UK Cholesterol Therapeutics Market Analysis

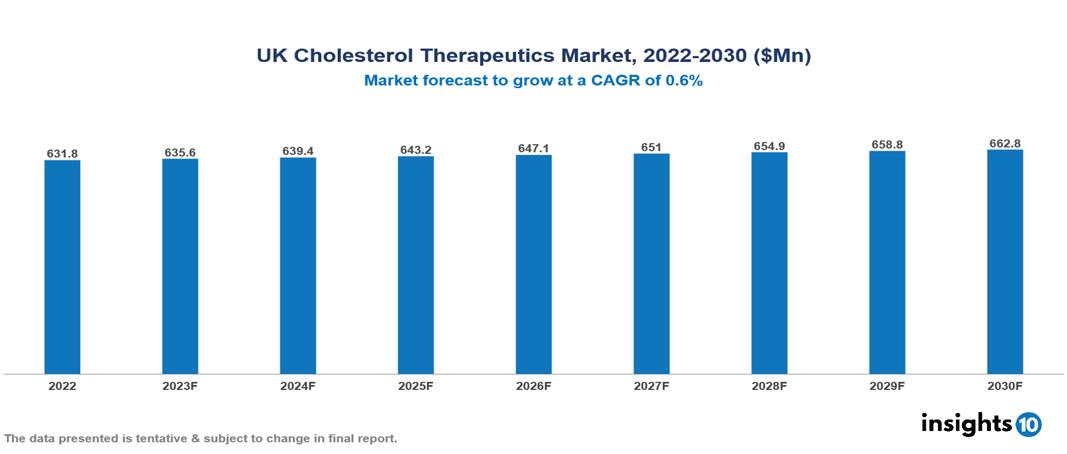

The UK Cholesterol Therapeutics Market is anticipated to experience a growth from $631.8 Mn in 2022 to $662.8 Mn by 2030, with a CAGR of 0.6% during the forecast period of 2022-2030. The increasing prevalence of high cholesterol, alignment with NHS policies emphasizing cost-effectiveness, and the demand for innovative solutions collectively act as drivers propelling the growth of the UK market. The UK Cholesterol Therapeutics Market encompasses various players across different segments such as Pfizer, Merck, Roche, Novartis, Amgen, AstraZeneca, Hikma Pharmaceuticals, Wockhardt, Alvotec, Omega Pharma, etc., among various others.

Buy Now

UK Cholesterol Therapeutics Market Analysis Executive Summary

The UK Cholesterol Therapeutics Market is anticipated to experience a growth from $631.8 Mn in 2022 to $662.8 Mn by 2030, with a CAGR of 0.6 % during the forecast period of 2022-2030.

Cholesterol, a lipid substance with a fatty and waxy nature, plays a crucial role in forming cell membranes and facilitating the production of certain hormones. While cholesterol is essential for various fundamental biological functions, excessive levels can pose significant health risks. Elevated cholesterol concentrations contribute to the accumulation of plaque in arteries, leading to a condition known as atherosclerosis, which in turn increases the likelihood of cardiovascular complications such as heart attacks and strokes. Numerous medications are available to manage cholesterol levels, with statins being a prominent example that works by reducing cholesterol synthesis in the liver. Other drugs, like bile acid sequestrants, operate by binding to bile acids, thereby limiting cholesterol absorption. PCSK9 inhibitors and fibrates target different aspects of cholesterol metabolism. These pharmaceutical interventions are often complemented by lifestyle changes such as adopting a healthy diet and engaging in regular physical exercise. Ongoing research in cholesterol control is focused on developing novel drugs and gaining deeper insights into the genetic factors influencing cholesterol regulation. Advances in precision medicine aim to tailor interventions based on an individual's genetic profile, enhancing the specificity and effectiveness of treatments.

In the UK, familial hypercholesterolemia (FH) affects an estimated 16.4 out of every 10,000 people, elevating the risk of early cardiovascular events. The prevalence of primary hypercholesterolemia and mixed dyslipidemia (PH/MD) has increased over the past five years. Many PH/MD patients, at high cardiovascular risk, lack adequate cholesterol-lowering treatment, potentially leading to more cardiovascular events with significant clinical and economic impacts.

The increasing prevalence of high cholesterol, alignment with NHS policies emphasizing cost-effectiveness, and the demand for innovative solutions collectively act as drivers propelling the growth of the UK Cholesterol Therapeutics Market.

In the UK, Pfizer leads with a 20-25% market share, driven by Lipitor's success. Hikma, a significant player in generics, holds a 5-10% market share. The market is segmented by medication types like statins and PCSK9 inhibitors, each with different major companies.

