UK Lipid Disorder Therapeutics Market Analysis

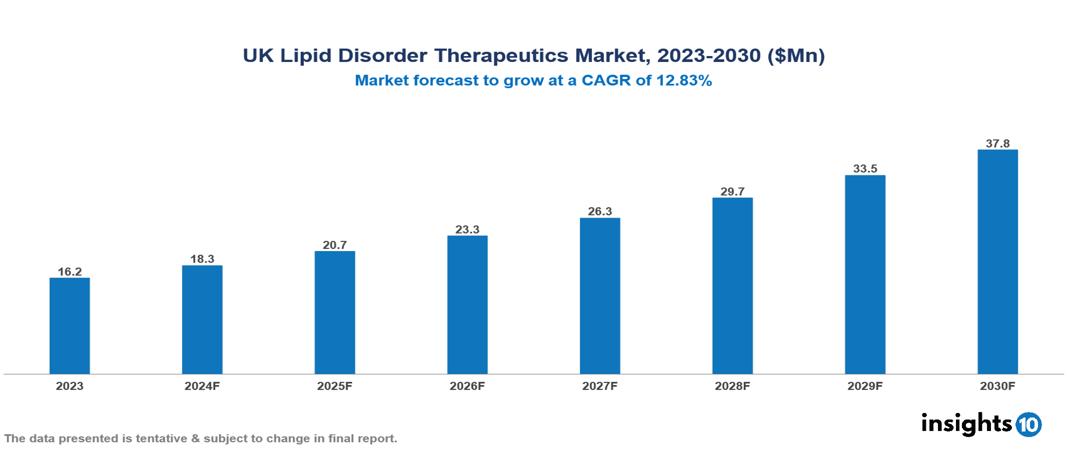

The UK Lipid Disorder Therapeutics Market was valued at $16.2 Mn in 2023 and is predicted to grow at a CAGR of 12.83% from 2023 to 2030, to $37.8 Mn by 2030. UK Lipid Disorder Therapeutics Market is growing due to the Increasing Prevalence of Cardiovascular Diseases, Government & NHS Support, Technological Advancements, and Personalized Medicine. The industry is primarily dominated by players such as Sanofi, Pfizer, Inc., GlaxoSmithKline plc, Novartis AG, Merck & Co., Inc., Amgen Inc., Takeda Pharmaceutical Company Limited, Sun Pharmaceutical Industries Ltd., AbbVie Inc., Viatris, AstraZeneca PLC, and Dr. Reddys Laboratories Ltd.

Buy Now

UK Lipid Disorder Therapeutics Market Executive Summary

UK Lipid Disorder Therapeutics Market is at around $16.2 Mn in 2023 and is projected to reach to $37.8 Mn in 2030, exhibiting a CAGR of 12.83% during the forecast period.

Lipid disorders refer to conditions where there are abnormal levels of lipids (fats) in the bloodstream. This includes high levels of cholesterol or triglycerides, which can increase the risk of heart disease and stroke. Signs and symptoms may not be apparent initially, but over time, they can manifest as chest pain, yellowish deposits on the skin (xanthomas), or fatty deposits around the eyes (xanthelasmas). Treatment often involves lifestyle changes such as adopting a healthy diet, regular exercise, and quitting smoking. Medications like statins or fibrates may also be prescribed to help lower lipid levels. It's crucial to consult a healthcare professional for proper diagnosis and management.

Nearly 50% of adult UK citizens, according to estimates from the British Heart Foundation, have cholesterol levels over the recommended national threshold of <5 mmol/L for total cholesterol (TC). Lipid management is primarily handled in primary care in the UK. Many individuals do not attain the cholesterol reductions indicated by guidelines, even with current oral lipid-lowering medications. Other therapy options are required for those for whom statins are either contraindicated or not tolerated. the market therefore is driven by significant factors like the increasing prevalence of cardiovascular diseases, government and national health service (NHS) support for technological advancements, and personalized medicine. However, regulatory challenges, side effects of treatments, and high costs of new therapies restrict the growth and potential of the market.

