UK Neurology Devices Market Analysis

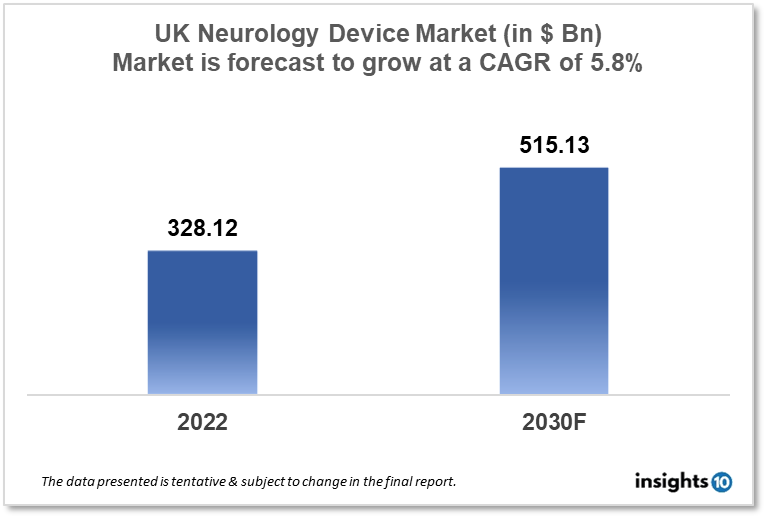

UK Neurology Device Market size is at around $328.12 Mn in 2022 and is projected to reach $515.13 Mn in 2030, exhibiting a CAGR of 5.8% during the forecast period. UK has a high demand for Implantable Pulse Generators (IPGs) and Spinal Cord Stimulation (SCS) Devices that are well-minted by players like Johnson and Johnson, St. Jude Medical, and Boston Scientific. This report by Insights10 is segmented by product type like neurostimulation, interventional neurology, neurosurgery devices, and neuro-endoscopes, and by the end user.

Buy Now

UK Neurology Device Market Executive Summary

Neurosurgery routinely involves the interpretation of complex brain imaging, and neurosurgeons routinely provide post-procedural care to INR patients. Endovascular and open neurosurgical techniques are performed by hybrid neurosurgeons in many countries outside the United Kingdom. The majority of neurosurgical training in the United Kingdom consists of 8 years of standardized training. Interventional neuroradiological (INR) procedures are a subset of procedures that treat a wide range of neurovascular disorders. The UK Neurointerventional Group (UKNG) is a group of specialists who perform minimally invasive operations on blood vessels in the brain, spine, head, and neck. These neuro-interventional procedures include the treatment of aneurysms, arteriovenous malformations, and mechanical thrombectomy for acute ischaemic stroke. Our neurology specialists now collaborate with neurosurgeons to diagnose and treat complex neurological and neuromuscular diseases such as Parkinson's disease, ALS (Lou Gehrig's disease), and stroke. The National Hospital for Neurology and Neurosurgery (NHNN), Queen Square, is the UK's largest dedicated neurological and neurosurgical hospital. It is affiliated with the National Health Service (NHS) UK and offers comprehensive services for the diagnosis, treatment, and care of all conditions affecting the brain, spinal cord, peripheral nervous system, and muscles.

Since 2017, major clinical trials like REVASCAT, SWIFT PRIME, EXTEND-IA, ESCAPE, and THRACE have confirmed the role of mechanical thrombectomy (MT) in the treatment of ischemic stroke. There is also evidence that patients admitted after hours with other indications for INR procedures, such as aneurysmal subarachnoid haemorrhage, have poorer outcomes. Endovascular therapy is an essential component of modern stroke care. Subarachnoid haemorrhage accounts for 8.9% of the total stroke burden and causes significant disability and mortality. Endovascular coiling for aneurysmal subarachnoid haemorrhage can reduce dependency and death risk. The NHS spends an estimated total of $156.8 million per year to treat aneurysmal subarachnoid haemorrhage, with the average cost per patient being $22,682. The average inpatient cost of endovascular coiling versus neurosurgical clipping to treat aneurysmal subarachnoid haemorrhage is comparable, but the endovascular procedure has a shorter operating time and a shorter length of hospital stay, which may result in financial savings. Indeed, in the context of ischemic stroke, which costs the NHS around $4 Bn per year, the higher treatment costs of stent-retriever thrombectomy were offset by long-term cost savings due to improved patient health status. This resulted in a total savings of $31,258 per patient. Given the potential long-term cost-effectiveness of endovascular procedures, expanding INR capability could be extremely beneficial, especially in publicly funded healthcare systems. Mechanical Thrombectomy (MT) heralds the resolution of pressing issues for neurosurgeons in the treatment of cerebral aneurysms.

