UK Healthcare Insurance Market Analysis

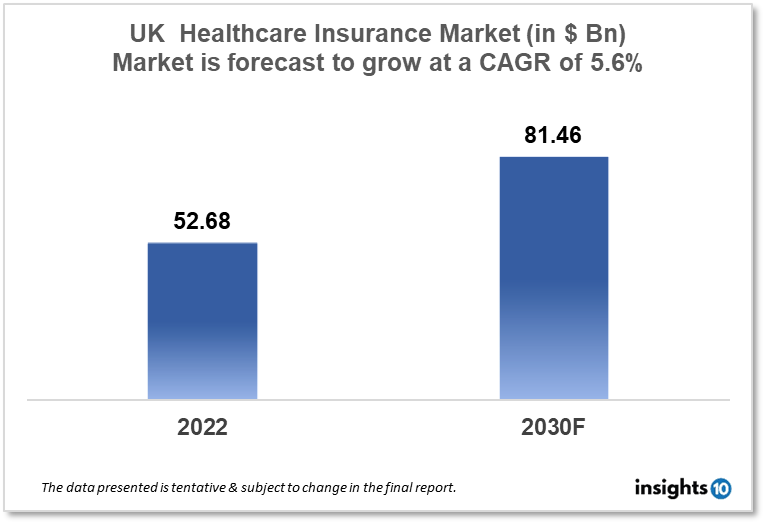

UK's healthcare insurance market is projected to grow from $52.68 Bn in 2022 to $81.46 Bn by 2030, registering a CAGR of 5.6% during the forecast period of 2022-30. The main factors driving the growth would be the rising cost of medical services, the increasing number of daycare procedures, and government initiatives. The market is segmented by component, provider, coverage, health insurance plans, and end-user. Some of the major players include Bupa, Aviva, VitalityHealth, Simplyhealth and Saga.

Buy Now

UK Healthcare Insurance Market Executive Summary

UK's healthcare insurance market is projected to grow from $52.68 Bn in 2022 to $81.46 Bn by 2030, registering a CAGR of 5.6% during the forecast period of 2022-30. In 2020, the UK spent $314.10 Bn on healthcare or $4,682.21 per person. This spending increased from 9.9% of GDP in 2019 to 12.0% of GDP in 2020. In 2020, the government covered almost 83% of all healthcare costs, or $ 260.2 Bn, an increase of 14.9% in real terms.

The UK health insurance market is a sizable and fiercely competitive sector that offers businesses and individuals private medical coverage. Access to private hospitals and clinics, faster treatment waiting time, and availability of specialized consultants are just a few of the advantages that private health insurance can provide. Large providers like Bupa, Aviva, and Vitality, as well as more niche companies like WPA and Freedom Health Insurance, make up the UK health insurance market. These companies provide a variety of plans to suit various financial situations and medical requirements.

Individuals may purchase health insurance plans directly from providers or through insurance brokers, who can assist them in finding the plan that best suits their needs. As part of their benefits package, businesses can also acquire health insurance for their staff members. The National Health Service (NHS), which handles the majority of medical procedures and treatments, is a free healthcare program run by the UK government. Private health insurance, however, may provide extra advantages and access to healthcare that the NHS might not.

Market Dynamics

Market Growth Drivers

The UK healthcare Insurance market is expected to be driven by factors such as:

- The rising cost of medical services- The UK health insurance industry is anticipated to be stimulated by an increase in the cost of medical services both internationally and domestically. This enables a lot of people to purchase life insurance to pay for medical expenses in the event that they or their families require medical attention

- The increasing number of daycare procedures- More daycare procedures are being covered by insurance plans by the majority of health insurance providers. There is no requirement that patients stay in the hospital for the minimum amount of time necessary to file an insurance claim, which is 24 hours, for these sorts of surgeries. Due to the rise in daycare operations, the UK health insurance industry has been able to expand

- Government initiatives- The UK government has launched a number of programs to promote the purchase of health insurance, including tax breaks for both individuals and corporations that purchase it

