UK Gaucher Disease Drugs Market Analysis

UK Gaucher disease drugs market is projected to grow from $xx Mn in 2023 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2023 - 2030. The market for gaucher disease drugs is growing rapidly as a result of rising incidence and prevalence of gaucher disease, increasing infrastructure spending for healthcare, rising acceptance rate of early diagnosis, increasing number of government initiatives to raise awareness and an increasing number of approved therapies for the treatment of Gaucher disease. Aptalis Pharma, Abbott Laboratories, Genzyme Corporation, Pfizer Inc., GlaxoSmithKline (GSK), Eli Lilly and Company, AVROBIO, Shire Human Genetic Therapies, Inc., Anthera Pharmaceuticals, Inc., Enobia Pharma Inc., BioMarin Pharmaceutical Inc., Merck Serono, Zymenex A/S, and MedPro Rx are the top key players of gaucher disease drugs market.

Buy Now

UK Gaucher Disease Drugs Market Analysis Summary

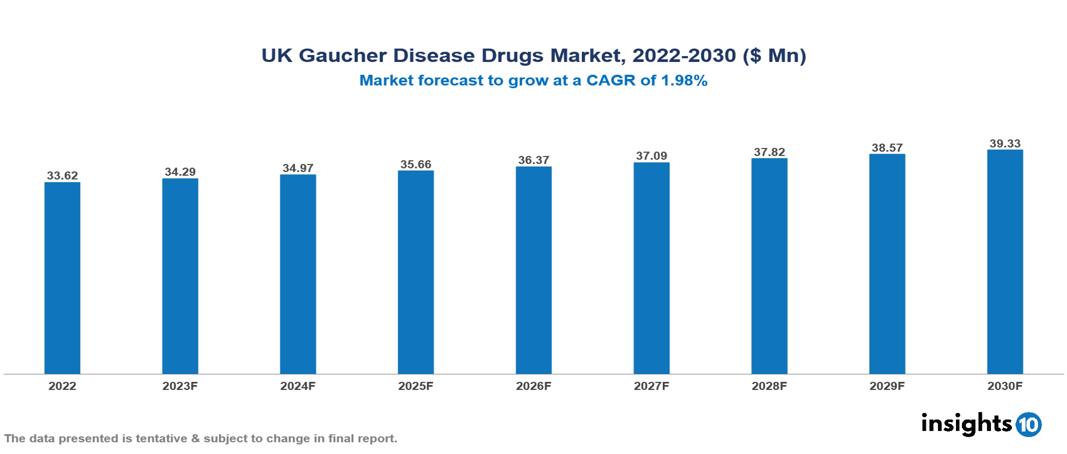

UK Gaucher Disease Drugs Market is valued at around $33.62 Mn in 2022 and is projected to reach $39.33 Mn by 2030, exhibiting a CAGR of 1.98% during the forecast period 2023-2030.

Gaucher disease is a rare type of liposomal disease which occurs due to a deficiency of the enzyme glucocerebrosidase, which breaks down the fatty compound glucocerebroside and causes Gaucher cells to accumulate in the spleen, liver, and bone marrow. Major symptoms of this disease include an enlarged liver or spleen, weariness, anaemia, bone discomfort and fractures and easy bleeding while brushing. The Gaucher disease has three different types Type I, Type II, and Type III. The most prevalent form of Gaucher illness, Type I, does not impact the nervous system of the patient. Type 1, Type 2, and Type 3 drugs are available on the market for Gaucher disease. The Type I Gaucher disease category is anticipated to occupy a sizable part of the Gaucher disorder market due to the increase in incidences across the globe. The short-term treatment objectives for Type I include symptoms related to anaemia, bleeding propensity, visceral issues, and general health. Another long-term therapy goal for Type I disease is to address respiratory issues. The effective treatment of Type I Gaucher disorder will be aided by factors such as the correct patient and family education on the condition and available treatments. The enzyme replacement therapy. the segment is expected to dominate the global Gaucher Disease market in terms of revenue contribution during the forecast period due to its higher adoption rate as compared to other therapies available for treating Gaucher disease. Regular oral or intravenous administration of a synthetic or recombinant version of glucocerebrosidase is done in ERT. ERT thus seeks to replace the lacking enzyme and lessen the buildup of glucocerebroside. The segment would expand because there are more approved drugs in the ERT. Aptalis Pharma, Abbott Laboratories, Genzyme Corporation, Pfizer Inc., GlaxoSmithKline (GSK), Eli Lilly and Company, AVROBIO, Shire Human Genetic Therapies, Inc., Anthera Pharmaceuticals, Inc., Enobia Pharma Inc., BioMarin Pharmaceutical Inc., are the key global market players.

Market Dynamics

Market Drivers

The market for treating Gaucher disease is primarily driven by the increasing number of medicinal approvals, which encourages leading market players to adopt a new strategy when developing new drugs. Collaboration between various biopharmaceutical companies and research institutes will also help the market flourish. Additionally, there are government programmes to raise awareness about Gaucher's illness. Increase incidence and prevalence of disease, orphan drug designations, patient advocacy programmes and emerging therapies all act as market growth drivers.

Market Restraints

The high cost associated with the treatment of Gaucher's disease may restrain the growth of this market during the forecast period.

Key players

Sanofi Pfizer Shire Amicus Therapeutics Takeda Pharmaceutical Company Intercept Pharmaceuticals Alexion Pharmaceuticals CSL Behring Octapharma Grifols1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market Segmentations For UK Gaucher disease drugs market

By Type

- Type 1

- Type 2

- Type 3

By Therapy

- Enzyme replacement therapy

- Substrate replacement therapy

By Diagnosis

- Physical Examination

- Blood tests

- Imaging Tests

- Preconception Screening

- Prenatal Testing

- Others

By end users

- Hospitals

- Speciality clinics

- Homecare

- Others

By Route of Administration

- Oral

- Parenteral

- Others

By Distribution Channels

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.