UK Gram-Negative Infection Therapeutics Market Analysis

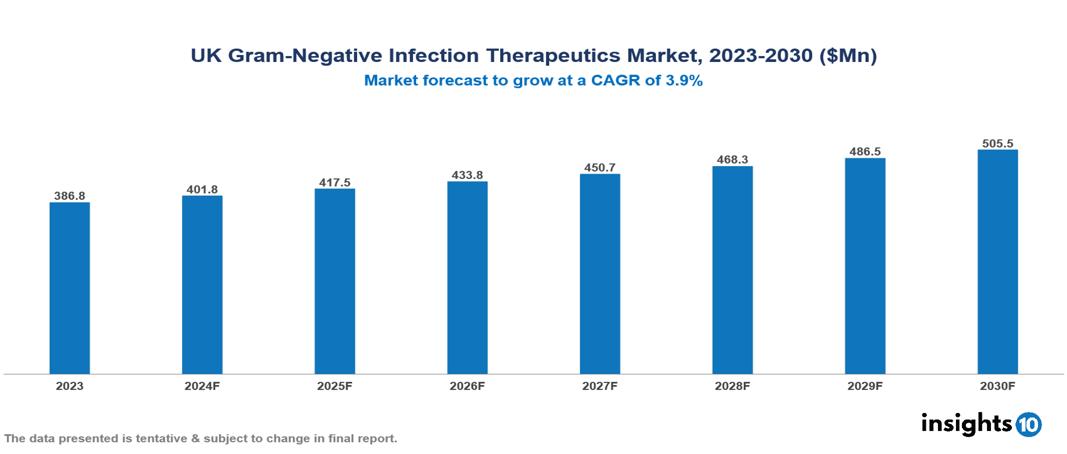

The UK Gram-Negative Infection Therapeutics Market was valued at $386.8 Mn in 2023 and is predicted to grow at a CAGR of 3.9% from 2023 to 2030 to $505.5 Mn by 2030. Public health initiatives, rising incidence of infections, and a growing demand for effective treatments drive this market expansion. Leading companies in this market include GlaxoSmithKline plc (GSK), Pfizer Inc., Novartis, Takeda, and Baxter, among others.

Buy Now

UK Gram-Negative Infection Therapeutics Market Executive Summary

The UK Gram-Negative Infection Therapeutics Market was valued at $386.8 Mn in 2023 and is predicted to grow at a CAGR of 3.9% from 2023 to 2030 to $505.5 Mn by 2030.

Gram-negative bacteria have a unique cell wall structure with an outer membrane containing lipopolysaccharides, making them resistant to antibiotics. Unlike gram-positive bacteria, they do not retain the crystal violet stain during Gram staining, appearing red or pink under a microscope. Common pathogens include Escherichia coli, Klebsiella pneumoniae, Pseudomonas aeruginosa, and Acinetobacter baumannii, which cause pneumonia, sepsis, UTIs, and wound infections, particularly in hospitals. Treatment is challenging due to rising antibiotic resistance, a shortage of new antibiotics, and complex treatment protocols. Research efforts are focused on developing novel antibiotics, implementing antimicrobial stewardship programs, and enhancing rapid diagnostic techniques. Effective public health initiatives and ongoing research are crucial to combat these infections and improve treatment outcomes.

The UK is burdened with gram-negative infections, with over 290,000 HAIs occurring annually in England alone, with a significant portion caused by gram-negative bacteria. Public health initiatives, increasing incidence, and the demand for effective treatments are the key factors driving market growth, while antibiotic resistance, limited treatment options, and high development costs impede the growth of the market.

Market Dynamics

Market Growth Drivers

Public Health Initiatives: The UK government's focus on promoting responsible antibiotic use, such as through the “Control AMR 2020 campaign”, encourages the exploration of alternative treatment options for Gram-negative infections. This national strategy is a crucial driver for the UK Gram-Negative Infection Therapeutics Market, fostering demand for novel therapeutics. Public health initiatives and awareness campaigns that address the challenges posed by these infections further contribute to market growth by highlighting the need for effective treatments and driving patient demand.

Increasing Incidence: It is estimated that over 290,000 HAIs occur annually in England alone, with a significant portion caused by gram-negative bacteria. The rate of acquired carbapenemase-producing Gram-negative bacterial episodes varied in England, with the highest overall rate reported in the North West (2.01 episodes per 100,000 population) and the lowest in the East of England and South West regions (0.22 and 0.14 episodes per 100,000 population, respectively). The rising prevalence of gram-negative bacterial infections in the UK is a significant driver for the market, necessitating effective treatment options.

Demand for Effective Treatments: The UK faces a growing threat from MDR pathogens, including E. coli and Klebsiella pneumonia, according to a 2023 report by the UK government's Antimicrobial Resistance Review. The need for innovative and effective therapies to combat Gram-negative infections is a driving force in the market, pushing for the development of new treatment options.

Market Restraints

Antibiotic Resistance: The widespread emergence of antibiotic-resistant gram-negative bacteria poses significant challenges to developing effective treatments, as traditional antibiotics are becoming increasingly ineffective. This limits the effectiveness of available treatments, restraining market growth.

Limited Treatment Options: The scarcity of novel and effective treatments for Gram-negative infections, especially those caused by multidrug-resistant (MDR) bacteria, limits the market's growth potential. The lack of diverse treatment options hampers the market's ability to meet demand.

High Development Costs: The substantial costs of developing new treatments for Gram-negative infections, including clinical trials and regulatory approvals, deter companies from investing in these projects. The financial burden restricts the entry of new products into the market, constraining its expansion.

Regulatory Landscape and Reimbursement Scenario

In the UK, the reimbursement scenario for novel Gram-negative infection therapeutics is shaped by the National Health Service (NHS), the National Institute for Health and Care Excellence (NICE), and the Department of Health and Social Care (DHSC). The NHS determines medication access, while NICE evaluates new medicines for cost-effectiveness and clinical standards. Companies must demonstrate significant clinical and cost advantages to secure favorable reimbursement decisions from the NHS and NICE.

Established cost-effective antibiotics are likely to be reimbursed. At the same time, newer therapeutics for multidrug-resistant (MDR) infections require rigorous evaluations and negotiations with the DHSC to secure a price within NICE's cost-effectiveness threshold. Regulatory bodies such as the Medicines and Healthcare Products Regulatory Agency (MHRA) oversee the entire lifecycle of these products, ensuring their safety, quality, and effectiveness.

Competitive Landscape

Key Players

Here are some of the major key players in the UK Gram-Negative Infection Therapeutics Market:

- Merck & Co., Inc.

- AstraZeneca

- Roche

- GlaxoSmithKline plc (GSK)

- Pfizer Inc.

- Sanofi-Aventis

- Takeda Pharmaceutical Company Limited

- Nektar Therapeutics

- Baxter

- Novartis

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UK Gram-Negative Infection Therapeutics Market Segmentation

By Drug Types

- Antibiotics

- Combination Therapies

- Adjunctive Therapies

By Infection Types

- Urinary Tract Infections (UTIs)

- Pneumonia

- Bloodstream Infections (Bacteraemia)

- Wound/Surgical Site Infections

- Gastrointestinal Infections

- Meningitis

- Hospital-Acquired Infections (HAIs)

- Respiratory Tract Infections (RTIs)

- Other Infections

By Route of Administration

- Oral

- Parenteral (injections, intravenous)

- Topical

By Distribution Channel

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Home Healthcare

- Long-term Care Facilities

- Community Health Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.