UK Patient Adherence Programs Market Analysis

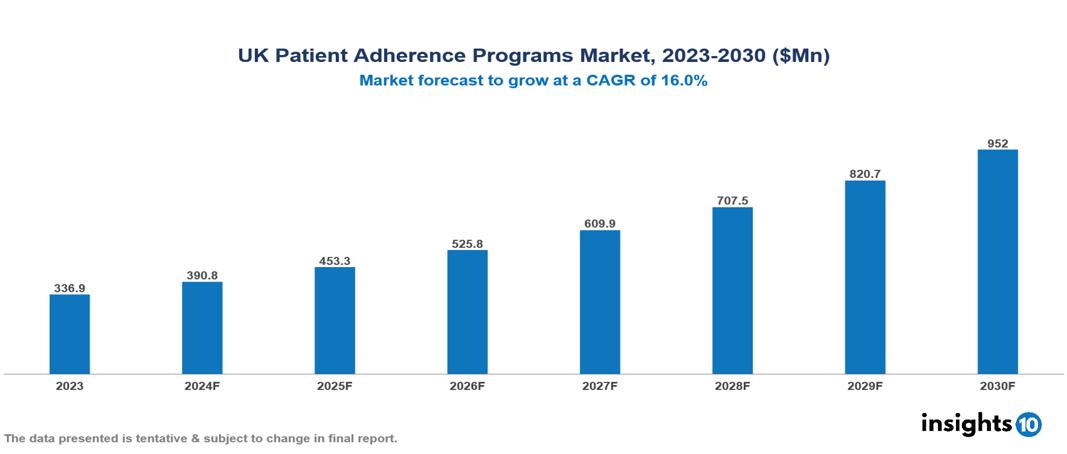

The UK Patient Adherence Programs Market was valued at $336.9 Mn in 2023 and is predicted to grow at a CAGR of 16% from 2023 to 2030, to $952 Mn by 2030. The key drivers of the market include increasing non-adherence, rising awareness, and technological innovations. The prominent players of the UK Patient Adherence Programs Market are AstraZeneca, Johnson & Johnson, Bayer, GSK, Merck, and Novartis, among others.

Buy Now

UK Patient Adherence Programs Market Executive Summary

The UK Patient Adherence Programs market is at around $336.9 Mn in 2023 and is projected to reach $952 Mn in 2030, exhibiting a CAGR of 16% during the forecast period.

A patient adherence program aims to ensure that patients follow prescribed medication regimens to improve treatment outcomes, using both direct and indirect methods to assess adherence. Direct methods include monitoring therapy by measuring drug levels, metabolites, or biological markers in blood or urine, and confirming medication intake. Indirect methods, more commonly used, involve patient self-reports, pill counts, prescription refill rates, clinical response evaluations, and electronic medication monitors. Pill counts compare the number of pills taken between appointments with the prescribed dosage, while patient self-reports collect information through interviews, questionnaires, or diaries. Electronic devices such as pill bottles or blister packs track medication access to provide precise data. A widely used tool for assessing adherence is the Morisky Medication Adherence Scale (MMAS), a validated and reliable questionnaire suitable for clinical use. These approaches help healthcare providers ensure consistent medication use, ultimately enhancing patient health outcomes.

The UK Patient Adherence Program Market is thus driven by significant factors such as increasing non-adherence, rising awareness, and technological innovations. However, data privacy and security concerns, regulatory compliance, and patient-related challenges restrict the growth and potential of the market.

The leading players of the UK Patient Adherence Programs Market are AstraZeneca, Johnson & Johnson, Bayer, GSK, Merck, and Novartis, among others.

Market Dynamics

Market Growth Drivers

Increasing Non-Adherence: In the UK, up to 50% of the medicines are not taken as intended. The medical field is focusing more on developing workable solutions as a result of growing recognition of the substantial negative effects of non-adherence on patient outcomes. Governments and healthcare organizations’ awareness campaigns and actions highlight the value of adherence, which increases demand and growth for patient adherence programs.

