US Adult Malignant Glioma Therapeutics Market Analysis

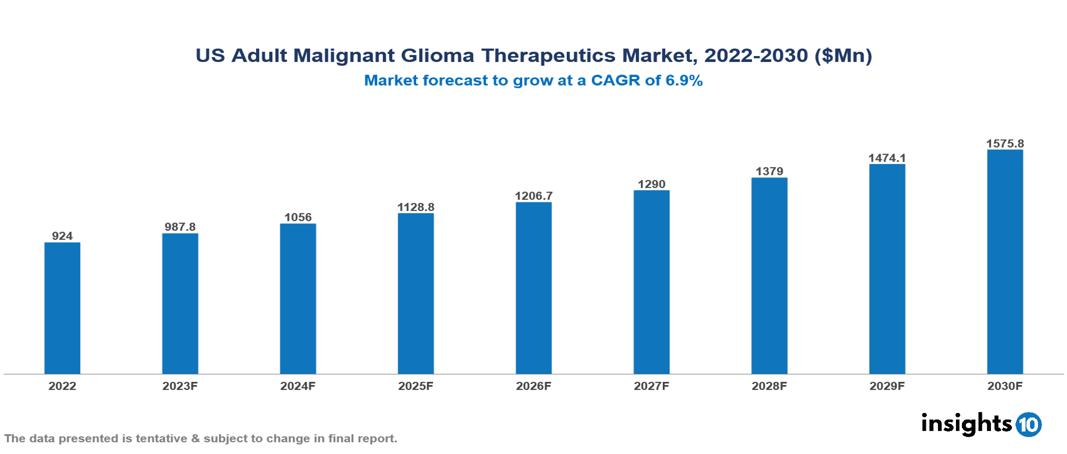

The US Adult Glioma Therapeutics Market is valued at around $924 Mn in 2022 and is projected to reach $1.576 Bn by 2030, exhibiting a CAGR of 6.9% during the forecast period. The increasing prevalence of metastatic glioma, driven by demographic shifts, advancements in diagnostic tools, and a rise in glioblastoma cases, coupled with the promise of targeted therapies based on genetic mutations, less invasive treatment options, and growing public awareness, collectively fuel the expansion of the market. Key players in the US Adult Malignant Glioma Therapeutics Market include Bristol-Myers Squibb, Roche, Novartis, Optune, Inc., Novocure, Arbor Pharmaceuticals, Elekta AB and Varian Medical Systems, Inc. among others

Buy Now

US Adult Malignant Glioma Therapeutics Market Executive Summary

The US Adult Glioma Therapeutics Market is valued at around $924 Mn in 2022 and is projected to reach $1.576 Bn by 2030, exhibiting a CAGR of 6.9% during the forecast period.

Adult Malignant Glioma is a form of brain tumour that develops in brain tissue. It is an aggressive tumour that grows quickly and aggressively, with the ability to penetrate healthy brain tissue. Gliomas are the most frequent primary brain tumours in adults. They can be categorized as astrocytomas, ependymomas, or oligodendrogliomas based on their microscopic appearance, genetic characteristics, and development trends. The most aggressive form of astrocytoma is glioblastoma. The categorization and grading of gliomas are critical for evaluating treatment choices and prognosis. Malignant glioma risk factors include ages 45 to 65, exposure to ionizing radiation, particularly to the head or neck, a family history of glioma, and specific genetic risk factors. Glioma therapy usually combines surgical, radiotherapeutic, chemotherapeutic, and immunotherapeutic techniques.

Approximately 12,000 new instances of adult malignant glioma are identified in the US each year. The most aggressive malignant primary brain tumour is glioblastoma (GBM). With an incidence rate of 3.19 per 100,000 people in the US and a median age of 64. Males have a 1.6-fold greater prevalence than females, while Caucasians have a 2.0-fold higher incidence than Africans and Afro-Americans, with a lower incidence among Asians and American Indians.

The increasing prevalence of metastatic glioma, driven by demographic shifts, advancements in diagnostic tools, and a rise in glioblastoma cases, coupled with the promise of targeted therapies based on genetic mutations, less invasive treatment options, and growing public awareness, collectively fuel the expansion of the US Adult Metastatic Glioma Therapeutics Market.

Key players in the US Adult Malignant Glioma Therapeutics Market include Bristol-Myers Squibb, Roche, Novartis, Optune, Inc., Novocure, Arbor Pharmaceuticals, Elekta AB, and Varian Medical Systems, Inc. among others.

Market Dynamics

Market Growth Drivers

The US Adult Malignant Glioma Therapeutics Market is a complex and dynamic landscape driven by an increasing glioma population, the aggressive nature of the illness, and ongoing breakthroughs in treatment choices. Rising Metastatic Glioma prevalence is one of the most crucial driving forces. As people age, their chance of acquiring glioma increases. This demographic transition inevitably results in a larger pool of prospective patients and increased demand for treatment alternatives across the country, expanding the opportunities for emerging therapeutic solutions. Another aspect contributing to rising prevalence is recent developments in diagnostic equipment. Tools like MRI and genetic testing allow for earlier and more accurate glioma identification, which leads to higher diagnostic rates and earlier treatment commencement. Thus, the necessity for therapy grows. According to a study published in JAMA Oncology, the incidence of GBM, the most dangerous form of glioma, rose by 12% in the US between 2000 and 2018, particularly among those aged 45 to 79.

