UK Connected Healthcare Market Analysis

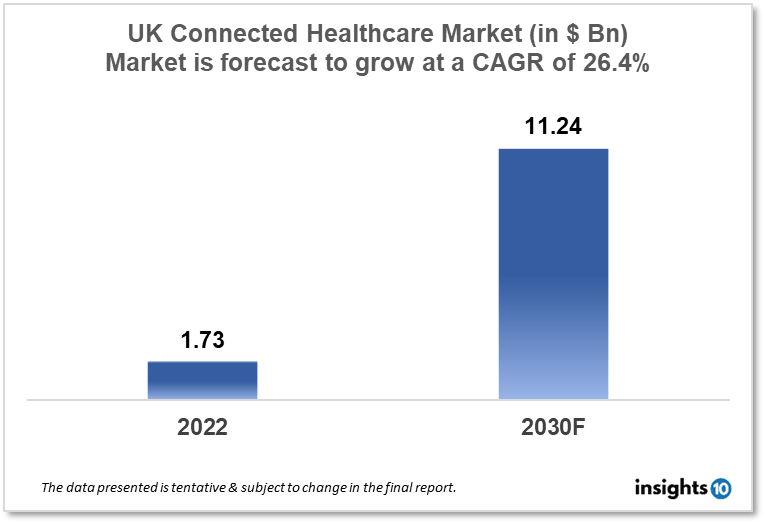

The UK-connected healthcare market is projected to grow from $1.73 Bn in 2022 to $11.24 Bn by 2030, registering a CAGR of 26.24% during the forecast period of 2022-2030. The main factors driving the growth would be the ageing population, advances in technology, the COVID-19 pandemic and regulatory support. The market is segmented by type, function and by application. Some of the major players include Babylon Health, Huma, Livi, Pudh Doctor, Cera Care, Apple, Microsoft, IBM and GE Healthcare.

Buy Now

UK Connected Healthcare Market Executive Summary

The UK-connected healthcare market is projected to grow from $1.73 Bn in 2022 to $11.24 Bn by 2030, registering a CAGR of 26.24% during the forecast period of 2022-30. Healthcare spending in the UK was $314.10 Bn in 2020 or $4,682.21 per person. From 9.9% of GDP in 2019 to 12.0% of GDP in 2020, this expenditure grew. In 2020, the government paid for around 83% of total healthcare spending, or $ 260.2 Bn, a 14.9% real-terms increase.

The connected healthcare market refers to the use of digital technology and connected devices to enhance healthcare delivery and patient care. These can include telemedicine, remote patient monitoring, wearable technology, mobile health apps, and other digital health solutions.

The connected healthcare sector in the UK is home to a wide range of businesses, from small startups to significant international organisations. To enhance patient care and outcomes, these businesses are working with healthcare providers to provide emerging digital health solutions. With initiatives like the NHS Digital Academy and the NHS Digital Innovation Center, the UK government has also contributed to the growth of digital health technologies.

Market Dynamics

Market Growth Drivers

The UK-connected healthcare market is expected to be driven by the following factors:

- Ageing population- The UK has an ageing population, with an increasing proportion of persons over the age of 65. People are more likely to develop various chronic diseases as they age, necessitating greater medical attention. Digital health technologies can support the management of chronic illnesses and aid to improve access to care

- Advances in technology- Technology advancements such as those in Artificial Intelligence (AI), machine learning, and the Internet of Things (IoT) have made it possible to create brand-new, cutting-edge digital health solutions. These innovations can enhance patient participation, diagnosis, and care

- COVID-19 pandemic- The UK's deployment of digital health technologies has been boosted by the COVID-19 pandemic. To lower the danger of transmission and maintain access to care throughout the pandemic, several healthcare providers used telemedicine and other remote care technologies

- Regulatory Support- With programs like the NHS Digital Academy and the NHS Digital Innovation Hub, the UK government has supported digital health innovations. These programs are supporting the uptake of fresh digital health solutions and foster industry innovation

Market Restraints

The following factors are expected to limit the growth of the connected healthcare market in the UK:

- Data privacy and security concerns- In the UK, there are stringent rules in place to protect patient data since data privacy and security are key issues in the healthcare industry. These rules, which can be complicated and expensive, must be followed by businesses that operate in the linked healthcare industry

- Infrastructure Challenges- A strong IT infrastructure, including secure data storage facilities and high-speed internet connectivity, is needed for the development and adoption of digital health innovations. Infrastructure issues in some areas of the UK may prevent the widespread use of digital health solutions

