US Bio-implant Market Analysis

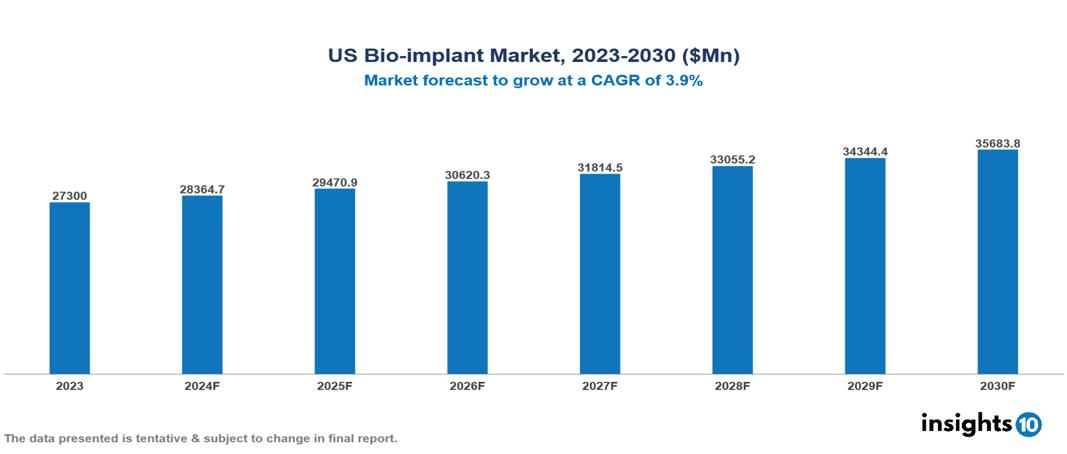

The US Bio-implant Market was valued at $27300 Mn in 2023 and is predicted to grow at a CAGR of 3.9% from 2023 to 2030, to $35683.8 Mn by 2030. The US Bio-implant Market is growing due to Aging population, Rising prevalence of chronic diseases, Technological advancements. The market is primarily dominated by players such as Boston Scientific Corporation, Johnson & Johnson Services, Inc., Zimmer Biomet Holdings Inc, LifeNet Health, Smith & Nephew, Arthrex, Inc.

Buy Now

US Bio-implant Market Executive Summary

US Bio-implant Market is at around $27300 Mn in 2023 and is projected to reach $35683.8 Mn in 2030, exhibiting a CAGR of 3.9% during the forecast period.

Bioimplants are advanced medical devices designed to be implanted into the body in order to support or replace a biological structure or function. These instruments range significantly in complexity and purpose from simple dental implants to sophisticated gadgets like pacemakers, prosthetic joints, and neurological implants. One of the primary objectives of bioimplants is to enhance the quality of life for people with a range of diseases or injuries by using implantable devices to restore lost or damaged functions. Bio-implants, which are often composed of biocompatible materials, reduce the likelihood of rejection. Innovations like adding wireless connectivity and sensors to bioimplants, which enable real-time physiological data monitoring and remote modifications, are driving the market's growth.

Chronic conditions affect approximately 60% of American adults, with 40% having two or more. The 65+ population is expected to reach 80 Mn by 2040, nearly doubling from 2000. This demographic is more prone to conditions requiring bio-implants, such as osteoarthritis, affecting 50% of adults over 65. Heart disease, the leading cause of death, impacts 11.7% of adults. Additionally, obesity rates have risen to 42.4% in adults, increasing the need for joint replacements. Therefore, the market is driven by significant factors like Aging population, Rising prevalence of chronic diseases, Technological advancements. However, High Costs and Limited Insurance Coverage, Stringent Regulatory Environment, Ethical and Privacy Concerns restrict the growth and potential of the market.

NuVasive, Inc. involved in spine technology innovation, announced that it obtained clearance from the US Food and Drug Administration (FDA), specifically the 510(k) clearance, to broaden the scope of applications for Attrax Putty within its extensive thoracolumbar interbody portfolio intended for spine surgery.

Market Dynamics

Market Growth Drivers

Aging population: US is experiencing a significant demographic shift towards an older population. By 2030, all baby boomers will be over 65, and older adults are projected to outnumber children for the first time in US history. According to the US Census Bureau, the number of Americans aged 65 and older is expected to nearly double from 52 Mn in 2018 to 95 Mn by 2060. This aging population drives demand for bio-implants as older adults are more likely to require medical interventions for age-related conditions such as joint problems, cardiovascular issues, and sensory impairments.

