UK Robotic Surgery Services Market Analysis

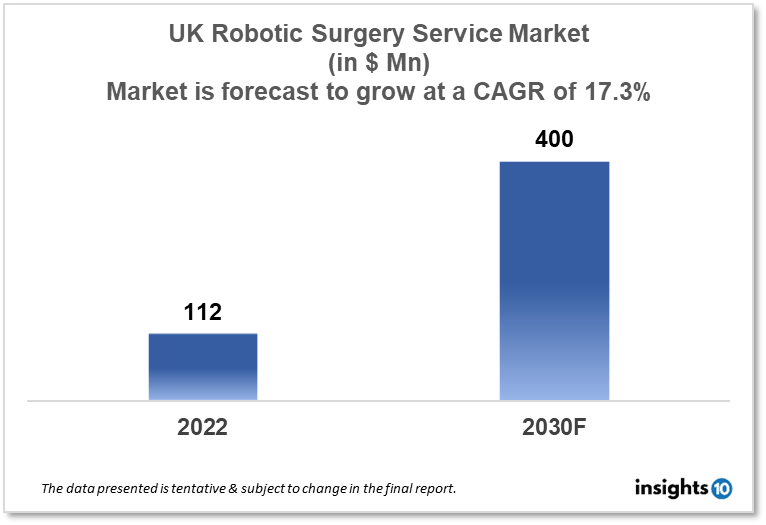

UK robotic surgery service market size was valued at $112 Mn in 2022 and is estimated to expand at a CAGR of 17.30% from 2022-30 and will reach $400 Mn in 2030. The robotic surgery service market will grow due to Robotic surgical systems providing physicians with greater accuracy and precision, which results in improved patient outcomes and reduced complications. The market is segmented by product and service type, application type, and end user. Some of the major players are Intuitive Surgical, Smith & Nephew, TransEnterix Surgical, Inc., Renishaw plc., and others

Buy Now

UK Robotic Surgery Service Market Executive Summary

The UK Robotic Surgery Service market size was valued at $112 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 17.30% from 2022 to 2030 and will reach $400 Mn in 2030. In the United Kingdom (UK), healthcare spending is a significant part of the government's budget. According to the Organisation for Economic Co-operation and Development (OECD), total health spending in the UK was estimated to be 9.8% of the country's gross domestic product (GDP) in 2020. Health spending in the UK is primarily funded by the government through the National Health Service (NHS), which is a publicly funded healthcare system that provides comprehensive medical services to all residents of the country. The NHS operates on a principle of universal access to healthcare, and patients are not required to pay for most medical services, including hospital stays, doctor visits, and prescription drugs.

In recent years, the UK government has been facing increased pressure to improve the efficiency and effectiveness of the NHS, while also maintaining its commitment to universal access to healthcare. This has led to a focus on reducing healthcare costs, while also investing in new technologies, such as digital health solutions and advanced medical devices, to enhance the quality of care and improve patient outcomes.

Robotic surgery has become increasingly popular in the United Kingdom (UK) in recent years, as it offers several advantages over traditional surgical methods, such as improved precision, reduced blood loss, and faster recovery times for patients. Robotic surgery is used in a wide range of procedures, including gynecological surgeries, colorectal surgeries, and urologic procedures. There are several companies in the UK that provide robotic surgery services, including private hospitals and NHS hospitals that have invested in robotic surgical systems. Some of the leading companies in this field include Intuitive Surgical, Medtronic, Stryker, and Johnson & Johnson. There are several companies in the UK that provide robotic surgery services, including private hospitals and NHS hospitals that have invested in robotic surgical systems.

The growth of robotic surgery services in the UK is driven by a combination of factors, including advances in technology, increasing demand for minimally invasive surgical procedures, and the benefits these procedures offer to patients in terms of improved outcomes and reduced recovery times. However, like in any healthcare system, there are also challenges, including cost and access to these services, that need to be addressed in order to ensure the continued growth and success of this field.

Market Dynamics

Market Growth Drivers

Robotic surgical systems provide physicians with greater accuracy and precision, which results in improved patient outcomes and reduced complications. Additionally, minimally invasive procedures: Robotic surgery is minimally invasive, which means that patients experience less pain and scarring, and can often return to normal activities more quickly than with traditional open surgery.

