UK Lung Cancer Therapeutics Market Analysis

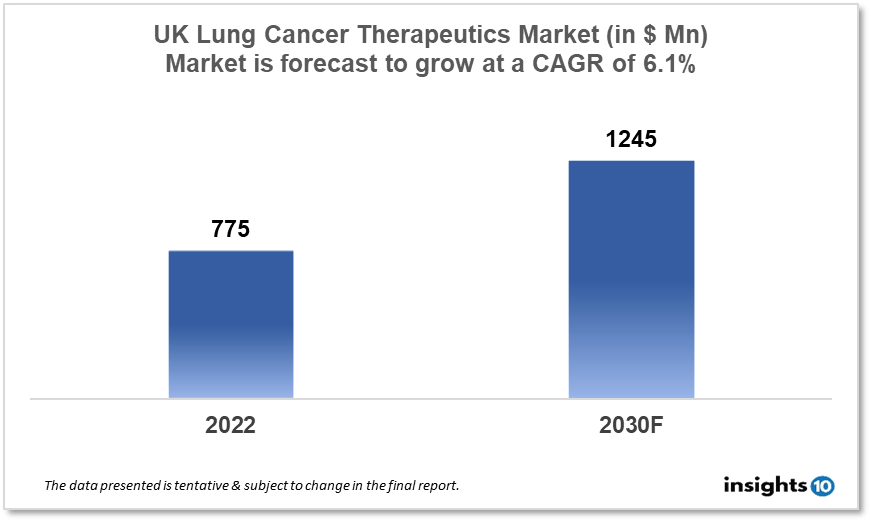

By 2030, it is anticipated that the UK Lung Cancer Therapeutics Market will reach a value of $1245 Mn from $775 Mn in 2022, growing at a CAGR of 6.1% during 2022-30. The Lung Cancer Therapeutics Market in the UK is dominated by a few domestic pharmaceutical companies such as Scancell, Sareum Holdings, and AstraZeneca. The Lung Cancer Therapeutics Market in the UK is segmented into different types of cancer and different therapy types. Some of the major factors affecting the UK lung cancer therapeutics market are the prevalence of unhealthy lifestyles, demand for targeted therapies and the presence of highly efficient drugs.

Buy Now

UK Lung Cancer Therapeutics Analysis Summary

By 2030, it is anticipated that the UK Lung Cancer Therapeutics market will reach a value of $1245 Mn from $775 Mn in 2022, growing at a CAGR of 6.1% during 2022-30.

The UK is a high-income, developed island country spanning an archipelago including Great Britain, located in Western Europe comprising England, Scotland, Wales, and Northern Ireland. After breast and prostate cancer, lung cancer is the third most frequent cancer in the UK, accounting for 13% of all new cancer cases. Every year, around 43,000 people in the UK are diagnosed with the illness.

According to the latest WHO data published in 2020 Lung Cancers Deaths in the United Kingdom reached 35,715 or 6.98% of total deaths. The age-adjusted Death Rate is 24.68 per 100,000 population ranks the United Kingdom 29th in the world. UK's government spends 12 % of its GDP on healthcare.

Market Dynamics

Market Growth Drivers

As part of their main cancer treatment, 2% of patients with small cell lung cancer (SCLC) and 16% of patients with Non-small cell lung cancer (NSCLC) have surgery to remove the tumour. Radiotherapy is used as part of the primary cancer treatment for 42 % of patients with small cell lung cancer (SCLC) and 27 % of patients with non-small cell lung cancer (NSCLC). As part of their main cancer treatment, 68 % of patients with small cell lung cancer (SCLC) and 25 % of patients with non-small cell lung cancer (NSCLC) received chemotherapy. In lung cancer treatment, there has also been a tendency toward personalised medicine, in which treatment is tailored to the individual genetic profile of each patient's cancer.

