US Atherosclerosis Therapeutics Market Analysis

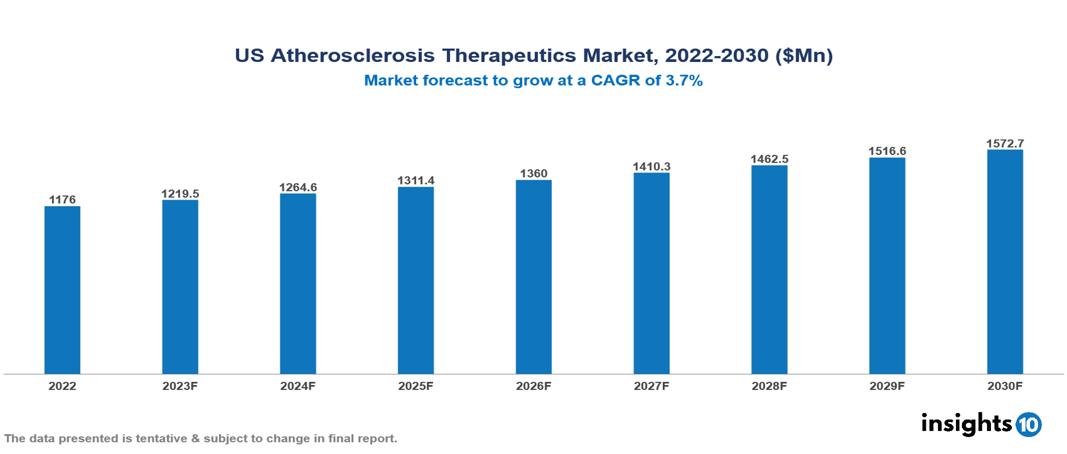

US Atherosclerosis Therapeutics Market was valued at $1176 Mn in 2022 and is estimated to reach $1573 Mn in 2030, exhibiting a CAGR of 3.7% during the forecast period. The market for atherosclerosis therapeutics is expected to grow as a result of the increased incidence of sedentary behaviour, poor diets, and the aging of the world's population, which are all contributing factors to the prevalence of cardiovascular diseases. Top leading pharmaceutical companies currently operating in the market are Pfizer, Novartis, AstraZeneca, Sanofi, Bayer, Johnson & Johnson, Eli Lilly, AbbVie, Roche and Amgen.

Buy Now

US Atherosclerosis Therapeutics Market Executive Summary

US Atherosclerosis Therapeutics Market was valued at $1176 Mn in 2022 and is estimated to reach $1573 Mn in 2030, exhibiting a CAGR of 3.7% during the forecast period.

Vascular constriction or blockage caused by plaque buildup is known as atherosclerosis. The plaque that is created by the combination of poor cholesterol and white blood cells might disrupt the body's normal blood flow. Damage to the inner lining of the blood vessel facilitates the attachment of dangerous cholesterol to the vessel walls. Plaque forms when the body's natural removal mechanism, cells, gets stuck from time to time. It is possible for this plaque to clog the channel, reducing blood flow and increasing the risk of potentially fatal conditions such as heart attacks and strokes. Several things can contribute to atherosclerosis, such as high blood pressure, high cholesterol, diabetes, obesity, smoking, heart disease in the family, inactivity, and eating an unhealthy diet.

As a precursor to heart disease, atherosclerosis affects an estimated 24% of all adults in the United States (61.7 Mn individuals) as of 2022. This has a significant impact on public health. With more than half (51%) of American people over the age of 18 exhibiting at least one major risk factor, the prevalence of heart disease risk factors is startling. Furthermore, atherosclerosis tends to increase with age, with men having a larger risk at younger ages and women catching up after menopause. Heart disease is still one of the leading causes of death in the United States, accounting for over 647,000 fatalities annually, or one in every four deaths.

Eli Lilly's Trulicity, a GLP-1 receptor agonist, has consistently demonstrated positive outcomes in effectively managing diabetes and cardiovascular risk factors, suggesting its potential to secure a more substantial market share.

Novartis accomplished a noteworthy landmark when the FDA approved Leqvio, a novel PCSK9 inhibitor, in December 2023. This approval adds to the pool of therapeutic options available to high-risk patients with severe cholesterol problems, hence increasing competition in the market.

