UK Cold Pain Therapy Market Analysis

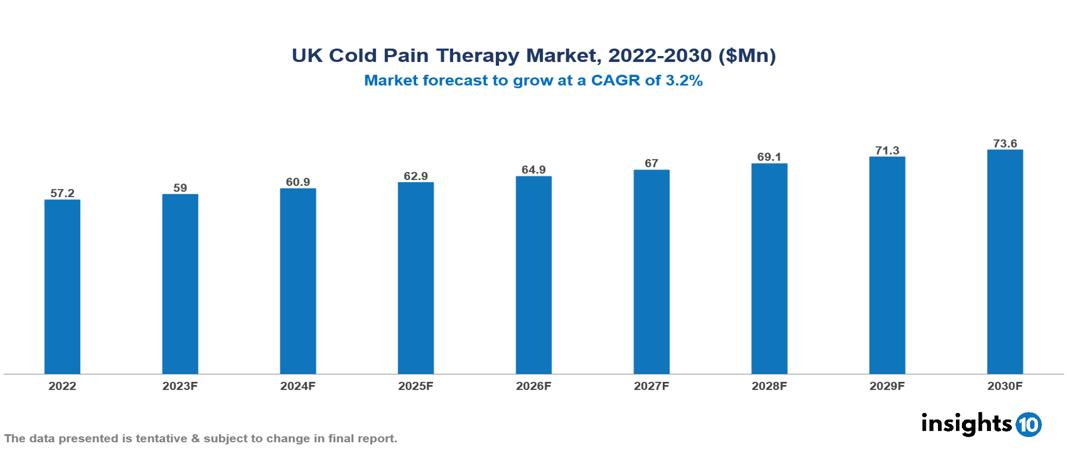

The UK Cold Pain Therapy Market was valued at $57 Mn in 2022 and is predicted to grow at a CAGR of 3.2% from 2023 to 2030, to $74 Mn by 2030. The key drivers of this industry include the increasing prevalence of chronic pain disorders, technological advances in the industry, and demand for non-invasive pain relief approaches. The industry is primarily dominated by players such as DJO Global, Breg, Beiersdorf, Ossur, Performance Health, Pfizer, and Hisamitsu among others.

Buy Now

UK Cold Pain Therapy Market Analysis Executive Summary

The UK Cold Pain Therapy Market is at around $57 Mn in 2022 and is projected to reach $74 Mn in 2030, exhibiting a CAGR of 3.2% during the forecast period.

Cold pain therapy, also known as cryotherapy, involves the application of cold temperatures to alleviate pain and reduce inflammation. This therapeutic approach is commonly utilized for addressing acute injuries, post-surgical discomfort, and a range of musculoskeletal conditions. The mechanism of cold therapy works by narrowing blood vessels and decreasing metabolic activity, leading to a reduction in swelling and the numbing of the affected area, ultimately providing relief from pain. Various application methods, including ice packs, cold compresses, ice baths, or specialized devices delivering controlled cold temperatures to specific body parts, can be employed. Multiple companies offer products for cold pain therapy, providing a diverse range of options tailored to different needs. Well-known brands in this field include Ossur, Biofreeze, DonJoy, and Chattanooga, offering ice packs, cold wraps, and devices designed for precise and controlled cooling. Healthcare professionals commonly recommend cold pain therapy, especially during the initial stages of injury or post-surgical recovery, aiming to effectively manage pain and expedite the healing process.

Around 15.5 Mn people in the UK are suffering from musculoskeletal disorders. Market growth is driven by several factors such as the increasing burden of chronic conditions due to the aging population, technological advances in the industry, and consumer demand for non-invasive pain relief approaches. However, conditions such as competition from established pharmaceutical alternatives, limited reimbursement, and limited awareness impede the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Increased prevalence of pain disorders: Musculoskeletal disorders (MSDs) such as osteoarthritis and back pain are extremely common in the UK, affecting an estimated 15.5 Mn people Cold therapy offers a non-invasive treatment option for managing pain and inflammation. UK is also actively engaged in sports and fitness activities coupled with increased adoption of active lifestyles which contribute to higher injury rates, creating a greater demand for cold therapy to relieve pain and speed up recovery. Factors such as an aging demographic, high prevalence of chronic pain, and others, drive market growth.

