (BLA) to the FDA in 2024. Continuous research and development endeavors aim to enhance manufacturing procedures, lower treatment expenses, and enhance the efficacy and safety of CAR T-cell therapies, rendering them increasingly appealing options.

Market Restraints

High Cost: The customized features and complex manufacturing processes lead to treatment costs that are more than $300,000, which puts a financial burden on patients and healthcare systems. Many commercial and governmental insurance programs have complex terms and limitations that result in high out-of-pocket costs for the insured. While the results are encouraging, the high cost needs to be evaluated against the possible benefits, raising concerns about whether this is a cost-effective option in comparison to other options.

Manufacturing and Logistical Challenges: Currently, very few specialized institutions can produce CAR T-Cell treatments, which creates bottlenecks that impact accessibility. Logistically complex and more expensive, the processing and shipment of CAR T-Cells necessitates strict protocols and temperature control. Identifying eligible patients and ensuring they meet stringent criteria poses challenges due to the personalized nature of the therapy.

Equity and Access Issues: Challenges regarding fairness and accessibility in CAR T-cell treatment arise from disparities in healthcare infrastructure and funding across provinces. The high expenses associated with the treatment pose a barrier to equitable access, particularly affecting individuals with lower incomes. Additionally, a lack of awareness among both patients and healthcare providers can impede prompt referrals, worsening the overall accessibility challenges.

Notable Recent Updates

- August 2023, the orphan drug designation (ODD) for the treatment of multiple myeloma has been approved by the US FDA for NXC-201 (Nexcella), a cutting-edge chimeric antigen receptor (CAR) T-cell therapy.

- August 2023, Invectys reported that the Fast Track Designation has been approved by the FDA for IVS-3001, a chimeric antigen receptor (CAR) T-cell therapy designed to treat individuals with renal cell carcinoma.

Healthcare Policies and Regulatory Landscape

In the US, various authorities manage the regulatory framework and healthcare policies related to therapeutic drugs. The Food and Drug Administration (FDA), a government entity, plays a crucial role in conducting thorough evaluations before a product enters the market, monitoring its safety post-market, and granting approval for new pharmaceuticals. The FDA's Centre for Drug Evaluation and Research (CDER) specifically handles pre-market assessments, drug regulation, and the formulation of guidelines for drug development. Within the U.S. Department of Justice, the Drug Enforcement Administration (DEA) is tasked with enforcing regulations to curb the misuse and diversion of prohibited narcotics. The Centres for Medicare & Medicaid Services (CMS) holds significant influence over a considerable portion of the population's access to pharmaceuticals by overseeing reimbursement policies for medications covered by Medicare and Medicaid.

Competitive Landscape

Key Players

- Gilead Sciences

- Novartis

- Bristol Myers Squibb

- Johnson & Johnson

- Kite Pharma

- Legend Biotech

- Celgene

- Cellectis

- Atara Biotherapeutics

- UCAR-T

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

US Car T-Cell Therapy Market Segmentation

By Product Type

- Axicabtagene Ciloleucel

- Tisagenlecleucel

- Brexucabtagene

- Lisocabtagene Maraleucel

- Idecabtagene Vicleucel

- Others

By Indication

- Acute Lymphocytic Leukaemia

- Diffuse Large B-cell Lymphoma

- Follicular Lymphoma

- Mantle Cell Lymphoma

- Multiple Myeloma

- Others

By End-Users

- Hospitals

- Cancer Treatment Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.