US Anemia Therapeutics Market Analysis

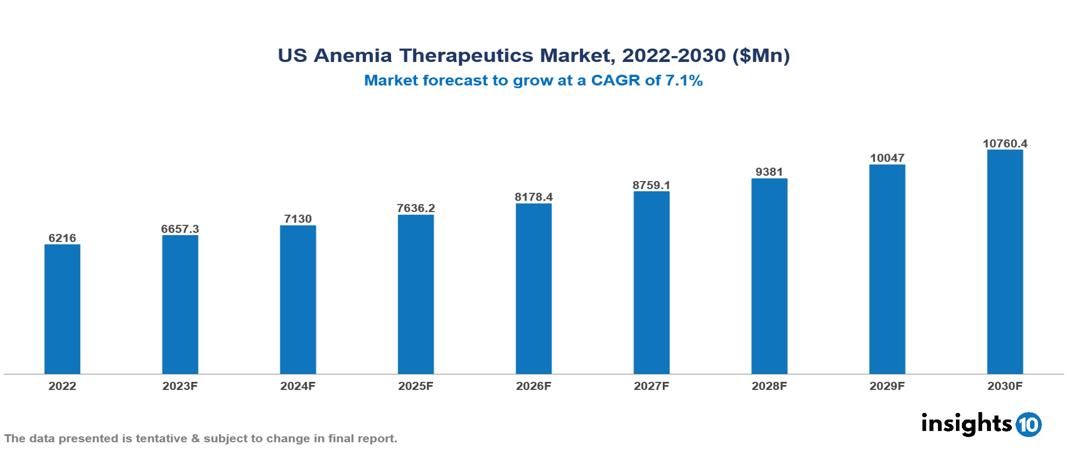

The US Anemia Therapeutics Market is anticipated to experience a growth from $6.216 Bn in 2022 to $10.76 Bn by 2030, with a CAGR of 7.1% during the forecast period of 2022-2030. Growing healthcare expenditures, favourable government and insurance policies, breakthroughs in treatment choices, and increased awareness campaigns that promote early diagnosis and individualized care all drive the US Anemia Therapeutics Market. The US Anemia Therapeutics Market encompasses various players across different segments, including Amgen, Pfizer, Roche, Sanofi, Novartis, Celgene, Blueprint Medicines, Janus Pharmaceuticals, Pharmacosmos, Apotex etc, among various others.

Buy Now

US Anemia Therapeutics Market Analysis Executive Summary

The US Anemia Therapeutics Market is anticipated to experience a growth from $6.21 Bn in 2022 to $10.76 Bn by 2030, with a CAGR of 7.1% during the forecast period of 2022-2030.

Anemia is characterized by a deficiency of healthy red blood cells, leading to symptoms like fatigue and weakness. There are different types of anemia, each with its unique causes and treatments. Varieties include iron deficiency anemia, vitamin B12 deficiency anemia, folate deficiency anemia, aplastic anemia, hemolytic anemia, and pernicious anemia. Anemia can result from various factors, such as insufficient dietary intake, absorption issues, vitamin deficiencies, chronic diseases, genetic disorders, bone marrow issues, hemolysis, medications, infections, and pregnancy-related iron needs. Dietary changes or supplements may address some cases, while more severe types might require treatments like blood transfusions, bone marrow transplants, or medications. Treatment depends on the specific anemia type and its underlying cause, often involving referral to specialists for comprehensive assessment and management by healthcare providers.

The incidence of anemia in the US has been growing over time. Data show that the general prevalence of anemia and moderate-to-severe anemia has nearly quadrupled in recent years. High-risk populations for anemia include the elderly, reproductive-age and pregnant women, Hispanics, and non-Hispanic blacks. There has been a considerable increase in general anemia prevalence, from 5.71% to 6.86%. Growing healthcare expenditures, favorable government and insurance policies, breakthroughs in treatment choices, and increased awareness campaigns that promote early diagnosis and individualized care all drive the US Anemia Therapeutics Market.

Novartis dominates the market with products such as Procrit and Revasal for iron deficiency anemia and Aranesp and Epogen for chronic kidney disease-related anemia. Pfizer has a strong market position with Xpozio (romiplostim) for immune thrombocytopenic purpura (ITP)-associated anemia and Retacrit (epoetin alfa) for chronic kidney disease anemia. Bluebird Bio, an upcoming player in the industry, is developing gene therapy for β-thalassemia, a hemoglobin disease that causes anemia.

Market Dynamics

Market Growth Drivers

Economic factors: As healthcare budgets rise, more resources are allocated to research and development of novel anemia medicines, as well as expanding access to existing treatments. Furthermore, supportive government and insurance policies for anemia treatment help to drive market expansion by reducing patient affordability issues.

Technological Advancements: Such as gene therapy for uncommon anemias and targeted medications, provide new therapeutic options. Early and precise diagnosis using modern diagnostics enables immediate action and individualized treatment strategies. Increased use of these technologies increases access to care and aids in the continuous management of anemia patients.

Increased Awareness: Campaigns raise awareness of anemia, its causes, and treatment choices, resulting in more patients being diagnosed and seeking treatment. The emphasis on individualized care and patient well-being encourages the development of tailored medicines and more effective treatment regimens.

Market Restraints

Market Saturation: Established pharmaceutical companies with strong names and contacts with healthcare providers may already dominate the market for some anemia medications. This may be a considerable barrier to entry for new enterprises looking to obtain market share. The expiry of patents on established anemia treatments may result in an inflow of generic copies available at much cheaper prices. This can reduce the market share of the original branded medicine, even if it provides apparent benefits.

Reimbursement Challenges: Negotiating good reimbursement rates with insurance companies can be challenging for both existing and novel anemia medications. If insurers judge potentially helpful therapies to be cost-ineffective, patients may have limited access to them.

Strict Regulations: Regulations for new pharmaceuticals might hinder entry and increase costs for bringing novel cures to market. This can limit competition and access to potentially more effective or less expensive therapies. Some anemia treatments, notably erythropoietin-stimulating agents, have been associated with major adverse effects such as cardiovascular disease and tumor development. This may result in additional scrutiny from regulatory organizations, limiting further use.

Healthcare Policies and Regulatory Landscape

In the US, the complex web of healthcare legislation has a significant impact on the delivery of medical services and the pharmaceutical business. The national healthcare system is distinguished by a dynamic mix of public and private efforts. Public programs such as Medicare and Medicaid are critical components that cater to certain populations and address healthcare access for the elderly, low-income folks, and those with disabilities. In this complicated landscape, the Food and Drug Administration (FDA) plays a critical role as the principal regulatory body for pharmaceuticals. The FDA has a significant impact not only in the US but across the world. The FDA, which is responsible for protecting public health, carefully assesses the safety, effectiveness, and quality of medications through severe approval processes that include rigorous clinical studies.

Competitive Landscape

Key Players:

- Amgen

- Pfizer

- Roche

- Sanofi

- Novartis

- Celgene

- Blueprint Medicines

- Janus Pharmaceuticals

- Pharmacosmos

- Apotex

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

US Anemia Therapeutics Market Segmentation

By Type of Disease

- Iron Deficiency Anemia

- Megaloblastic Anemia

- Pernicious Anemia

- Hemorrhagic Anemia

- Hemolytic Anemia

- Sickle Cell Anemia

By Population

- Pediatrics

- Adults

- Geriatrics

By Therapy Type

- Oral Iron Therapy

- Parenteral Iron Therapy

- Red Blood Cell Transplantation

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.