UK Patient Engagement Solutions Market Analysis

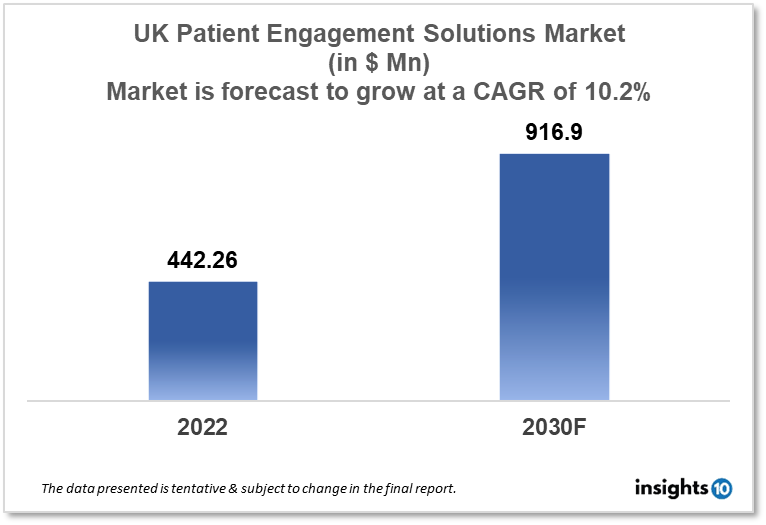

The UK patient engagement solutions market is projected to grow from $442.26 Mn in 2022 to $961.9 Mn by 2030, registering a CAGR of 10.2% during the forecast period of 2022 - 2030. The main factors driving the growth would be a focus on patient-centred care, the rising prevalence of chronic diseases, rapid growth in digital health firms and government support and initiatives. The market is segmented by component, delivery mode, application, therapeutic area, functionality and by end-user. Some of the major players include Medesk, Cambio Healthcare System, ClinicYou, Orion Health and Open Health.

Buy Now

UK Patient Engagement Solutions Market Executive Summary

The UK patient engagement solutions market is projected to grow from $442.26 Mn in 2022 to $961.9 Mn by 2030, registering a CAGR of 10.2% during the forecast period of 2022 - 2030. In 2020, the healthcare expenditure in the UK was $314.10 Bn or $4,682.21 per person. From 9.9% of GDP in 2019 to 12.0% of GDP in 2020, this expenditure grew. The government paid for around 83% of total healthcare costs, or $260.2 Bn, a 14.9% real-terms increase in 2020.

A patient engagement solution is a cloud-based platform that enables healthcare providers to enhance the patient experience. In-depth patient engagement is achieved by sophisticated patient engagement software at every stage of the patient journey, from booking to triage to follow-up.

The COVID-19 pandemic has pushed healthcare professionals to develop new ways to deliver treatment remotely, which has accelerated the adoption of patient engagement solutions in the UK. Patients can now control their health and obtain healthcare services from the comfort of their homes owing to telemedicine, remote monitoring, and other patient engagement strategies.

Market Dynamics

Market Growth Drivers

The UK patient engagement solutions market is expected to be driven by factors such as a focus on patient-centred care, the rising prevalence of chronic diseases and government support and initiatives. Moreover, digital health firms have expanded rapidly in the UK in recent years, offering a variety of patient engagement solutions like telemedicine, remote monitoring, and health tracking. These startups are advancing healthcare innovation and fostering greater patient involvement.

Market Restraints

The National Health Service (NHS) in the UK has limited resources and confronts financing constraints, making it difficult for healthcare providers to invest in patient engagement solutions. It has been difficult for the NHS to invest in new technology and innovation in recent years due to severe budgetary pressures. This restricts the growth of the market in the country.

Competitive Landscape

Key Players

- Medesk (GBR)

- Cambio Healthcare System (GBR)

- ClinicYou (GBR)

- Orion Health

- Open Health

Notable Deals

July 2019: Cambio Healthcare Systems has acquired Daintel, a Danish software firm that provides clinical IT solutions to the healthcare sector, particularly intensive care and anaesthesia units. With the acquisition, Cambio Healthcare Systems increases its product line of health technology solutions while strengthening its electronic patient records system, Cambio COSMIC. Future versions of Daintel's products will also be sold separately.

Healthcare Policies and Regulatory Landscape

The National Health Service (NHS) Long-Term Plan, which describes the government's ambitions for the healthcare system for the next ten years, is one of the major policies that affect patient engagement solutions in the UK. The strategy explicitly emphasises the significance of digital health technologies and patient engagement solutions in attaining these goals. The plan is focused on improving patient outcomes, expanding access to care, and lowering healthcare costs.

Additionally, the UK has implemented a number of laws and regulations to encourage the creation and use of patient interaction tools. The Information Governance Alliance (IGA), for instance, offers advice on data security and patient confidentiality, two issues that are crucial for patient engagement solutions. The Medicines and Healthcare Products Regulatory Agency (MHRA), another regulatory body in the UK, is in charge of regulating the creation and endorsement of medical devices and digital health technology.

Reimbursement Scenario

The funding and reimbursement processes for the NHS have an impact on UK reimbursement policies for patient engagement solutions. In the UK, there are currently few chances for patient engagement solutions to be reimbursed, though this is starting to change. New payment structures are required in order to fund the use of digital health technology, such as patient interaction tools, according to the NHS Long Term Plan. The Innovation and Technology Payment (ITP) program, which offers to finance the use of digital health technology in the NHS, is one such payment scheme.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Patient Engagement Solutions Market Segmentation

By component (Revenue, USD Billion):

- Hardware

- Software

- Standalone Software

- Integrated Software

- Services

By Delivery Mode (Revenue, USD Billion):

- PREMISE Mode

- CLOUD-BASED Mode

By Application (Revenue, USD Billion):

- Health Management

- Home Health Management

- Social

- Financial Health Management

By Therapeutic area (Revenue, USD Billion):

- Chronic Diseases

- Cardiovascular Diseases (CVD)

- Diabetes

- Obesity

- Other chronic Diseases

- Women's Health

- Fitness

- Other Therapeutic Areas

By Functionality (Revenue, USD Billion):

- E-Prescribing

- Virtual Consultation

- Patient/Client Scheduling

- Document Management

By End-user (Revenue, USD Billion):

- Providers

- Payers

- Patients

- Other End users

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.