UK Periodontal Therapeutics Market Analysis

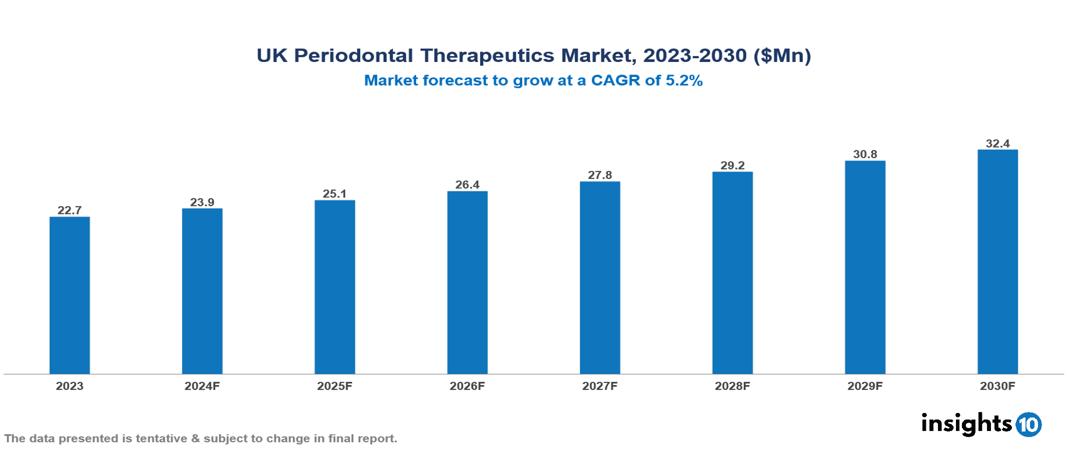

The UK Periodontal Therapeutics Market was valued at $22.7 Mn in 2023 and is predicted to grow at a CAGR of 5.2% from 2023 to 2030, to $32.4 Mn by 2030. The UK Periodontal Therapeutics Market is growing due to Rising prevalence of periodontitis, Emphasis on Preventive Oral Care, and Technological Developments. The market is primarily dominated by players such as Pfizer Inc., Lupin Ltd, Teva Pharmaceuticals USA, Sun Pharmaceutical Industries Ltd, Tokyo Chemical Industry Co. Ltd., and Bausch Health Companies Inc.

Buy Now

UK Periodontal Therapeutics Market Executive Summary

UK Periodontal Therapeutics Market is at around $22.7 Mn in 2023 and is projected to reach $32.4 Mn in 2030, exhibiting a CAGR of 5.2% during the forecast period.

Periodontal disease, commonly known as gum disease, is a major dental health disease associated with inflammation and infection of the gums surrounding the teeth. Periodontitis is a very common condition, usually caused by poor oral hygiene, and can be prevented in most cases by surgical, non-surgical, or therapeutic treatment procedures Periodontal therapeutics include the use of antibiotics alone for the treatment of periodontitis and is relatively a small but lucrative method, gaining promise among patients and dentists. Metronidazole, amoxicillin, and doxycycline are often used antibiotics in periodontal therapy. Adjunctive therapies for reducing gingival inflammation and plaque include a variety of mouthwashes and rinses that contain antimicrobial agents such as hydrogen peroxide, chlorhexidine, and essential oils.

The UK periodontal market is characterized by a significant prevalence among adults, with around 45% affected by periodontal disease. Demographically, older adults and those from lower socioeconomic backgrounds are more susceptible. The healthcare expenses associated with periodontal care in the UK reflect substantial costs due to treatments such as scaling, root planning, and surgical interventions. These expenses encompass both public and private healthcare sectors, impacting overall healthcare expenditure. Efforts in public health emphasize prevention and early intervention to mitigate the economic burden and improve oral health outcomes across the population. The market, therefore, is driven by significant factors like Rising prevalence of periodontitis, Emphasis on Preventive Oral Care, and Technological Developments. However, Stringent Regulatory Requirements, Side Effects, and Complications, High Cost restrict the growth and potential of the market.

A new alcohol-free version of its gingivitis mouthwash, PrPERICHLOR® without alcohol, was released by Pendopharm, a division of Pharmascience Inc.

