US Anti Aging Therapeutics Market Analysis

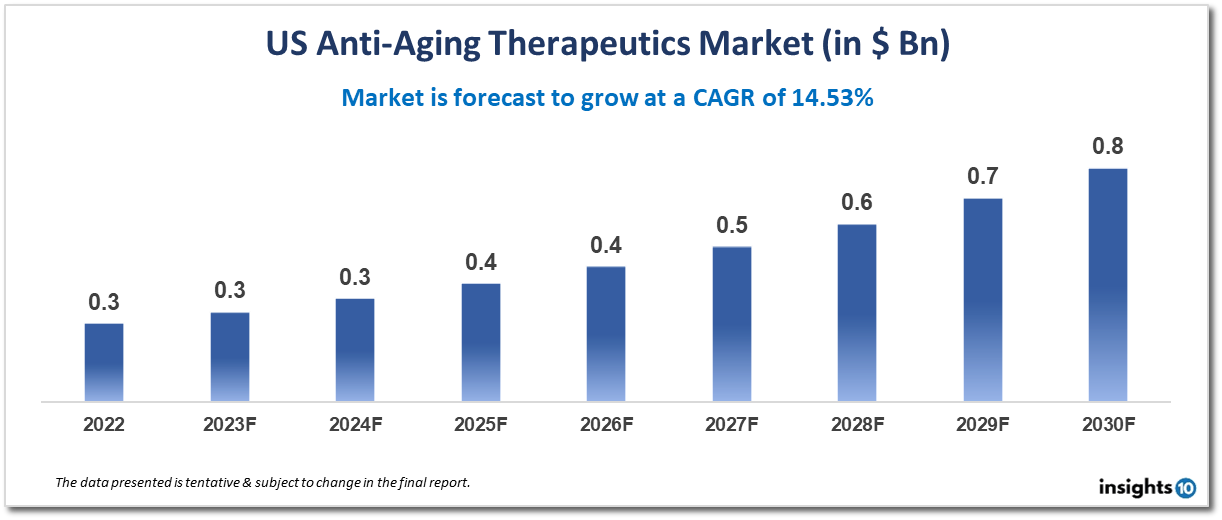

The US anti-aging therapeutics market is projected to grow from $0.3 Bn in 2022 to $0.8 Bn by 2030, registering a CAGR of 14.53% during the forecast period of 2022-30. The market is a rapidly growing sector that includes a variety of products and services aimed at reducing or reversing the effects of aging. The key players in the market include Allergan, Inc., Lumenis Ltd., Cynosure, Inc., Personal Microderm, Johnson & Johnson, and Alma Lasers, among others. These companies are investing heavily in research and development to develop new and innovative products to meet the growing demand for anti-aging products and services.

Buy Now

US Anti-Aging Therapeutics Market Executive Summary

Over the projection period of 2022-30, the US anti-aging therapeutics market is anticipated to expand from $0.3 Bn in 2022 to $0.8 Bn in 2030, showing a CAGR of 14.53%. A wide range of goods and services intended to lessen or reverse the effects of ageing are included in the rapidly expanding US anti-aging therapeutics market.

The market is largely driven by the ageing population's growth, rising anti-aging product and treatment awareness, and technological improvements. As more individuals explore ways to keep their young looks and enhance their general health and well-being, the demand for anti-aging goods and services is rising.

The four basic categories into which anti-aging goods and services may be divided are:

- Skincare

- Haircare

- Vitamins, and

- Hormone replacement treatment

The largest market sector is made up of skincare items including anti-aging creams, serums, and lotions, which are followed by haircare items. Consumers who want to boost their general health and fight ageing are also drawn to supplements including vitamins, minerals, and antioxidants.

Another well-liked anti-aging procedure called hormone replacement therapy (HRT) uses hormones to restore the body's diminishing hormone levels. Due to worries about its safety and potential adverse effects, the use of HRT has been divisive in recent years.

Allergan, Inc., Lumenis Ltd., Cynosure, Inc., Personal Microderm, Johnson & Johnson, and Alma Lasers are a few of the leading companies in the US anti-aging therapies industry. To address the rising demand for anti-aging goods and services, these businesses are making significant investments in research and development in order to create fresh, cutting-edge products.

Market Dynamics

Market Growth Drivers

In the upcoming years, the US market for anti-aging pharmaceuticals is anticipated to expand significantly due to a number of causes. They consist of the following:

- Rising interest in anti-aging products The demand for goods and services that might help people keep their youth and vigour is rising as the American population ages

- Modern medical technology advances: There are more potential for the development of anti-aging medicines thanks to the advancement of new medical technologies like stem cell therapies

- Increasing public awareness of the advantages of healthy ageing: There is a rising demand for goods and services that can assist consumers in achieving this aim

The market is expanding as a result of rising disposable income levels, which enable more individuals to purchase anti-aging goods and services.