Rising Awareness: Higher participation rates result from patients’ growing understanding of the benefits of adherence programs in controlling their health and averting complications. Healthcare professionals are more inclined to suggest and carry out these programs if they are aware of the benefits to patient outcomes and financial savings. Furthermore, more funds and resources may be given to adherence programs by healthcare institutions. Growing public knowledge of patient adherence initiatives promotes its value and advantages to a wider range of people, which leads to market growth.

Technological Innovations: Mobile health apps, wearable devices, telemedicine, and AI-driven personalized reminders are transforming patient adherence by enabling real-time medication tracking, providing educational content, and facilitating direct communication between patients and healthcare providers. These technologies help identify and address adherence barriers, tailor interventions, and improve patient engagement and health outcomes. Data analytics and machine learning further enhance the prediction of non-adherence risks and enable tailored support. As a result, these innovations drive market growth for patient adherence programs by enhancing the efficiency, effectiveness, and scalability of adherence solutions, leading to better health outcomes and reduced healthcare costs.

Market Restraints

Regulatory Compliance: Regulatory compliance poses a significant market growth restraint for the patient adherence program market due to the complex and varying requirements across different regions and healthcare systems. Adherence programs must adhere to stringent regulations regarding patient privacy (such as HIPAA in the United States), data security, and healthcare standards, which can be challenging and costly to navigate. The need to meet these regulatory standards adds layers of administrative burden and operational costs for providers and developers of adherence solutions. As a result, regulatory compliance remains a critical factor influencing market dynamics and the adoption of adherence programs.

Patient-related challenges: Factors such as patient forgetfulness, lack of understanding of the treatment regimen, low health literacy, and motivational issues can hinder adherence efforts. Additionally, socioeconomic barriers like limited access to healthcare resources, high medication costs, and cultural or language differences further impede patient participation in adherence programs. Patient-related challenges act as a market growth restraint for the patient.

Regulatory Landscape and Reimbursement Scenario

The Medicines and Healthcare Products Regulatory Agency (MHRA) is the government authority of the UK, sponsored by the Department of Health and Social Care. MHRA ensures that pharmaceuticals, blood components, advanced therapy medical products, and medical devices meet applicable standards of safety, quality, and efficacy. Its core responsibilities include overseeing UK-notified bodies, regulating clinical trials, monitoring compliance for medicines and medical devices, and offering technical and regulatory advice for these products. Moreover, MHRA serves to protect the overall public health by promoting international standardization and harmonization.

The license or marketing authorization for new drugs is granted by the regulatory authority, i.e., MHRA after ensuring that the drug is safe, effective, and meets GMP requirements. The MHRA is responsible for granting licenses in England, Scotland, and Wales and the European Medicines Agency (EMA) is responsible in Northern Ireland. Once the drug is granted a license, appraisal takes place before it is made available on the National Health Service (NHS). In England and Wales, this appraisal is carried out by the National Institute for Health and Care Excellence (NICE), in Scotland by the Scottish Medicines Consortium (SMC), and in Northern Ireland by the Department of Health (DoH).

The goal of the National Health Service (NHS), the UK’s tax-funded healthcare system, is to provide comprehensive healthcare services free at the point of access for its residents. Two primary methods of reimbursement exist: Primary Care and Secondary Care. Local Clinical Commissioning Groups (CCGs) are tasked with contracting with and compensating general practices for primary care services, such as doctor visits. For Secondary Care, NHS England oversees the funding of hospitals and specialized services centrally. Hospital reimbursement is determined by a national tariff system that establishes rates for particular medical services.

Competitive Landscape

Key Players

Here are some of the major key players in the UK Patient Adherence Programs Market:

- AstraZeneca

- Johnson & Johnson

- Bayer

- GSK

- Merck

- Novartis

- Roche

- AbbVie

- Pfizer

- Boehringer Ingelheim

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UK Patient Adherence Programs Market Segmentation

By Type

- Hardware centric

- Software centric

By Medication

- Cardiovascular

- Nervous System

- Diabetes

- Gastrointestinal

- Oncology

- Rheumatology

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.