UK Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Analysis

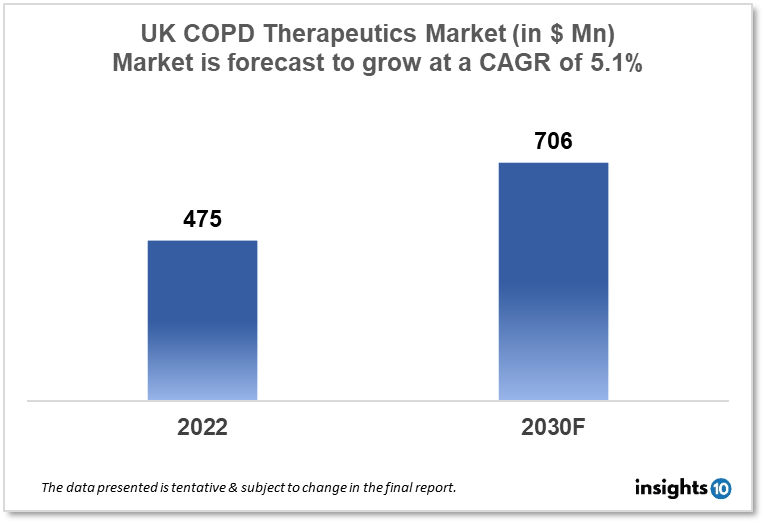

The UK Chronic Obstructive Pulmonary Disease (COPD) therapeutics market was valued at $475 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 5.1% from 2022-30 and will reach $706 Mn in 2030. One of the main reasons propelling the growth of this market is the increased prevalence rate and government initiative. The market is segmented by Drug class and By distribution channel. Some key players in this market are Verona Pharma, GlaxoSmithKline, AstraZeneca, Chiesi, Boehringer Ingelheim, Teva Pharmaceuticals, Novartis, Pfizer, Merck, and others.

Buy Now

UK Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Executive Summary

The UK Chronic Obstructive Pulmonary Disease (COPD) therapeutics market was valued at $475 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 5.1% from 2022-30 and will reach $706 Mn in 2030. Unlike many other common chronic diseases, the prevalence of COPD has not decreased in recent years". NHS Data shows that in 2021, roughly 1.17 Mn people in England had been diagnosed with COPD, which is around 1.9% of the population.

Chronic obstructive pulmonary disease (COPD) is a widespread respiratory disease that affects Mns of individuals worldwide, including millions in the United Kingdom. The COPD therapeutics market in the United Kingdom is a substantial component of the country's healthcare business, and it is likely to grow further in the future years. This increase can be ascribed to a number of variables, including an increase in the prevalence of COPD, technological developments, and the introduction of novel treatments. Bronchodilators, corticosteroids, and combination therapy containing both are the most widely recommended COPD medications in the United Kingdom. These medications are intended to assist control of COPD symptoms such as shortness of breath, coughing, and wheezing.

Market Dynamics

Market Growth Drivers

The prevalence of COPD is expected to increase due to factors such as an aging population, air pollution, and smoking. According to a report by the British Lung Foundation, around 1.2 Mn people in the UK have been diagnosed with COPD, and it is estimated that there may be an additional 2 Mn undiagnosed cases. This presents a significant opportunity for growth in the COPD therapeutics market. The development of new technologies, such as inhalers with improved drug delivery systems and digital health solutions, is expected to drive growth in the UK COPD therapeutics market. For example, the use of smart inhalers that track medication usage and provide real-time feedback to patients and healthcare providers is expected to improve treatment outcomes and patient adherence. The introduction of new therapeutics, such as biologics and gene therapies, is expected to further drive growth in the UK COPD therapeutics market. For example, AstraZeneca's benralizumab, a biologic therapy that targets eosinophilic inflammation, has shown promising results in clinical trials and is expected to be approved for use in the UK soon.