Market Dynamics

Market Growth Drivers

Sociocultural factors leading to increased prevalence: The escalating prevalence of high cholesterol, attributed to factors such as an aging population, rising obesity rates, and cultural and dietary habits, serves as a significant driver for the growth of the cholesterol therapeutics market in the UK. As individuals age, there is a natural tendency for cholesterol levels to increase, contributing to a higher incidence of cardiovascular disorders. The prevalence of obesity, influenced by lifestyle and dietary choices, further amplifies the risk of elevated cholesterol levels. This demographic shift and lifestyle-related factors create a substantial patient pool in need of cholesterol management, thereby driving the demand for cholesterol therapeutics.

Favouring National Health Service (NHS) policies: NHS also plays a pivotal role in propelling the growth of the cholesterol therapeutics market in the UK. The reimbursement mechanisms and pricing negotiations implemented by the NHS significantly influence the market access and adoption of specific cholesterol-lowering therapies. The emphasis on cost-effectiveness within NHS policies directs attention towards medications that not only demonstrate positive impacts on patient outcomes but also offer economic benefits by reducing the burden of cardiovascular diseases. This focus aligns with the goal of optimizing healthcare resources and encouraging the development and uptake of cholesterol therapeutics that prove to be both clinically effective and economically viable.

Growing demand for novel therapies: This is another driving force behind the expansion of the cholesterol therapeutics market in the UK. As awareness of cholesterol-related health risks increases and patient expectations evolve, there is a heightened demand for innovative and more effective therapeutic options. This demand is likely to stimulate research and development activities within the pharmaceutical industry, leading to the introduction of advanced cholesterol-lowering drugs. The pursuit of novel therapies aligns with the evolving landscape of healthcare, promoting continuous advancements in cholesterol management and creating opportunities for market growth in the UK.

Market Restraints

Regulatory hurdles: The stringent regulatory environment in the UK, overseen by the Medicines and Healthcare Products Regulatory Agency (MHRA), imposes rigorous criteria for drug approval. This includes demanding processes like extensive clinical trials and the presentation of compelling evidence regarding safety and efficacy. Navigating through this intricate regulatory landscape can be both time-consuming and costly, especially for smaller companies. This may result in potential delays in market entry or, in some cases, pose obstacles that hinder entry altogether.

Intense competition: The cholesterol therapeutics market is marked by intense competition, with well-established players holding a dominant position. These key industry participants boast strong brand recognition, diverse product portfolios, and well-established distribution channels. For new entrants, breaking into this competitive space poses a considerable challenge. Convincing healthcare professionals and patients to transition to their therapies becomes a substantial hurdle that requires strategic and effective approaches.

Patient non-adherence: A notable challenge in the cholesterol therapeutics market is the issue of limited patient adherence to long-term treatment regimens, particularly for chronic conditions like high cholesterol. Non-adherence can significantly impact the effectiveness of treatments and hinder overall market growth. New entrants must carefully consider and implement strategies aimed at improving patient adherence.

Healthcare Policies and Regulatory Landscape

The commitment of the United Kingdom to delivering affordable and high-quality healthcare has significantly shaped its healthcare policy. At the forefront of this effort is the National Health Service (NHS), which offers comprehensive healthcare services, largely free of charge. Key priorities in healthcare policy include a strong emphasis on preventive care, public health initiatives, and ensuring equitable access to medical services. A crucial institution responsible for upholding these regulations is the Medicines and Healthcare Products Regulatory Agency (MHRA). Serving as the UK's regulatory authority, the MHRA plays a vital role in safeguarding the quality, safety, and effectiveness of pharmaceuticals, medical devices, and blood components. Its responsibilities encompass the evaluation and approval of these products, continuous monitoring of their safety post-approval, and contributing to the overall healthcare system by implementing stringent controls and surveillance. Aligned with the broader objectives of UK healthcare policy, the MHRA's function is indispensable in maintaining the effectiveness and integrity of the healthcare system, thus safeguarding public health.

Competitive Landscape

Key Players:

- Pfizer

- Merck

- Roche

- Novartis

- Amgen

- AstraZeneca

- Hikma Pharmaceuticals

- Wockhardt

- Alvotec

- Omega Pharma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UK Cholesterol Therapeutics Market Segmentation

By Indication

- Hypercholesterolemia

- Hyperlipidaemia

- Cardiovascular Diseases

- Others

By Drug Class

- Statins

- Bile Acid Sequestrants

- Lipoprotein Lipase Activators

- Fibrates

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End User

- Hospitals

- Speciality Clinics

- Homecare

- Academics & Research Centers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.