UK Oncology Clinical Trials Market Analysis

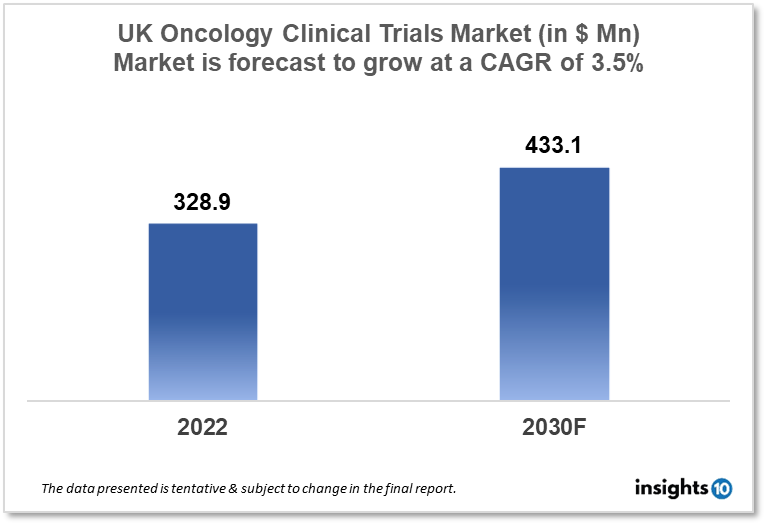

UK oncology clinical trials market is projected to grow from $328.9 Mn in 2022 to $433.1 Mn by 2030, registering a CAGR of 3.50% during the forecast period of 2022-30. The market will be driven by the rising incidence of cancer in the UK and efforts to promote research, collaboration, and innovation. The market is segmented by phase, study design, and indication. Some of the major players include Novartis AG, AstraZeneca & Astex Pharmaceuticals.

Buy Now

UK Oncology Clinical Trials Market Executive Summary

UK oncology clinical trials market is projected to grow from $328.9 Mn in 2022 to $433.1 Mn by 2030, registering a CAGR of 3.50% during the forecast period of 2022-30. Healthcare spending in the United Kingdom will account for 11.9% of the GDP by 2021. In England, 1,390,483 people participated in clinical research in 2020/2021, about twice the number that participated in 2019/2020. In 2020, the UK contributed for 3.6% of worldwide clinical trial activity. Every year, over 167,000 people die from cancer in the UK, which equates to almost 460 fatalities every day. Lung, bowel, breast, and prostate cancer account for about half of all cancer fatalities in the UK.

The United Kingdom has also been a pioneer in the development of precision medicine cancer treatment techniques, which entail analyzing genetic and other molecular data to personalize therapies for specific patients. The 100,000 Genomes Project, which sought to sequence the genomes of 100,000 persons suffering from cancer or uncommon disorders, was an important endeavor in this field, giving crucial data for research and therapeutic trials.

In terms of individual clinical trials, the UK presently has a diverse set of studies active, encompassing a broad variety of cancer types and treatment options. The CRUK-funded TRACERx project, for example, is looking at the genetic development of lung cancer and how it influences therapy response, whilst the NIHR-funded RECOVERY trial is looking into the efficacy of different COVID-19 therapies in cancer patients. Generally, the United Kingdom has a robust and active cancer clinical trial environment, with continuing efforts to foster cooperation and innovation, as well as to ensure that patients have access to the most recent and effective treatments.

Market Dynamics

Market Growth Drivers

The United Kingdom has also been a pioneer in the development of precision medicine cancer treatment techniques, which entail analyzing genetic and other molecular data to personalize therapies for specific patients. The 100,000 Genomes Project, which sought to sequence the genomes of 100,000 persons suffering from cancer or uncommon disorders, was an important endeavor in this field, giving crucial data for research and therapeutic trials.

The UK government has aggressively promoted cancer research and development, providing funding and facilities to enable clinical studies. The government's Life Sciences Industrial Plan included a goal to increase the number of clinical trials in the UK by 2021. In the United Kingdom, there is a long history of partnership between research universities and the pharmaceutical business, which will aid in driving innovation and accelerating the development of novel therapies.

Market Restraints

According to research released by the Association of British Pharmaceutical Industry, the number of industry-backed clinical trials launched in the UK each year declined by 41% between 2017 and 2021. According to the ABPI, pharma firms are increasingly locating their trials in other countries such as Spain and Australia, and this has already impacted the UK's global position for phase III industry clinical trials, which has dropped from fourth place in 2017 to tenth place in 2021.

Moreover, clinical trial regulations may be complicated and time-consuming, with tight requirements governing patient safety and data security. This may be an impediment to conducting clinical trials, especially for smaller businesses or academic institutions. Clinical studies are expensive to carry out, and funds may be difficult to come by. This may reduce the number of studies conducted, especially for uncommon cancers or therapies that are less financially feasible. Patient recruitment for clinical trials may be challenging, especially for studies requiring a high number of participants or including complicated treatment regimens.

Competitive Landscape

Key Players

- Novartis AG

- AstraZeneca PLC

- Merck & Co Inc.

- FHoffmann-La Roche Ltd

- Pfizer Inc.

- Abcam Plc (GBR)

- Astex Pharmaceuticals (GBR)

- CellCentric (GBR)

- Sareum (GBR)

Notable Insights

- January 2023, The UK government launched a collaboration with the German business BioNTech on Friday to explore possible cancer and other illness vaccines

- December 2022, In the first phase III study, a new targeted medicine (Capivasertib) showed effectiveness against breast cancer. Capivasertib is a first-in-class medication that inhibits the activity of the cancer-causing protein molecule AKT. It was discovered by AstraZeneca during a drug discovery research program at The Institute of Cancer Research in London in conjunction with Astex Pharmaceuticals.

Healthcare Policies and Regulatory Landscape

The Medicines and Healthcare products Regulatory Agency (MHRA) is in charge of ensuring that clinical trials are done in a safe and ethical way in the United Kingdom.

The National Cancer Research Institute (NCRI), Cancer Research UK (CRUK), and the National Institute for Health Research are all active in cancer clinical trials in the United Kingdom (NIHR). These organizations offer clinical trial financing, assistance, and infrastructure, as well as organizing research activities and encouraging cooperation between researchers and healthcare professionals.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Clinical Trials Regulation in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

6. Methodology and Scope

Oncology Clinical Trials Market Segmentation

By Phase (Revenue, USD Billion):

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design Outlook (Revenue, USD Billion):

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle regeneration

- Others

By Indication Outlook (Revenue, USD Billion):

- Interventional

- Observational

- Expanded Access

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.