US Acne Therapeutics Market Analysis

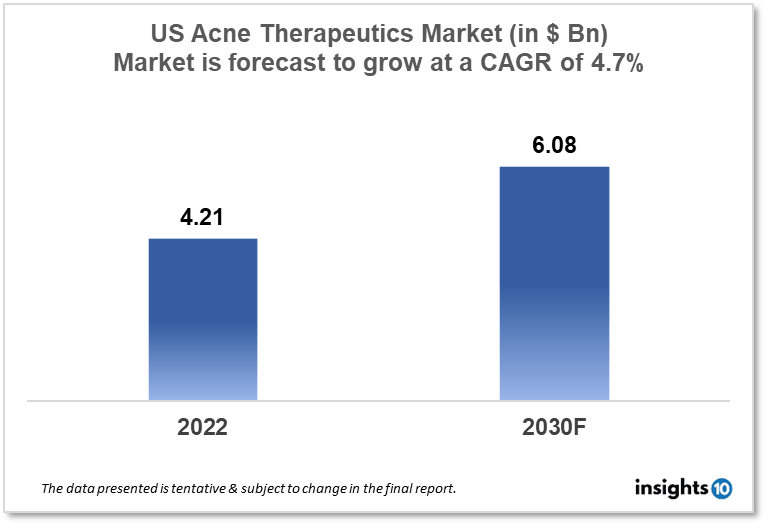

The US acne therapeutics market is expected to witness growth from $4.21 Bn in 2022 to $6.08 Bn in 2030 with a CAGR of 4.7% for the forecasted period 2022-2030 mainly due to increased incidence of acne and demand for cosmeceuticals in the US. The market is segmented by treatment, route of administration, age group, and by distribution channel. Pfizer, Johnson & Johnson, and Padagis are some of the key market players in the US acne therapeutics market.

Buy Now

US Acne Therapeutics Market Executive Analysis

The US acne therapeutics market size is at around $4.21 Bn in 2022 and is projected to reach $6.08 Bn in 2030, exhibiting a CAGR of 4.7% during the forecast period. In the US, healthcare spending increased by 2.7 % in 2021 to reach $4.3 Tn, a far slower rate than the 10.3 % growth observed in 2020. After rising in 2020, partly as a result of the COVID-19 pandemic, the federal government's healthcare spending decreased by 3.5 % in 2021, which contributed to the slower rate of growth. In 2021, the consumption of medical supplies and services rose in tandem with this drop. The health sector's contribution to the GDP decreased from 19.7% in 2020 to 18.3% in 2021, however, it was still larger than the 17.6 % contribution in 2019.

About 50 Mn US citizens have acne each year, with 85% of those affected being between the ages of 12 and 24 and 40% being between the ages of 7 and 11 years. Each year, 14% of visits to primary care doctors and 27% of visits to dermatologists are due to acne. Women are more likely than men to get acne, which peaks between the ages of 16 and 20. The anterior chest, face, and upper back are examples of locations with a propensity for lesions to form. If patients experience persistent scarring or post-inflammatory hyperpigmentation, the effects of acne may last for a very long time. Furthermore, anxiety, low self-esteem, and a poor quality of life have all been associated with acne. Some of these persistent consequences can be avoided with early identification and treatment.

In the US, treatment for mild acne begins with topical retinoids like asadapalene, tazarotene, and tretinoin. Mild acne only manifests as noninflammatory comedones. Since retinoids treat aberrant desquamation and sebaceous hyperplasia, topical retinoid-based therapy is advised as a first-line treatment for nearly all acne patients. Retinoids help prevent the development of microcomedones, which can exist even in the skin that appears normal. In doing so, they aid in the treatment of an active condition and stop the development of new acne lesions.

Market Dynamics

Market Growth Drivers

US acne therapeutics market growth is anticipated to be fuelled by the increased incidence of acne and the use of cosmeceuticals in treatment solutions. Additionally, it is expected that increased government initiatives would fuel the expansion of the US acne therapeutics market.

Market Restraints

The US acne therapeutics market's expected growth can be hampered by concerns about the safety of acne medications and the entry of generics. Moreover, the adverse effects of currently available treatments and patients switching to other alternatives may prevent the US acne therapeutics market from growing in terms of revenue.

Competitive Landscape

Key Players

- Pfizer (USA)

- Johnson & Johnson (USA)

- Padagis (USA)

- Bausch

- Galderma

- GlaxoSmithKline

- Allergan

Healthcare Policies and Regulatory Landscape

Acne diagnosis and treatment are frequently covered by health insurance policies in the US. The level of coverage varies by insurance type, and some plans could demand a referral from a primary care doctor or have a deductible or copay. Prescription topical and oral drugs, as well as various outpatient procedures like chemical peels, light therapy, drainage, and extraction, are typical treatments that are covered by insurance. However, some cosmetic procedures, such as microdermabrasion or laser treatments for aesthetic purposes, might not be covered.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Acne Therapeutics Market Segmentation

By Treatment (Revenue, USD Billion):

- Therapeutics

- Retinoid

- Antibiotics

- Hormonal Agents

- Anti-Inflammatory

- Other Agents

- Other Treatments

By Route of Administration (Revenue, USD Billion):

- Oral

- Topical

- Injectable

By Age Group (Revenue, USD Billion):

- 10 to 17

- 18 to 44

- 45 to 64

- 65 and above

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail and Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.