US Alcohol Addiction Therapeutics Market Analysis

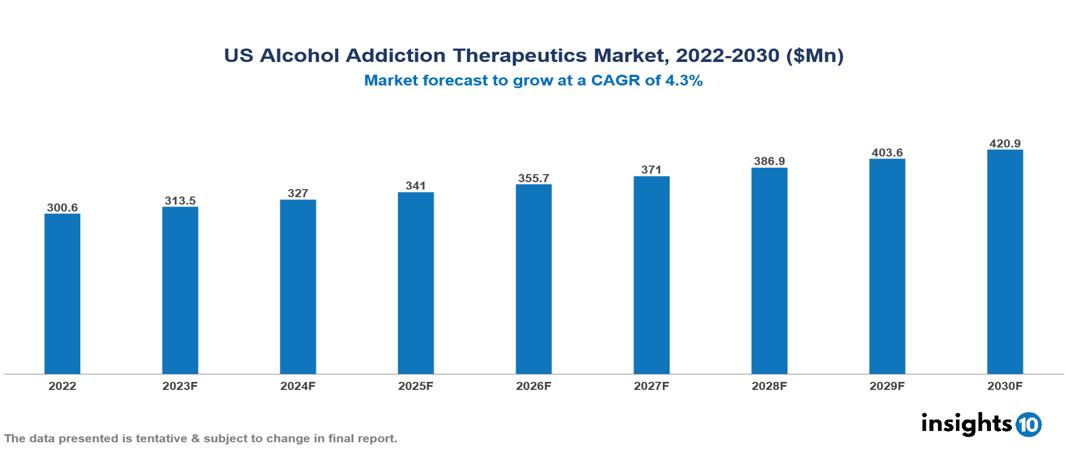

The US Alcohol Addiction Therapeutics Market is valued at around $301 Mn in 2022 and is projected to reach $421 Mn by 2030, exhibiting a CAGR of 4.3% during the forecast period. The market is driven by a mix of factors, such as the increasing prevalence of alcohol addiction in the US, the presence of promising drugs in the pipeline and increased coverage of therapeutics by insurance providers. The key players involved in the research, development and distribution of Alcohol Addiction Therapeutics in US are Alkermes, TEVA, GlaxoSmithKline, Lundbeck, Eli Lilly, BioCorRx, Chronos, AstraZeneca, Roche, Opiant Pharmaceuticals, etc among others

Buy Now

US Alcohol Addiction Therapeutics Market Executive Summary

The US Alcohol Addiction Therapeutics Market is valued at around $301 Mn in 2022 and is projected to reach $421 Mn by 2030, exhibiting a CAGR of 4.3% during the forecast period.

Alcohol use disorder (AUD), another name for alcohol addiction, is a medical illness characterized by heavy or regular alcohol consumption, even when it interferes with one's life or negatively impacts one's health. There is no one scientific test used to diagnose AUD; instead, it develops gradually. A discussion with a healthcare professional, forms the basis of the diagnosis. Detoxification, behaviour modification, psychotherapy, and medication are available as forms of treatment. Depending on the patient's condition and recovery level, the type of treatment will vary and may include inpatient treatment (hospital), outpatient intensive therapy, residential rehabilitation (rehab), or outpatient maintenance. For the treatment of AUD, there are pharmaceuticals such as acamprosate, naltrexone, and disulfiram, as well as behavioural therapies like cognitive-behavioural therapy (CBT)

Over the age of 12, 1 in 10 Americans suffers from an AUD. 10.5% of those aged 12 and over, or around 29.5 Mn individuals, reported having AUD in the past year. This comprises 12.2 Mn females and 17.4 Mn males aged 12 and older (8.5% and 12.6%, respectively, in this age range). This trend is growing at an accelerated rate since the COVID-19 lockdowns. The market is driven by a mix of factors, such as the increasing prevalence of alcohol addiction in the US, the presence of promising drugs in the pipeline, and increased coverage of therapeutics by insurance providers.