Pfizer has introduced innovative lipid-lowering drugs, such as PCSK9 inhibitors, which offer effective cholesterol management for patients with familial hypercholesterolemia or those at high cardiovascular risk.

Market Dynamics

Market Growth Drivers

Increasing Prevalence of Cardiovascular Diseases: The growing incidence of cardiovascular diseases, often linked to lipid disorders such as hypercholesterolemia, is a significant driver. A study published in the Journal of the American College of Cardiology found that elevated LDL-C levels alone were responsible for an estimated 3.81 million deaths globally in 2023. The aging population and lifestyle changes, including poor diet and lack of exercise, contribute to higher rates of lipid disorders, thereby increasing the demand for therapeutic interventions.

Government and NHS Support: The National Health Service (NHS) in the UK provides extensive support for lipid disorder treatments. Government initiatives and funding for cardiovascular health, combined with public health campaigns to raise awareness about the importance of managing cholesterol levels, bolster the market. Additionally, regulatory bodies like the Medicines and Healthcare Products Regulatory Agency (MHRA) ensure the availability of safe and effective treatments

Technological Advancements and Personalized Medicine: The integration of advanced technologies, such as genetic testing and personalized medicine, helps identify individuals at higher risk for lipid disorders and tailor treatments to individual needs. This approach improves treatment efficacy and encourages more people to seek medical intervention, thus expanding the market.

Market Restraints

Regulatory Challenges: The stringent regulatory environment for pharmaceutical products in the UK poses another restraint. The approval process for new drugs can be lengthy and complex, delaying the introduction of innovative therapies into the market. Additionally, ongoing updates to national guidelines, require continuous compliance, which can be resource-intensive for pharmaceutical companies.

Side Effects of Treatments: One of the primary challenges in the lipid disorder therapeutics market is the side effects associated with the medications. Statins, which are commonly used to manage lipid levels, can cause muscle pain, liver damage, and an increased risk of diabetes. These adverse effects can deter patients from adhering to prescribed treatments and limit the market's growth.

High Costs of New Therapies: The introduction of novel therapies, such as gene therapies, comes with high development and production costs. A Tufts Center for the Study of Drug Development study found that the median cost to develop a new drug, from discovery to approval, is a staggering $2.6 billion. These costs are often passed on to patients and healthcare systems, making these treatments less accessible to a broader population. This financial burden can slow market growth as payers and patients may be reluctant to adopt expensive new therapies.

Regulatory Landscape and Reimbursement Scenario

The UK’s healthcare regulation is overseen by the European Medicines Agency (EMA), a major regulatory agency ensuring the safety and efficacy of medicines across member states. The EMA, headquartered in Amsterdam, Netherlands, plays a pivotal role in evaluating and supervising medicinal products in the UK, adhering to stringent regulatory standards. Its responsibilities include authorizing medicines for market access, monitoring their safety post-approval, and facilitating research and innovation in healthcare. The agency collaborates with national competent authorities and other stakeholders to uphold public health interests.

In the UK healthcare market, reimbursement is primarily handled by the National Health Service (NHS), funded through general taxation. Private healthcare also exists but constitutes a smaller share of the market. Reimbursement policies are overseen by various regulatory bodies ensuring quality and cost-effectiveness. This system ensures free healthcare at the point of need for all permanent residents, covering around 85% of total healthcare expenditure.

Competitive Landscape

Key Players

Here are some of the major key players in the UK Lipid Disorder Therapeutics Market:

- Sanofi

- Pfizer, Inc.

- GlaxoSmithKline plc

- Novartis AG

- Merck & Co., Inc.

- Amgen Inc.

- Takeda Pharmaceutical Company Limited

- Sun Pharmaceutical Industries Ltd.

- AbbVie, Inc.

- Viatris

- AstraZeneca PLC

- Dr. Reddy’s Laboratories Ltd.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UK Lipid Disorder Therapeutics Market Segmentation

By Drug Type

- Atorvastatin

- Fluvastatin

- Simvastatin

- Pravastatin

- Others

By Indication

- Hypercholesterolemia

- Dysbetalipoproteinemia

- Familial Combined Hyperlipidemia

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.