Many patients have benefited from this method. In addition to these breakthroughs in treatment, there is a focus on improving lung cancer detection and diagnosis. Screening programmes for high-risk persons have been developed in several parts of the UK, potentially leading to earlier disease discovery and treatment. These aspects could boost the UK Lung Cancer Therapeutics market.

Market Restraints

Age and health state can both influence the type of lung cancer therapy that is most suited. Certain therapies, such as chemotherapy or radiation therapy, may not be tolerated by older individuals or those with underlying health issues. It is uncommon in people under the age of 40. More than four out of every ten persons diagnosed with lung cancer in the UK are 75 or older. It is vital to observe regulatory guidelines established by organisations such as the UK's Medicines and Healthcare Products Regulatory Agency (MHRA) while producing new medications and therapies. These criteria can be complicated and time-consuming, resulting in delays and higher expenses. These factors may deter new entrants into the UK Lung Cancer Therapeutics market.

Competitive Landscape

Key Players

- AstraZeneca: AstraZeneca is a British-Swedish multinational pharmaceutical company that produces several drugs for the treatment of lung cancer, including Tagrisso and Imfinzi

- GlaxoSmithKline (GSK): GSK is a British multinational pharmaceutical company that produces several drugs for the treatment of lung cancer, including Nucala and Benlysta

- Sareum Holdings: Sareum Holdings is a UK-based drug discovery and development company that focuses on developing targeted small molecule therapeutics for cancer, including lung cancer

- Scancell: Scancell is a UK-based biotechnology company that is developing innovative cancer immunotherapies for a range of cancers, including lung cancer

Recent Notable Updates

March 2023: Owlstone Medical, the global leader in Breath Biopsy for applications in early disease detection and precision medicine, has announced a Research Agreement with Bicycle Therapeutics, a biotechnology company pioneering a new and distinct class of therapeutics based on its proprietary bicyclic peptide technology. The Companies will research the possibilities of integrating technologies and methods to develop antigen-targeted diagnostic probes that use bicyclic peptides as their targeting mechanism and are coupled to Owlstone's Exogenous Volatile Organic Compound probes under the terms of the Agreement. The work will initially focus on lung cancer screening as a proof of principle for the larger opportunity by encouraging the selective accumulation of the probe at the tumour for higher signal and enhanced selectivity.

January 2022: Lung cancer patients will benefit from a ground-breaking new medicine on the NHS. Thanks to a contract negotiated by NHS England, thousands of lung cancer patients in England will have access to a ground-breaking new medicine that can greatly lower the chance of cancer recurring. The MHRA has officially authorised atezolizumab, an effective therapy for non-small cell lung cancer (NSCLC), with more than 850 patients in England projected to be eligible for the drug in the first year, increasing to more than 1000 in the third year.

Healthcare Policies and Reimbursement Scenarios

Lung cancer therapeutics are regulated and reimbursed in the UK by several entities, including the Medicines and Healthcare Products Regulatory Agency (MHRA), the National Institute for Health and Care Excellence (NICE), and the National Health Service (NHS). The MHRA is responsible for regulating medicines and medical devices in the UK. NICE evaluates the cost-effectiveness of lung cancer therapeutics and makes recommendations on whether they should be funded by the NHS. The local integrated care board (ICB) is involved to decide whether to support the doctor’s decision and pay for the medicine from NHS budgets.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Lung Cancer Therapeutics Segmentation

By Type (Revenue, USD Billion):

- Small Cell Lung Cancer

- Non-small Cell Lung Cancer

- Lung Carcinoid Tumor

By Therapy (Revenue, USD Billion):

- Radiation Therapy

- Targeted Therapy

- Immunotherapy

- Chemotherapy

- Others

By Type of Molecule (Revenue, USD Billion):

- Small Molecules

- Biologics

By Drug Class (Revenue, USD Billion):

- Alkylating Agents

- Antimetabolites

- Multikinase Inhibitors

- Mitotic Inhibitors

- EGFR Inhibitors

- Others

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.