Market Dynamics

Market Growth Drivers

Increasing Prevalence of Cardiovascular Diseases: Over 24% of US adults suffer from heart disease, a major consequence of atherosclerosis. This vast population base translates to a significant market demand for treatment options. One prominent cause of this health issue is atherosclerosis, which increases the need for therapeutic medications that aim to mitigate its effects. The population is exposed to common risk factors, including obesity, high blood pressure, and unhealthy cholesterol levels. As a result, the need for effective atherosclerosis treatment measures is growing.

Aging Population: The increasing age of population contributes significantly to the older population's increased susceptibility to atherosclerosis, which in turn drives the expansion of the relevant drug market. By 2050, the number of people aged 65 and over is projected to reach 82 million, or about 23% of the total population. The aging population's increased risk of developing Atherosclerosis underscores the growing importance of addressing the therapeutic needs associated with this cardiovascular condition.

Lifestyle-Related Risk Factors: The increased prevalence of risk factors connected to lifestyle, such as bad eating habits and sedentary behaviour, is primarily responsible for the growing incidence of atherosclerosis. This in turn fuels the demand for effective drugs to manage and treat atherosclerosis and other associated medical conditions.

Market Restraints

Cost and Affordability: The high cost of atherosclerosis drugs, particularly novel ones such as PCSK9 inhibitors, makes it hard for patients to obtain them, particularly those with low incomes or insurance coverage. This charge not only costs consumers money but also puts pressure on public healthcare systems to make the best use of the limited resources they have.

Regulatory landscape: The FDA's rigorous clearance process poses obstacles for the Atherosclerosis Therapeutics industry, potentially delaying the release of new medications in comparison to other markets. This delay might have serious repercussions, limiting the market's total growth potential and influencing patient’s access to potentially life-saving therapies. Furthermore, there are growing ethical concerns about the overdiagnosis and overtreatment of atherosclerosis, especially in cases that are borderline. These moral concerns could result in more stringent prescription usage guidelines, which could slow down the growth of the business.

Patient Adherence: Effective treatment of atherosclerosis usually requires long-term medication adherence, which can be challenging for some people. Many things, such as adverse effects, complicated dosage schedules, and a lack of obvious immediate benefits, can contribute to non-adherence. This may make treatment less effective and increase the cost of healthcare if complications arise.

Healthcare Policies and Regulatory Landscape

The Food and Drug Administration (FDA) is the main regulatory body in charge of regulating treatment drug regulations and healthcare laws in the United States. The FDA plays a crucial role in evaluating, approving, and regulating pharmaceutical products, including drugs for various medical conditions. Before pharmaceuticals are released into the market, they must pass stringent clinical and scientific evaluations to guarantee their efficacy and safety. Operating under the guidance of federal laws, including the Federal Food, Medication, and Cosmetic Act, the FDA carries out rules that provide guidelines for medication development, production, labelling, and marketing. The agency takes preclinical and clinical trial data into account when evaluating new medication applications that pharmaceutical companies submit. The FDA permits a drug's commercialization after it has been established to be both safe and effective. In addition, government initiatives like Medicare and Medicaid have an impact on healthcare policy pertaining to drug pricing, reimbursement, and market access. These programs are overseen by the Centre’s for Medicare & Medicaid Services (CMS), which also sets beneficiary drug reimbursement regulations. In addition, the Affordable Care Act (ACA) has greatly influenced healthcare regulations, particularly those pertaining to biosimilars, the authorization and availability of generic medications, and the control of specific pharmaceutical practices.

Competitive Landscape

Key Players

- Pfizer

- Novartis

- AstraZeneca

- Sanofi

- Bayer

- Johnson & Johnson

- Eli Lilly

- AbbVie

- Roche

- Amgen

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

US Atherosclerosis Therapeutics Market Segmentation

By Therapy

- Atherosclerosis Medications

- Cholesterol-lowering Medications

- Antiplatelet drugs and Anticoagulants

- Atherosclerosis Beta Blockers

- Diuretics or Water Pills

- Angiotensin Converting Enzyme (Ace) Inhibitors

- Other Atherosclerosis Treatment Therapies

By Surgery

- Bypass Surgery (Coronary Artery Bypass Grafting (CABG)

- Angioplasty

- Atherectomy

By Drug Class

- Cholinesterase Inhibitors

- NMDA Receptor Antagonists

- Manufactured Combination

By End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

By Distribution Channel

- Hospital pharmacies

- Clinics

- Drug stores

- Retail pharmacies

- Online pharmacies

- Other distribution channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.