In 2022, Alkermes's primary product, Vivitrol, brought in around $1 Bn in sales worldwide, most of which reportedly came from the US market. Even if they may not individually take the top rank, businesses like GSK and Lundbeck, which have well-known brands like Selinex and Campral, contribute significantly to the US Alcohol Addiction Therapeutics Market

Market Dynamics

Market Drivers

Increasing prevalence: Millions of Americans are impacted by AUD, as one in ten adults and adolescents in the US struggle with it. The yearly economic cost of AUD, including missed productivity and medical expenses, is more than $249 Bn. For the benefit of the whole nation, it is imperative that the growing prevalence be addressed and the problem be resolved. Due to the scarcity of AUD treatment alternatives, there is a growing market need for novel and advanced therapies in the country.

Pipeline Drugs: Prescriptions for long-acting injectable naltrexone, such as VIVITROL, increased by 30% between 2020 and 2022. There are more than 50 new AUD medicines in various stages of research in the pipeline. New and promising solutions for treating AUD have been made possible by technological improvements in pharmaceutical development.

Increasing coverage and reimbursement: In order to improve access and reimbursement, policies are being changed, and this is making the healthcare system more equal for those with AUD. Treatment for mental health and drug addiction must be covered equally with other medical diseases, according to the Mental Health Parity and Addiction Equity Act. Millions of Americans now have more insurance coverage for AUD treatment because to the Affordable Care Act's Medicaid expansion.

Market Restraints

Lack of Knowledge and Acceptance of Addiction: Almost 60% of AUD sufferers do not undergo treatment because of things like a lack of knowledge or acceptance of their illness. Admitting that they have a problem makes people feel horrible. The social stigma associated with addiction might occasionally persist, which deters people from getting treatment. Erroneous beliefs about addiction as a sickness rather than a moral shortcoming exacerbate the issue. This reduces the demand for therapy.

Therapy Cost: Even with insurance coverage, the high out-of-pocket expenses linked to certain treatment alternatives can be a major barrier. Their reach is limited by the cost and insurance coverage of some medications, such as long-acting naltrexone injectables. Furthermore, accessibility and extension of AUD treatment programs are limited by a lack of public financing.

Social problems and Attitude: When heavy drinking becomes accepted in some social settings, it might minimize the seriousness of AUD and hinder treatment. The easy availability to alcohol through a variety of channels, even to minors, raises the risk of alcohol abuse and the emergence of AUD. Additionally, rehabilitation attempts may be hampered by inadequate social support networks for those who are addicted.

Healthcare Policies and Regulatory Landscape

The safety, effectiveness, and accessibility of healthcare services and goods are the main goals of the extensive array of laws and programs that make up US healthcare policies. The US Food and Drug Administration (US FDA), the nation's drug regulatory agency, is mostly responsible for managing the pharmaceutical sector. It is one of the most powerful drug regulatory organizations in the world and is vital to drug regulation not just in the US but in most parts of the world. It is in charge of assessing a medication's efficacy and safety prior to marketing it, as well as overseeing and controlling its usage beyond that point. The FDA plays a critical role in addressing pressing public health issues and providing guidance for the creation and execution of regulatory actions. In order to maintain data integrity in international clinical trials, the agency also works with other international regulatory authorities, highlighting the significance of data quality management procedures and human subject protection.

Competitive Landscape

Key Players

- Alkermes

- TEVA

- GlaxoSmithKline

- Lundbeck

- Eli Lilly

- BioCorRx

- Chronos

- AstraZeneca

- Roche

- Opiant Pharmaceuticals

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

US Alcohol Addiction Therapeutics Market Segmentation

By Therapy Type

- Pharmacological Therapy

- Behavioural Therapy

- Digital Health Interventions

- Others

By Disease Stage

- Mild Alcohol Dependence

- Moderate Alcohol Dependence

- Severe Alcohol Dependence

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Residential Treatment Centres

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.