Competitive Landscape

Key Players

The American anti-aging therapies industry is very crowded with companies, making it extremely competitive. Some of the major companies in the US market for anti-aging medications are listed below:

- Allergan, Inc.: Allergan is a large pharmaceutical business with operations all over the world. It produces and sells a variety of anti-aging goods and services, such as Juvéderm and Botox.

- Lumenis Ltd.: Lumenis is a medical device firm that creates and produces cutting-edge energy-based technologies, such as laser and light-based anti-aging devices

- Cynosure, Inc.: Cynosure is a pioneer in the development and production of light-based medical and aesthetic treatment systems. Products from the business are utilised in additional anti-aging procedures, including hair removal and skin rejuvenation.

- Personal Microderm: Personal Microderm is a skincare business with a focus on at-home microdermabrasion treatments that aim to reduce the appearance of wrinkles, fine lines, and other ageing symptoms

- Johnson & Johnson: Neutrogena and Aveeno are two examples of the business's line of anti-aging skincare products. Johnson & Johnson is a worldwide healthcare corporation.

- Alma Lasers is a leading manufacturer of laser, light-based, and radiofrequency equipment for use in anti-aging therapies. Alma Lasers is a multinational medical technology firm.

Galderma Laboratories, Merz Pharma, Sinclair Pharma, and Syneron Candela are a few further significant companies operating in the US anti-aging therapies sector. To fulfil the rising demand from customers, these businesses are substantially spending in research and development to create brand-new anti-aging goods and treatments.

Healthcare Policies and Regulatory Landscape

A variety of healthcare rules and regulations are applied to the US anti-aging pharmaceutical industry in order to ensure the security and effectiveness of anti-aging goods and services. The following are some of the major healthcare regulations and regulatory agencies that have an influence on the US market for anti-aging medications:

- Drug Enforcement Agency (DEA): In the US, the FDA is in charge of overseeing the efficacy and safety of medicines, medical devices, and other healthcare items. For anti-aging goods and services, the FDA has developed a specialised regulatory framework that includes pre-market product evaluation and clearance for some items.

- Federal Trade Commission (FTC): The FTC is in charge of upholding laws and rules pertaining to consumer protection, particularly those pertaining to the marketing and advertising of anti-aging goods and services. The FTC keeps a careful eye on the promises made by businesses marketing anti-aging goods and services and takes enforcement action against those that do so.

- The National Institutes of Health (NIH) is a government organisation in charge of carrying out and supporting medical research. The National Institutes of Health (NIH) invests heavily in anti-aging research, including investigations into the fundamental causes of ageing, the creation of novel anti-aging medications, and the impact of lifestyle changes on ageing.

- The Health Insurance Portability and Accountability Act (HIPAA) is a federal legislation that controls how personal health information is used and shared. All healthcare professionals, including those who supply anti-aging goods and treatments, are subject to the legislation.

- Governmental Rules: The practice of medicine and the delivery of healthcare services are also governed by state-specific laws. State-by-state variations in these laws may have an effect on the delivery of anti-aging goods and services as well as the practice of anti-aging medicine.

The regulatory environment and healthcare regulations in the US anti-aging pharmaceutical industry are intricate and dynamic. To ensure the safety and effectiveness of their goods and services, businesses in this industry must keep abreast of regulatory developments and adhere to all applicable laws.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

US Anti-Aging Therapeutics Market Segmentation

By Product (Revenue, USD Billion):

- Anti-Wrinkle

- Hair Color

- Ultraviolet (UV) Absorption

- Anti-Stretch Mark

- Others

By Treatment (Revenue, USD Billion):

- Hair Restoration

- Anti-Pigmentation

- Adult Acne Therapy

- Breast Augmentation

- Liposuction

- Chemical Peel

- Others

By Target Group (Revenue, USD Billion):

- Male

- Female

By Type of Aging (Revenue, USD Billion):

- Cellular Aging

- Immune Aging

- Metabolic Aging

- Others

By Type of Molecules (Revenue, USD Billion):

- Biologics

- Small Molecules

By Mechanism of Action (Revenue, USD Billion):

- Senolytic

- Cell Regeneration

- mTOR inhibitor/Modulator

- AMP-kinase/AMP Activator

- Mitochondria Inhibitor/Modulator

- Others

By Ingredient (Revenue, USD Billion):

- Retinoid

- Hyaluronic Acid

- Alpha Hydroxy Acid

- Others

By Distribution Channel (Revenue, USD Billion):

- Pharmacies

- Stores

- Online Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.