Market Restraints

The following factors are expected to limit the growth of the healthcare insurance market in the UK:

- High insurance premium cost- The expenditures associated with medical treatment are covered by health insurance. Since it pays for all medical costs incurred when the policyholder is hospitalised for treatment, it offers the policyholder financial support. Health insurance also pays for expenses incurred before and after hospitalisation. In order to maintain the health insurance policy's validity, the policyholder must pay premiums on a regular basis. Depending on the insurance plan, insurance premiums are typically expensive, which could impede the market's expansion

- High Competition- The UK healthcare insurance market is extremely cutthroat, with a number of sizable companies selling comparable coverage. This may make it more difficult for new competitors to establish themselves on the market and may slow market expansion in general

Competitive Landscape

Key Players

- Bupa (GBR)- Leading private healthcare provider Bupa offers insurance plans and medical services both domestically and abroad. For people on their own, families, and businesses, it provides a variety of health insurance policies

- Aviva (GBR)- It is the largest insurance group in the UK and the fifth largest in the world. It has a sizable business abroad in the world and is among the top providers of life and pensions products in Europe. Long-term savings, fund management, and general insurance are its primary pursuits

- VitalityHealth (GBR)- With over 1 Mn subscribers, VitalityHealth is a private medical insurance firm with a UK base. It is a division of Discovery Health which also offers VitalityLife and Vitality Corporate Services in the UK

- Simplyhealth (GBR)- a leading provider of healthcare solutions that are certified as a B-Corp and dedicated to supporting everyone's daily healthcare requirements. Around 2 Mn consumers are taken care of through the health and dental plans, which include market leader Denplan and the top provider of eye care packages, Ocuplan

- Saga (GBR)- Saga offers insurance services and products, mostly to seniors over the age of 50. Three segments make up its business: insurance, travel, new businesses, and central costs. The major component of the company, Saga's insurance section, offers specialised insurance services and products such as private medical, motor, house, and travel insurance. Acromas Insurance Company Ltd (AICL), the company's internal insurer, approves a range of personal lines products

Notable Deals and Upcoming Events

August 2022- With the purchase of a division from the London-based insurance company Azur Underwriting, leading UK insurance carrier Aviva plans to increase the size of its customer base. As part of its effort to dominate this industry, Aviva purchased the division of Azur Underwriting that manages wealthy clientele. After the acquisition is complete, Aviva Private Clients will oversee that division of Azur Underwriting.

July 2023- The British Insurance awards 2023 is organised on 5th July at Royal Albert Hall, London. It honours the creativity and outstanding accomplishments of the UK insurance business during the previous 12 to 18 months.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Healthcare Insurance Market Segmentation

By Provider (Revenue, USD Billion):

It mainly includes healthcare insurance that provides safety against the increasing cost of medical treatments and in case of health emergencies such as critical illnesses. Hence, it is the best way to safeguard medical expenses.

- Public

- Private

By Coverage Type (Revenue, USD Billion):

In terms of sales and market share, it is anticipated to rule the market over the projection period. This is explained by a number of benefits provided by life insurance, including guaranteed death payout and permanent coverage. Additionally, investing in these kinds of plans enables working professionals to save taxes

- Life Insurance

- Term Insurance

By Health Insurance Plans (Revenue, USD Billion):

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- High Deductible Health Plan (HDHP)

By Demographics (Revenue, USD Billion):

- Minors

- Adults

- Seniors

There is a high prevalence of lifestyle disease in the adult population that can increase health risks in the future. The population is more prone to cardiac and other diseases that require hospitalization. Healthcare insurance plans for seniors are more of a necessity, especially in the case of retirement. Also, it carries various advantages such as no medical screening before buying plans, includes coverage of the outpatient department, and provides the benefit of fee annual checkups along with lifetime renewability.

By End-user (Revenue, USD Billion):

- Individuals

- ?Corporates

A large number of people buy individual health plans as they are also customizable. Also, it gives more control over deductibles, co-pays, and benefits limits and is not dependent on employment status.

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.