Market Restraints

The market for COPD therapeutics is highly competitive, with several major pharmaceutical companies operating in the UK. As new therapeutics are introduced, companies must compete for market share, which can lead to pricing pressures and decreased profitability. The high cost of COPD therapeutics is a major concern for patients and healthcare providers, particularly as healthcare budgets are constrained. In the UK, the National Institute for Health and Care Excellence (NICE) evaluates the cost-effectiveness of new therapeutics and may restrict access to those that are deemed too expensive. The regulatory environment for COPD therapeutics is complex, and obtaining approval for new drugs can be a lengthy and expensive process. Additionally, regulatory requirements may vary across different countries, which can add to the complexity of bringing new therapeutics to market.

Competitive Landscape

Key Players

- Verona Pharma

- GlaxoSmithKline

- AstraZeneca

- Chiesi

- Boehringer Ingelheim

- Teva Pharmaceuticals

- Novartis

- Pfizer

- Merck

Recent Updates

- In Jun 2021, Glenmark Pharma announced the launch of Tiotropium Bromide Dry Powder Inhaler, used in the treatment of chronic obstructive pulmonary disease (COPD), in the UK

- In Aug 2021, Lupin Ltd, a global pharmaceutical company, stated on Friday that its UK subsidiary, Lupin Healthcare (UK) Limited, has acquired permission from the Medicines and Healthcare Products Regulatory Agency (MHRA) to commercialize a generic version of Spiriva. This will aid in the treatment of chronic obstructive pulmonary disease (COPD)

Healthcare Policies and Regulatory Landscape

The healthcare policy and regulatory framework in the UK are designed to ensure that patients receive safe, effective, and high-quality care. The Department of Health and Social Care is responsible for setting healthcare policies in the UK. This includes the development of policies related to the prevention, treatment, and management of diseases such as COPD.

The Medicines and Healthcare Products Regulatory Agency (MHRA) is responsible for regulating medicines and medical devices in the UK. The agency oversees the approval and licensing of new drugs and medical devices, as well as their safety and efficacy.

The National Institute for Health and Care Excellence (NICE) is responsible for evaluating the cost-effectiveness of new drugs and treatments in the UK. The agency provides guidance to healthcare providers and commissioners on which treatments should be made available on the National Health Service (NHS).

The Care Quality Commission (CQC) is responsible for monitoring and inspecting healthcare providers in the UK. The agency ensures that providers meet certain standards of safety and quality, and takes enforcement action against those that do not.

In addition to these regulatory bodies, there are several policies and initiatives in place to improve healthcare outcomes in the UK. For example, the NHS Long Term Plan, which was published in 2019, outlines a range of measures aimed at improving the prevention and treatment of diseases such as COPD. These measures include increased funding for respiratory services, the development of new models of care, and the use of digital technologies to improve patient outcomes.

Reimbursement Scenario

In the UK, healthcare services are provided by the National Health Service (NHS), which is funded by taxes and provides healthcare services to all UK residents free of charge at the point of use. The NHS provides a range of services, including primary care, hospital care, and specialist care. The reimbursement scenario for COPD therapeutics in the UK is complex, as the cost of drugs is often shared between the NHS, patients, and pharmaceutical companies. The cost of drugs is determined by a variety of factors, including the cost of manufacturing, research and development costs, and the cost of distribution.

The National Institute for Health and Care Excellence (NICE) plays a key role in determining which drugs and treatments are available on the NHS. NICE evaluates the cost-effectiveness of new drugs and treatments and makes recommendations to the NHS on which treatments should be funded. These recommendations consider the clinical effectiveness of the drug, as well as its cost-effectiveness compared to other treatments.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UK Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Segmentation

By Drug Class

Bronchodilators: Bronchodilators are medications that help to relax the muscles around the airways, making it easier to breathe. These can be further classified as short-acting or long-acting bronchodilators.

Corticosteroids: Corticosteroids are anti-inflammatory medications that can help reduce swelling and inflammation in the airways. These can be used alone or in combination with bronchodilators.

Combination therapies: Combination therapies combine bronchodilators and corticosteroids in a single medication. These are often used for patients with more severe COPD.

Phosphodiesterase-4 inhibitors: Phosphodiesterase-4 inhibitors are medications that help to reduce inflammation and improve airflow in the lungs.

Others: Other medications that may be used to treat COPD include mucolytics, oxygen therapy, and vaccines for influenza and pneumococcal disease.

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.