Furthermore, as surgical techniques and technologies continue to evolve, there is increasing demand for specialized procedures that can only be performed with the help of robotics. Robotic surgery has been shown to result in improved patient outcomes, including reduced blood loss, shorter hospital stays, and faster recovery times.

Market Restraints

- High costs: Robotic surgical systems are significantly more expensive than traditional surgical equipment, which can make them prohibitively expensive for some healthcare facilities and patients

- Lack of trained personnel: There is a shortage of trained surgeons and operating room staff who are proficient in using robotic surgical systems, which can limit their adoption

- Regulatory hurdles: The approval process for new robotic surgical devices can be lengthy and complex, which can slow the introduction of new technologies

- Reimbursement issues: Reimbursement policies for robotic surgical procedures can vary widely, and may not always cover the full cost of the procedure, which can deter some patients from seeking treatment

Competitive Landscape

Key Players

- Intuitive Surgical

- Smith & Nephew

- TransEnterix Surgical, Inc.

- Renishaw plc.

- Intuitive Surgical

- THINK Surgical, Inc.

- Zimmer Biomet

Notable Deals

In 2020, Johnson & Johnson, a multinational medical devices company, acquired Orthotaxy, a UK-based developer of robotic-assisted orthopedic surgery systems, as part of its strategy to expand its portfolio of digital surgery solutions.

Healthcare Policies and Regulatory Landscape

In the UK, the regulation of medical devices, including robotic surgical systems, is primarily handled by the Medicines and Healthcare products Regulatory Agency (MHRA). The MHRA is responsible for ensuring the safety and effectiveness of medical devices and works to ensure that these devices meet appropriate quality and performance standards.

In terms of the specific regulation of robotic surgical systems, the MHRA classifies these devices as "Class III" medical devices, which are considered to be high-risk and require a detailed assessment of their safety and performance prior to being placed on the market. In order to be approved for use in the UK, a robotic surgical system must undergo a rigorous evaluation process, which includes clinical trials and other studies to assess its safety and effectiveness.

Once a robotic surgical system has been approved for use in the UK, the MHRA continues to monitor its performance and safety and may take action if any issues are identified. The agency also works to ensure that healthcare providers and patients are adequately informed about the risks and benefits of these devices, and provides guidance on the appropriate use of these systems in surgical procedures.

Reimbursement Scenario

The reimbursement scenario for robotic surgery services in the United Kingdom is complex, and depends on several factors, including the type of procedure being performed, the specific system being used, and the patient's healthcare provider and insurance coverage.

In general, many robotic surgery procedures are covered by the National Health Service (NHS), the UK's publicly funded healthcare system. However, the exact level of coverage can vary depending on the procedure and the specific circumstances of the patient. For example, some procedures may be fully covered, while others may require a patient contribution or co-pay. In addition, some procedures may not be covered at all, depending on the availability of alternative treatments and the patient's individual needs and circumstances.

For patients who have private health insurance coverage, the level of reimbursement for robotic surgery services can also vary, depending on the specifics of the insurance policy. Some private insurance plans may fully cover the cost of a robotic surgery procedure, while others may require a patient co-pay or deductible.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Robotic Surgery Services Market Segmentation

By Product and Services (Revenue, USD Billion):

The surgical robotics market volume data has been covered for all the major surgical robotics systems. In terms of value, the surgical systems market is anticipated to expand at a CAGR of 11.22% from 2018 to 2025.

- Instruments and Accessories

- Robotic Systems

- Services

By Application (Revenue, USD Billion):

Gynecology accounted for the largest market share in 2017 and is anticipated to expand at a CAGR of 7.0% from 2018 to 2025. This is explained by the rising prevalence of gynecological complications in women worldwide and the ongoing development of robotic technologies.

- General Surgery

- Gynecological Surgery

- Urological Surgery

- Neurosurgery

- Orthopedic Surgery

- Other Applications

By End User (Revenue, USD Billion):

The hospitals segment had the largest market value in 2017 and experienced a CAGR of 13.20% from 2018 to 2025. However, during the projected period of 2018–2025, the ambulatory surgical center's income is predicted to rise at the highest CAGR of 18.20%.

- Hospitals

- Ambulatory Surgery Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.