UK Chronic Pain Therapeutics Market Analysis

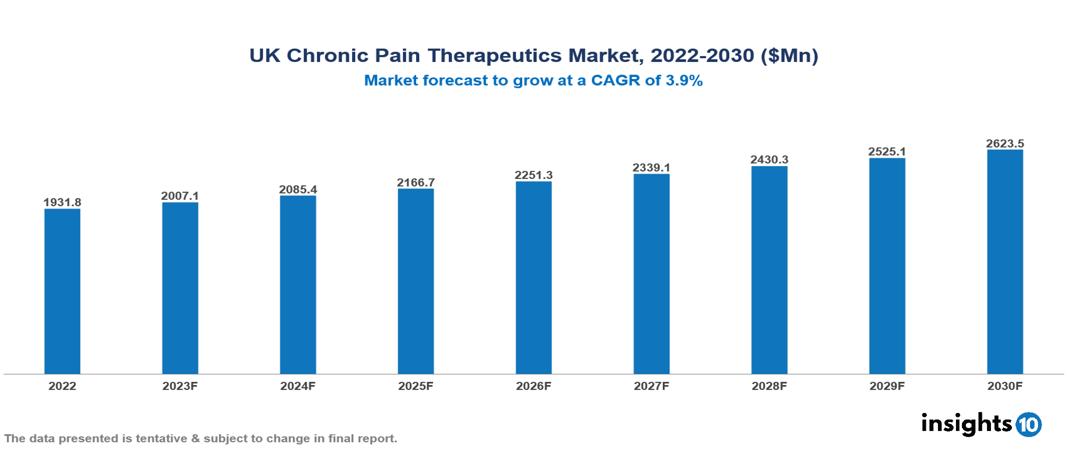

The UK Chronic Pain Therapeutics Market is anticipated to experience a growth from $1.932 Bn in 2022 to $2.624 Bn by 2030, with a CAGR of 3.9% during the forecast period of 2022-2030. The main drivers of market growth include the imperative for cost-effective medicines to address the substantial financial burden on the NHS, rising demand for non-opioid treatments due to concerns over opioid risks, and the increasing prevalence of chronic pain linked to an aging population and the growing incidence of chronic diseases. The UK Chronic Pain Therapeutics Market encompasses various players across different segments, including Sanofi, Pfizer, Merck, Novartis, Bayer, Amgen, Abbott, AstraZeneca, Norgine, Xenova, etc., among various others.

Buy Now

UK Chronic Pain Therapeutics Market Analysis Executive Summary

The UK Chronic Pain Therapeutics Market is anticipated to experience a growth from $1.932 Bn in 2022 to $2.624 Bn by 2030, with a CAGR of 3.9% during the forecast period of 2022-2030.

Chronic pain is a persistent type of pain that lasts for an extended period, typically beyond three months, and can continue for several years. It differs from acute pain, which is short-term and usually related to an injury or illness that resolves once the underlying cause is treated. Chronic pain can affect various parts of the body and significantly impact daily activities, leading to issues like depression, anxiety, and sleep disturbances. The causes of chronic pain can vary, ranging from ongoing health conditions like arthritis or cancer to changes in the body's sensitivity to pain even after healing from an injury. Additionally, psychogenic pain, triggered by psychological factors such as stress and depression, is another form of chronic pain. Managing chronic pain involves a combination of medications, therapies, and lifestyle adjustments to alleviate symptoms and improve quality of life. While there is no universal cure for chronic pain, seeking appropriate treatment and support from healthcare providers is essential to effectively manage this challenging condition.

About 23 Mn people in the UK, or approximately one-third of the population, suffer from chronic pain. Across all assessed phenotypes, chronic pain was more prevalent in female individuals than in male ones. Chronic pain was more common as people aged, with a range of 18% in the 16–34 age group and 53% in the 75+ age group. Of the various forms, the most prevalent cause of chronic pain is musculoskeletal disorders, which account for 8 out of 10 cases (84%) of chronic pain. These illnesses include osteoarthritis, and back, neck, and limb pain.

The main drivers of market growth include the imperative for cost-effective medicines to address the substantial financial burden on the NHS, rising demand for non-opioid treatments due to concerns over opioid risks, and the increasing prevalence of chronic pain linked to an aging population and the growing incidence of chronic diseases.