Rising prevalence of chronic diseases: Chronic diseases are becoming increasingly common in the US, partly due to lifestyle factors and the aging population. The CDC reports that 6 in 10 adults in the US have a chronic disease, and 4 in 10 have two or more. Conditions like diabetes, heart disease, and arthritis often require bio-implant solutions. For instance, the American Diabetes Association states that about 1.6 Mn will have Type 1 diabetes, many of whom could benefit from implantable insulin pumps or glucose monitors.

Technological advancements: Rapid progress in bioengineering, materials science, and miniaturization is driving innovation in bio-implants. These advancements are making implants more effective, longer-lasting, and less invasive. Innovations like 3D-printed implants, biocompatible materials, and implants with integrated sensors are expanding the possibilities and applications of bio-implants across various medical fields.

Market Restraints

High Costs and Limited Insurance Coverage: Bio-implants are often expensive, with costs ranging from $5,000 to over $50,000 depending on the type and complexity. A 2023 study found that only about 60% of private insurance plans fully covered bio-implants, while Medicare and Medicaid coverage varied by state. Out-of-pocket expenses can be substantial, with patients paying an average of $8,000 for partially covered procedures. This financial burden limits market growth, especially among lower-income populations. The American Medical Association reported that approximately 30% of patients who could benefit from bio-implants delay or forego treatment due to cost concerns.

Stringent Regulatory Environment: The FDA approval process for bio-implants is rigorous and time-consuming, often taking 3-7 years from initial application to market approval. This lengthy process increases development costs, estimated at $30-100 million per device. In 2023, only 12% of new bio-implant submissions received FDA approval on their first attempt. The stringent regulations, while ensuring safety, can slow innovation and market entry for new products. Smaller companies, in particular, struggle with the regulatory burden, with 40% of startups citing regulatory challenges as a major obstacle to market entry.

Ethical and Privacy Concerns: As bio-implants become more advanced, particularly those with digital components, ethical and privacy concerns have emerged. There are concerns about potential hacking, unauthorized data access, or use of implant data by insurance companies or employers. These issues have led to calls for stricter regulations on data collection and usage from bio-implants. Several high-profile legal cases involving data breaches from medical devices have further fueled public skepticism.

Regulatory Landscape and Reimbursement scenario

The US bio-implant market is regulated primarily by the Food and Drug Administration (FDA) under the Medical Device Amendments to the Federal Food, Drug, and Cosmetic Act. Bio-implants are typically classified as Class III medical devices, requiring the most stringent controls due to their high-risk nature. Manufacturers must obtain premarket approval (PMA) through clinical trials demonstrating safety and efficacy. The FDA also oversees post-market surveillance, manufacturing practices, and adverse event reporting. Additional oversight comes from the Centers for Medicare and Medicaid Services for reimbursement policies, and various state-level regulations. The regulatory landscape aims to balance innovation with patient safety, addressing challenges like biocompatibility, long-term effects, and cybersecurity for smart implants.

In the US bioimplant market, reimbursement typically involves a complex interplay between manufacturers, healthcare providers, insurers, and government agencies. Medicare and private insurance companies evaluate bioimplants for safety, efficacy, and cost-effectiveness before determining coverage. Reimbursement rates are often based on diagnosis-related groups (DRGs) or current procedural terminology (CPT) codes. Providers must navigate intricate billing processes, including prior authorization and documentation requirements. Some innovative bioimplants may face initial reimbursement challenges, requiring manufacturers to demonstrate clinical and economic value. Patient cost-sharing, such as copayments or deductibles, can also impact access to bioimplants. The reimbursement landscape continues to evolve with value-based care initiatives and efforts to contain healthcare costs.

Competitive Landscape

Key Players

Here are some of the major key players in US Bio-implant Market:

- Boston Scientific Corporation

- Johnson & Johnson Services, Inc.

- Zimmer Biomet Holdings Inc

- LifeNet Health

- Smith & Nephew

- Arthrex, Inc.

- Clinic Lemanic

- Alpha Bio Tec

- MiMedx Group

- Medtronic,

- St Jude Medical (Abbott)

- Stryker Cooperation

- DePuy Synthes

- Biomet (Zimmer)

- Exactech, Inc.

- Cochlear Ltd

- Straumann AG

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

US Bio-implant Market Segmentation

By Material

- Ceramics

- Polymers

- Alloys

- Biomaterials Metals

By Type

- Dental Bio-implants

- Orthopedic Bio-implants

- Spinal Bio-implants

- Ophthalmology Bio-implants

- Cardiovascular Bio-implants

- Others

By Mode of Administration

- Surgical

- Injectable

By End User

- Hospitals

- Speciality Clinics

- Ambulatory surgical centres

By Origin

- Autograft

- Allograft

- Xenograft

- Synthetic

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.