- Funding- The use and development of digital health technology might be severely constrained by funding. Healthcare providers may find it difficult to raise the funds necessary to invest in cutting-edge digital health solutions given the severe financial strain on the UK healthcare system

Competitive Landscape

Key Players

- Babylon Health (GBR)- Babylon Health is a digital health service that offers online consultations with medical specialists. The business provides a variety of wellness and fitness programs in addition to using artificial intelligence (AI) to assist in patient diagnosis and treatment

- Huma (GBR)- Huma (formerly known as Medopad) develops applications that securely communicate patient wearables, other mobile devices, and health data from current hospital systems to be used by clinicians. Its hospital-at-home technology connects clinical teams with patients, expands access to treatment from anywhere, and boosts clinician productivity

- Livi (GBR)- Livi is a digital healthcare platform that provides online consultations with doctors, psychologists, and other healthcare specialists

- Push Doctor (GBR)- Push Doctor is a digital healthcare firm that offers prescription delivery, medical advice, and doctor video consultations

- Cera Care (GBR)- Cera Care is a healthcare-at-home business that focuses on using technology to give care, nursing, telehealth, and repeat prescription services in people's homes. It offers care in the comfort of families for old and vulnerable populations

- Apple- A variety of health and fitness features are available on Apple's Health app and Apple Watch, and the company is increasingly collaborating with healthcare organisations to incorporate its technologies into patient treatment

- Microsoft- Microsoft's cloud computing platform Azure is used by several healthcare companies to store and analyse patient data, and the business is also developing new healthcare tools and technology

- IBM- IBM Watson Health employs AI technology to analyse patient data and develop innovative healthcare solutions, including tools for clinical decision-making and patient engagement

- GE Healthcare- GE Healthcare is a multinational healthcare company that delivers a range of digital health solutions, including medical imaging and monitoring devices, and healthcare analytics technologies

Notable Deals

January 2022: Babylon acquired of DayToDay Health in order to enhance the healthcare services offered via its digital platform. With the acquisition, Babylon's members will now have access to highly engaging programs and clinical services given to patients.

January 2023: Huma acquired Alcedis in order to broaden its clinical trial platform. By acquiring the company, Huma will establish an advanced clinical trials section that will provide digital health solutions for every stage of the research and development process.

Healthcare Policies and Regulatory Landscape

The Department of Health and Social Care is in charge of developing and implementing healthcare policies. The National Health Service (NHS) is the primary supplier of healthcare services in the UK. The government's vision for the future of healthcare in the UK is laid out in the NHS Long-Term Plan, which was released in 2019. It places particular emphasis on digital health technology and the use of data to enhance patient care and results.

Medical device regulation and usage safety are the purviews of the Medicines and Healthcare Products Regulatory Agency (MHRA), one of the regulatory organisations. In the UK, the General Data Protection Regulation (GDPR) and the Data Protection Act 2018 set strict penalties for non-compliance with regulations on gathering, storing, and use of patient data.

Additionally, the government launched NHS App, a mobile health app, in 2018 that enables users to view their medical records, schedule appointments, and place online medication orders. As part of its dedication to digital health, the NHS also provides telemedicine services, such as video consultations with medical experts.

Reimbursement Scenario

The NHS in the UK sets the reimbursement guidelines for connected healthcare technologies. The NHS is a publicly funded healthcare system that offers all UK citizens free medical care. Connected healthcare technologies can be financed in a variety of ways, even though the NHS does not have a defined reimbursement policy for them. First of all, if digital health innovations are determined to be cost-effective and improve patient outcomes, the NHS may provide funding for their development and use. This money can come from the NHS Innovation Accelerator or other government programs that support innovation in the healthcare industry. Second, some digital health innovations could receive private funding from patients or medical professionals. Digital health costs may be covered by private health insurance policies.

Lastly, to promote the creation and application of their innovations, digital health technology businesses may be able to seek grant funding from the government or other sources. The NHS Digital Innovation Fund, which provides funding for the development of digital health solutions, is one program via which these grants could be given out.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Connected Healthcare Market Segmentation

By Type (Revenue, USD Billion):

Based on the Type the market is segmented into mHealth services, mHealth Devices, and E- Prescription

- MHealth services

- mHealth Devices

- E- Prescription

By FunctionType (Revenue, USD Billion):

- Remote patient monitoring

- Clinical monitoring

- Telemedicine

- Others (Assisted Living)

By Application Type (Revenue, USD Billion):

- Diagnosis and Treatment

- Monitoring Application

- Wellness and Prevention

- Healthcare management

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.