Market Dynamics

Market Growth Drivers

Rising prevalence of periodontitis: The widespread occurrence of periodontal disease significantly impacts healthcare economies. A significant prevalence among adults, with around 45% affected by periodontal disease. It drives substantial spending on treatments, creates jobs in dental care, and spurs investment in research and development. The persistent nature of gum problems ensures a stable, growing market for periodontal products and services.

Emphasis on Preventive Oral Care: Dental professionals employ motivational interviewing techniques to understand patient perspectives and barriers to care. Goal-setting and habit-formation strategies are integrated into treatment plans. Studies show that implementing such behavioural strategies can increase patient adherence to oral hygiene routines by up to 50%. Behavioural nudges, such as smartphone reminders, further support long-term habit changes, enhancing the effectiveness of periodontal prevention efforts.

Technological Developments: Cone-beam computed tomography (CBCT) is one digital imaging technique that makes it possible to create accurate three-dimensional (3D) representations of patients' oral structures. Accurate treatment planning is made easier by these simulations, especially for intricate operations like implant insertion. Systems for computer-aided design and manufacture (CAD/CAM) improve the process of creating personalized prostheses. By doing away with the necessity for conventional imprints, intraoral scanners increase patient comfort and accuracy.

Market Restraints

Stringent Regulatory Requirements: Brexit-related regulatory changes and NHS funding constraints have introduced uncertainties for periodontal service providers. Regulatory divergence from EU standards may affect product approvals and market access, while funding pressures limit investment in advanced periodontal care technologies.

Side Effects and Complications: Restraint on the periodontal market due to treatment side effects includes the risk of post-operative complications such as dental implant failure or gum recession, which can require additional corrective procedures and increase overall treatment expenses. Moreover, concerns over the long-term sustainability of periodontal interventions may influence patient decision-making and treatment adherence

High cost: While the National Health Service (NHS) provides some dental coverage, advanced periodontal procedures often fall outside its scope, leading to substantial out-of-pocket expenses. The high cost of private dental care, coupled with long waiting times for NHS treatments, discourages timely intervention. Currently, only 30% of advanced periodontal procedures are covered under NHS, leaving a significant portion of the population to manage costly treatments independently.

Regulatory Landscape and Reimbursement scenario

The UK periodontics market is governed by stringent regulatory frameworks aimed at ensuring patient safety, treatment efficacy, and professional standards. Regulatory bodies such as the General Dental Council (GDC) and the Medicines and Healthcare products Regulatory Agency (MHRA) oversee the practice of periodontics, including the use of dental implants, periodontal treatments, and related medical devices. Compliance with these regulations is mandatory for dental practitioners and manufacturers, ensuring that treatments meet established standards of quality, safety, and ethical practice. Continuous monitoring and updates in regulations reflect ongoing efforts to maintain high standards of care and innovation in the field of periodontics in the UK.

Reimbursement plays a crucial role in treatment decisions and patient care. National Health Service (NHS) funding covers basic periodontal treatments, such as scaling and root planning, but more advanced procedures may require private funding. The reimbursement landscape influences access to specialized periodontal care and patient choices between NHS and private practices. Dentists navigate these dynamics to ensure patients receive appropriate treatments while managing financial considerations. Private insurance schemes also impact reimbursement, shaping the affordability and availability of comprehensive periodontal services across different demographic segments in the UK.

Competitive Landscape

Key Players

Here are some of the major key players in UK Periodontal Therapeutics Market:

- Pfizer Inc.

- Lupin Ltd

- Teva Pharmaceuticals USA, Inc.

- Sun Pharmaceutical Industries Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Bausch Health Companies Inc.

- Melinta Therapeutics LLC

- Cipla, Inc.

- Chartwell Pharmaceuticals LLC.

- ASA Dental S.p.A.

- Steris-Hu-Friedy

- Carl Martin GmBH

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UK Periodontal Therapeutics Market Segmentation

By Disease

- Gingivitis

- Chronic Periodontal Disease

- Aggressive Periodontal Disease

- Others

By Drug Type

- Doxycycline

- Minocycline

- Chlorhexidine

- Metronidazole

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Channel

By Treatment procedures

- Scaling And Root Planing

- Gum Grafting

- Regenerative Therapy

- Dental Crown Lengthening

- Periodontal Pocket Procedures

- Single Tooth Dental Implants

- Multiple Tooth Dental Implants

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.