Individual nylon or PGLA microfilaments have been overlapped between coil loops in newer devices, forming an intra-aneurysmal surface area for stable scar tissue formation and high thrombogenicity. These coils offer the acute performance of a coil as well as flow reduction across the neck and increased thrombogenicity. These are helpful in Acute Ischemic Stroke, Brain Aneurysm, Deep Brain Stimulation for Movement Disorders, Deep Brain Stimulation for Psychiatric Disorders, Dura Mater Repair, External Drainage & Monitoring, Head & Neck Surgery, Hydrocephalus Shunting, Idiopathic Intracranial Hypertension Shunting, Spinal Cord Stimulation, Subdural Evacuation, Targeted Drug Delivery for Chronic Pain are some of the disorders treated. Balloon Kyphoplasty, Bone Grafting, Intrathecal Baclofen Therapy for Severe Spasticity, Posterior OCT Reconstruction, Vertebroplasty, and Sacroplasty are all options for spinal reconstruction. Neuro-balloon devices provide stability in large and small vessels by applying supple conformity to complex structures. They are ideal for distal access and unique and irregular anatomies, such as bifurcation geometries. Discover dependable coverage that is specifically designed to create stable occlusion across the difficult diameters found in large and small vessels. Occlusion balloons are specially designed with extra softness to conform to asymmetrical, irregular, and complex vasculature geometries for sidewall aneurysms and reliable occlusions.

Access and Distribution, Products for Revascularization of Acute Ischemic Stroke, Aneurysm Treatment, Cranial Repair, Deep Brain Stimulation Systems for Movement Disorders, Deep Brain Stimulation Systems for Psychiatric Disorders, Haemorrhagic Stroke, Laser Ablation Technology Powered Physicians who have received appropriate training in interventional neuro-endovascular techniques use surgical instruments. Devices are designed to be installed by clinical support staff under the supervision of a trained physician. Recovery of an instrument or device from resistance without careful evaluation of the cause using fluoroscopy can result in breakage or damage, so users must be monitored.

Market Dynamics

Market Growth Drivers

The UK neurology market, a global leader in medical technology, provides treatment providers with a variety of neurology medical devices for the treatment of conditions such as chronic pain, epilepsy, and movement disorders. Medical device companies that offer a variety of neurology medical devices, such as spinal cord stimulation devices, implantable pulse generators, and neurostimulation leads, generate the most revenue, indicating high-demand areas. Implantable Pulse Generators (IPGs) are devices that deliver electrical stimulation to specific areas of the body to treat conditions such as chronic pain, movement disorders, and depression. IPGs have recently gained a significant market share due to their effectiveness and specificity of treatment outcomes. Spinal Cord Stimulation (SCS) devices, which are implantable devices that deliver electrical stimulation to the spinal cord to treat chronic pain, have also gained traction. DBS systems are traditionally used devices that deliver electrical stimulation to specific areas of the brain to treat conditions such as Parkinson's disease and dystonia, which have always been sought after and continue to be in demand in the neurology device market.

Market Restraints

Potential complications include proximal emboli of air, foreign material, tissue, or thrombus, hematoma, haemorrhage, infection, ischemia, and thrombus formation. Neurological deficits that could lead to stroke and death, vessel spasm, dissection, perforation, or injury are all things to be concerned about when treatment providers decide to switch from one manufacturer to another. Torquing without restraint or forcing the catheter against resistance has historically resulted in device or vessel damage, leading to stringent policies that discourage switching brands or manufacturers. Structural integrity and/or function, catheter manipulation, and intralumenal devices are high-risk devices that must pass additional regulatory scrutiny.