Global giants like Pfizer and GSK are considered major players in the UK market as well. Pfizer provides a large selection of painkillers, both prescription and over-the-counter. It is heavily involved in the investigation and creation of novel pain treatments. With brands including Voltaren and Panadol, GSK holds a substantial market share in the UK for over-the-counter chronic pain management. Like Grünenthal which specializes in neuropathic pain, several local and smaller businesses are segment-focused. Cassava Sciences (Pain Therapeutics) is an example of an up-and-coming innovator in this segment.

Market Dynamics

Market Growth Drivers

Need for cost-effective medicines: The escalating healthcare costs represent a significant financial challenge for the NHS, and chronic pain stands out as a substantial contributor, accounting for an estimated $21.4 Bn annually. This financial strain underscores the urgency to explore and implement new treatments that effectively manage chronic pain and are more economically sustainable, aiming to alleviate the overall burden on the healthcare system.

Demand for non-opioid treatment: The growing demand for non-opioid treatments is a response to the increasing recognition of the risks associated with opioid painkillers, including addiction and overdose concerns. This heightened awareness has spurred efforts to develop and adopt alternative pain management therapies. Innovations such as neuromodulation devices, cannabinoids, and botulinum toxin are gaining prominence as they offer potential solutions with reduced risks and improved outcomes.

Increasing pain prevalence: Chronic pain's prevalence in the UK is a pressing health concern, currently affecting approximately 23 Mn people. Projections indicate a future rise in these numbers, attributed to the aging population and the expanding incidence of chronic diseases such as arthritis, back pain, and cancer. This demographic shift and evolving health landscape emphasize the ongoing need for comprehensive strategies to effectively address and manage chronic pain, ensuring the well-being of individuals and optimizing healthcare resources.

Market Restraints

Economic challenges: High development costs pose a barrier, as extensive research and development needed for novel pain management solutions can place them beyond the reach of some companies. Moreover, the NHS's budget limitations constrain the adoption of expensive therapies, even when their efficacy is demonstrated. Out-of-pocket costs associated with certain pain management options may also create access barriers, especially for vulnerable populations.

Incomplete understanding of chronic pain: Chronic pain presents challenges due to its subjective nature, making it difficult to establish standardized measures and treatment protocols. The complex mechanisms underlying chronic pain further complicate the development of effective treatments. The focus on managing symptoms rather than addressing root causes may limit the long-term effectiveness of existing therapies.

Competition from Alternative Therapies: The rise of Complementary and Alternative Medicine (CAM) options introduces competition and potential confusion among patients, influencing treatment choices and potentially delaying or hindering adherence to conventional approaches. Additionally, the limited evidence base for some CAM therapies poses challenges, as insufficient research on their efficacy and safety may impact their acceptance within mainstream healthcare.

Healthcare Policies and Regulatory Landscape

The National Health Service (NHS), UK’s publicly financed system governs the overall healthcare policies in the country. The Medicines and Healthcare Products Regulatory Agency (MHRA) regulates the pharmaceutical industry in the UK. The MHRA is an important regulatory authority in the UK that oversees the safety, quality, and efficacy of medicines, medical devices, and blood components. The MHRA is responsible for ensuring standard compliance for these products, it also helps in securing the supply chain, and above all, it helps in promoting international harmonization. It assesses and authorizes all the medicinal products for sale in the UK, conducts post-marketing surveillance for drugs, and educates both the public and healthcare professionals on the risks and benefits of healthcare products. With an emphasis on safety and efficacy, the MHRA also supervises Notified Bodies for medical devices, licenses and inspects manufacturers and importers, and monitors adverse reactions through programs such as the Yellow Card Scheme. As an executive agency of the Department of Health and Social Care, the MHRA's work is critical to protecting public health and ensuring the quality of healthcare goods in the UK.

Competitive Landscape

Key Players:

- Sanofi

- Pfizer

- Merck

- Novartis

- Bayer

- Amgen

- Abbott

- AstraZeneca

- Norgine

- Xenova

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UK Chronic Pain Therapeutics Market Segmentation

By Indication

- Neuropathic Pain

- Back Pain

- Headaches

- Arthritis Pain

- Muscular Pain

- Idiopathic Pain

- Others

By Drug Class

- Analgesics

- Opioids

- NSAIDs

- Anaesthetics

- Others

By Route of Administration

- Oral

- Topical

- Parenteral

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End User

- Hospitals

- Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.