Targeted medicines and therapies based on particular genetic mutations provide promise for more successful and less harmful therapeutic techniques. This tailored strategy has the potential to maximize patient benefits while also expanding the market. Advancements such as Optune (tumor-treating fields) and immunotherapy provide alternate treatment choices to standard chemotherapy and radiation, broadening the market landscape and appealing to a larger spectrum of patients.

Another driver is the growing public knowledge of minimally intrusive and less damaging therapeutic approaches. The American Brain Tumor Association raises public awareness about gliomas, which leads to improved research funding and market exposure. Government efforts, such as the Brain Tumor Moonshot project in the US, seek to speed Malignant glioma research and development, perhaps resulting to faster discoveries and a more robust market. The National Cancer Institute (NCI) announced a new project in 2023 to promote research on personalized medicine treatments for glioma, highlighting the government's commitment to sponsoring advances in this field.

Market Restraints

The US Adult Malignant Glioma Therapeutics Market is additionally constrained by numerous barriers that prevent widespread acceptance and accessibility of therapeutic alternatives. Glioma treatments, including targeted medicines and modern technology such as Optune, are expensive. These prices can be exorbitant for millions of uninsured Americans, resulting in treatment delays or discontinuations, limiting market reach dramatically. While Medicare and Medicaid cover several glioma therapies, gaps in coverage and high copays for individual treatments continue to be financial hurdles for many patients, limiting market potential. According to research published in the Journal of Neuro-Oncology, uninsured glioblastoma patients are nearly twice as likely to encounter treatment delays as insured individuals.

Glioma is a life-threatening condition, and patients may be hesitant to try novel treatment options owing to concerns about potential adverse effects or long-term efficacy, particularly with immunotherapy. According to a poll conducted by the American Brain Tumour Association, approximately 40% of brain tumour patients are unaware of treatment alternatives other than chemotherapy and radiation.

The market for conventional chemotherapy and radiation for glioma is well-established, with a large number of established companies and treatment procedures. Newer medicines may have difficulty getting into this established market. Pharmaceutical firms developing new glioma therapies must engage considerably in marketing and convincing healthcare providers and payers of the specific benefits their medication provides over existing choices.

Notable Recent Updates

December 2022, Phase III trial results confirmed the efficacy of Optune (tumor-treating fields) in extending overall survival in GBM patients compared to standard treatment alone.

August 2023, The FDA granted breakthrough therapy designation to RO7495947, a small-molecule drug targeting a specific genetic mutation in GBM. This designation expedites the development and review process for promising new therapies.

September 2023, The National Cancer Institute (NCI) announced a new initiative to accelerate the development of personalized medicine approaches for glioma.

October 2023, Roche submitted a new drug application to the FDA for atezolizumab (Tecentriq), an immunotherapy drug, in combination with temozolomide for newly diagnosed GBM. This potential new treatment option could open doors for future regulatory approvals.

Healthcare Policies and Regulatory Landscape

The healthcare system in the US is complicated and multidimensional, with a wide range of rules in place. The major option, private insurance, covers more than 60% of the population. Employer-sponsored plans are widespread, although individual plans are also available. Medicare (for the elderly and the handicapped) and Medicaid (for low-income people and families) serve around 30% of the population. In the US, the Food and Drug Administration (FDA) is the major therapeutic regulating organization. The FDA, a federal organization within the Department of Health and Human Services (HHS), is in charge of protecting public health by guaranteeing the safety, effectiveness, and quality of human and animal pharmaceuticals, medical devices, biological products, food, cosmetics, and tobacco products. To assure the safety and efficacy of new drugs and biological products, the FDA conducts a rigorous review and approval procedure. This involves examining clinical study results, manufacturing methods, and labelling information.

Competitive Landscape

Key Players

- Bristol-Myers Squibb

- Roche

- Novartis

- Merck & Co.

- Pfizer

- Optune, Inc.

- Novocure

- Arbor Pharmaceuticals

- Elekta AB

- Varian Medical Systems, Inc.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

US Adult Malignant Glioma Therapeutics Market Segmentation

By Disease Type

- Glioblastoma Multiforme

- Anaplastic Astrocytoma

- Anaplastic Oligodendroglioma

- Anaplastic Oligoastrocytoma

- Other Types

By Treatment Type

- Chemotherapy

- Targeted Drug Therapy

- Radiation Therapy

- Surgery

- Gene Therapy

- Immunotherapy

- Vaccines

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By Disease Stage

- Early-Stage Tumour

- Late-Stage Tumour

- Palliative Care

By Route of Administration

- Oral

- Parenteral

- Others

By End User

- Hospitals

- Speciality Clinics

- Chemotherapy Centres

- Radiotherapy Centres

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.