Consumer preference for non-invasive approaches: Increasing awareness of potential side effects associated with conventional pain medications such as opioids is prompting patients to explore safer alternatives like cold therapy. Consumers are increasingly inclined toward non-invasive and drug-free methods for managing pain. Cold pain therapy offers a natural and non-pharmacological means of pain relief. Individuals, especially those seeking alternatives to traditional pain medications, are turning to cold therapy products for their analgesic and anti-inflammatory effects.

Technological advancements: Cold pain therapy market is marked by constant technological advancements by manufacturers. These developments include improved cold therapy devices with capabilities such as temperature control, mobility, and personalized applications. Such advances meet the varied demands of patients in providing effective pain relief, hence driving market expansion.

Market Restraints

Competition from traditional pain management alternatives: The market competes with competition from established pain management solutions such as over-the-counter medications, heat therapy, and physiotherapy. Consumers may view these alternatives as more familiar, easily accessible, or providing quicker pain relief, influencing the adoption of cold therapy. The increasing popularity of complementary and alternative therapies like acupuncture and massage may also draw users looking for non-medication options for pain relief.

Limited awareness: A considerable number of people around 40% in the UK lack awareness regarding the advantages and versatile applications of cold therapy for pain alleviation. They may prioritize more easily accessible alternatives such as pain medication, overlooking the potential benefits of cold therapy, such as minimized side effects and targeted relief. Insufficient knowledge about the functionalities of specific products and their optimal usage can further impede adoption. Consumers might feel uncertain about selecting the appropriate product type, such as ice packs, gels, or wraps, tailored to their specific pain requirements, resulting in dissatisfaction and hindering repeat purchases.

Limited reimbursement: Prescription cold therapy devices face challenges in obtaining coverage through national health insurance plans, rendering them financially out of reach for certain patients. This presents a notable obstacle, particularly for individuals dealing with chronic pain conditions that necessitate prolonged therapy. Additionally, even for non-prescription products, the initial expense of reusable cold therapy devices, when compared to more readily accessible disposable options like pain medication, can serve as a deterrent for budget-conscious consumers.

Healthcare Policies and Regulatory Landscape

In the UK, the main regulatory body overseeing the approval and licensure of drugs and pharmaceuticals is the Medicines and Healthcare Products Regulatory Agency (MHRA). The MHRA is an executive agency of the Department of Health and Social Care and is responsible for ensuring the safety, quality, and efficacy of medicines and medical devices in the UK.

The process of obtaining licensure for drugs in the UK involves a comprehensive evaluation of scientific and clinical data submitted by pharmaceutical companies. Applicants must adhere to Good Manufacturing Practice (GMP) standards, provide robust evidence from clinical trials, and demonstrate the risk-benefit profile of the drug. Once granted, the marketing authorization allows the pharmaceutical product to be legally marketed and sold in the UK.

New entrants into the pharmaceutical industry must navigate this regulatory landscape, ensuring compliance with MHRA requirements, which can involve significant investment in research, development, and regulatory affairs to bring a new drug to market successfully. The MHRA's commitment to ensuring public safety and maintaining high regulatory standards plays a crucial role in shaping the competitive environment for pharmaceutical companies entering the UK market.

Competitive Landscape

Key Players

- Beiersdorf AG

- Breg

- Custom Ice

- Johnson & Johnson

- DJO Global Inc

- Hisamitsu Pharmaceutical

- Medline Industries

- Ossur

- Pfizer

- Performance Health

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UK Cold Pain Therapy Market Segmentation

By Therapy Type

- Icepack

- Chamber

- Cryosurgery

By Product Type

- OTC Products

- Prescription Drugs

By Application

- Dermatology

- Oncology

- Musculoskeletal disorders

- Pain management

- Sports medicine

- Ophthalmology

- Others

By End Users

- Hospitals and clinics

- Sports person

- Adults

- Others

By Distribution channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.