Competitive Landscape

Key Players

- Johnson and Johnson

- L. Gore & Associates

- Braun Mesungen

- St. Jude Medical

- Integra LifeSciences Holdings

- Boston Scientific

- Stryker Corporation

- Medtronic PLC

- Rapid Medical

- Acandis

- MicroPort Scientific

- Ekso Bionics

- TyroMotion

- FEsia

- ZeroG

- MAG and more

Notable Recent Updates

November 2021 – Government funding announced by the UK. People suffering from neurodegenerative diseases may live longer, healthier lives as a result of innovative new research, thanks to the UK government's commitment to invest $375 Mn over the next five years. At least $50 Mn will be made available for research to aid in the discovery of a cure for Motor Neuron Disease (MND), which affects the brain and nerves and affects 5,000 people in the UK. The entire investment will go toward projects that will improve our understanding of diseases like Pick's Disease, Fronto-temporal dementia, Wernicke-Korsakoff, Parkinson's disease dementia, Lewy Body dementia, Alzheimer's disease, and mild cognitive impairment while searching for new treatments.

Healthcare Policies and Regulatory Landscape

The Medicines and Healthcare products Regulatory Agency (MHRA) regulates the medical device industry in the UK, including neurology medical devices. For the development, testing, and marketing of medical devices, strict guidelines and standards are in place. The UK has a thriving medical device industry, with several companies developing cutting-edge neurology devices for the diagnosis and treatment of a variety of neurological conditions. The UK National Health Service (NHS) buys and uses these devices on a regular basis in its healthcare facilities. Overall, the position of neurology devices in the UK is strong, with a well-regulated industry and high demand in the healthcare sector. Manufacturers and distributors of neurology devices in the UK are subject to a variety of policies and regulations established by MHRA. Device classification, conformity assessment, device registration, technical documentation, post-market surveillance, and adverse event reporting are some of the key policies and requirements. Medical devices are divided into four categories based on their risk level. Neurology devices are typically classified as Class III or Class IIb, requiring more stringent regulations. Manufacturers must ensure that their devices meet the relevant safety, performance, and quality standards and that they have the documentation to back them up. Manufacturers must register their devices with the MHRA before they can be placed on the market, and any adverse events or incidents related to post-market use must also be reported. Other policies and regulations, such as data protection and privacy laws, must be followed in addition to these requirements. The policies and regulations are in place to ensure the safety, quality, and efficacy of neurology medical devices for patients and healthcare providers.

Reimbursement Scenario

The NHS UK reimburses certain neurology medical devices used to diagnose and treat neurological conditions. The National Institute for Health and Care Excellence (NICE), which provides guidance on the use of healthcare technologies in the NHS, determines the coverage and reimbursement of these devices. To be reimbursed by the NHS, a neurology device must meet certain criteria, including being cost-effective, having a positive impact on patient outcomes, and being recommended by NICE. NICE considers a number of factors when determining whether a device is cost-effective, including clinical effectiveness, device cost, and cost savings generated for the NHS. If a neurology device is approved for reimbursement by the NHS, healthcare providers in the NHS can purchase and use it. The exact reimbursement amount for a device, however, may vary depending on the patient's individual circumstances and the NHS organization that provides the treatment.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Neurology Device Market Segmentation

The Neurology Device Market is segmented as mentioned below:

By Product Type (Revenue, USD Billion):

- Neurostimulation

- ?Spinal Cord Stimulation Devices

- Deep Brain Stimulation Devices

- Sacral Nerve Stimulation

- Vagus Nerve Stimulation

- Gastric Electric Stimulation

- Interventional Neurology

- Aneurysm Coiling & Embolization

- Embolic Coils

- Flow Diversion Devices

- Liquid Embolic Agents

- Cerebral Balloon Angioplasty & Stenting

- Carotid Artery Stents

- Filter Devices

- Balloon Occlusion Devices

- Neurothrombectomy

- Clot Retriever

- Suction Aspiration Devices

- Snares

- CSF Management

- CSF Shunts

- CSF Drainage

- Neurosurgery Devices

- Ultrasonic Aspirators

- Stereotactic Systems

- Neuroendoscopes

- Aneurysm Clips

By End User (Revenue, USD Billion):

- ??Hospitals and Clinics

- Specialty Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.