UK Cancer Induced Bone Diseases Therapeutics Market

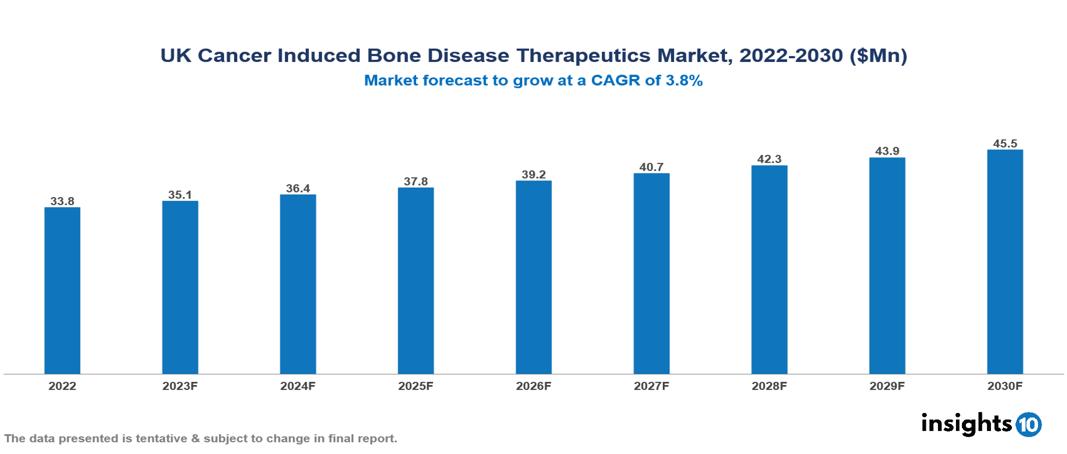

UK Cancer Induced Bone Disease Therapeutics Market valued at $34 Mn in 2022, projected to reach $46 Mn by 2030 with a 3.8% CAGR. The key drivers of this industry include the rising incidence of cancers, a favorable regulatory environment, and technological advancements. The industry is primarily dominated by players such as Advaxis, Takeda, Gradalis, Johnson & Johnson, Hikma, Cellectar, and Amgen among others.

Buy Now

UK Cancer Induced Bone Diseases Therapeutics Market Analysis

UK Cancer Induced Bone Disease Therapeutics Market valued at $34 Mn in 2022, projected to reach $46 Mn by 2030 with a 3.8% CAGR.

Cancer-induced bone diseases encompass conditions where cancer cells metastasize and impact the bones, resulting in complications such as bone destruction, fractures, and pain. Common causes involve the spread of cancer from primary tumors to the bones, frequently observed in breast, prostate, lung cancers, and multiple myeloma. Symptoms often manifest as localized pain, bone fractures, and reduced mobility, significantly affecting the overall quality of life for those affected. The current approach to treating cancer-induced bone diseases involves a multi-disciplinary strategy. Medical interventions include chemotherapy, radiation therapy, and targeted therapies to address the underlying cancer. Additionally, the use of bisphosphonates and other bone-targeted agents may be employed to strengthen bones and alleviate pain. Prominent pharmaceutical companies, including Amgen, Novartis, and Eli Lilly, play a significant role in developing and producing medications. These companies have introduced drugs such as denosumab and bisphosphonates to manage bone complications in cancer patients.

In the UK, there is a growing incidence of cancers like breast, prostate, and lung cancer leading to bone metastases, with a 2.4% increase in diagnoses. The market is being driven by factors such as the upward trend in cancer incidence, advancements in technology, and a favorable regulatory environment. However, conditions such as limited reimbursement and the dominance of generic medications in the country limit the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Increasing cancer incidence: The UK is struggling with a growing cancer burden, anticipating an annual 2.4% rise in diagnoses until 2040. This increase directly correlates to a higher number of individuals at risk of experiencing cancer-induced bone diseases. Enhanced cancer survival, attributed to advancements in treatment, is contributing to improved survival rates. However, this progress also raises the likelihood of bone complications since patients are living longer with the disease.

Favorable regulatory landscape: The Medicines and Healthcare Products Regulatory Agency (MHRA) in the UK provides accelerated approval routes for groundbreaking drugs addressing unmet medical needs, potentially expediting the introduction of new treatments for patients. Early access programs, such as the Early Access to Medicines Scheme (EAMS), enable individuals with severe or life-threatening conditions to obtain access to promising new medications before obtaining full market approval. This not only grants patients the opportunity to benefit from potential breakthroughs but also generates valuable data that could contribute to quicker market acceptance.

Technological advancements: The advancement of targeted therapies with precise mechanisms of action against cancer cells and bone-related pathways shows potential for increased effectiveness and decreased side effects. Progress in nanotechnology and drug delivery systems allows for the targeted delivery of therapeutics to bone lesions, potentially improving treatment efficacy and minimizing systemic exposure. A promising pipeline of investigational drugs, including monoclonal antibodies, bisphosphonates, and radiopharmaceuticals, provides hope for future treatment options with enhanced effectiveness and safety profiles.

Market Restraints

Limited reimbursement: Securing reimbursement from the National Health Service (NHS) for new therapeutics aimed at CIBD can be challenging. Rigorous assessments of cost-effectiveness and prolonged negotiations introduce uncertainty for manufacturers, potentially restricting the market acceptance of promising yet costly drugs.

The dominance of generic medications: Existing treatments for cancer-induced bone diseases (CIBD) frequently have generic or biosimilar counterparts, leading to reduced prices and putting pressure on profit margins for innovative therapies. This trend can discourage investments in the development of new drugs for CIBD patients.

Healthcare Policies and Regulatory Landscape

In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) serves as the principal regulatory body overseeing pharmaceuticals, drugs, and medical products. As an executive agency of the Department of Health and Social Care, the MHRA is responsible for ensuring the safety, quality, and efficacy of medicines and medical devices. Collaborating with other international regulatory agencies, the MHRA plays a crucial role in maintaining a robust regulatory framework for healthcare products in the UK.

The process of obtaining a license for pharmaceuticals and medical products in the UK involves a thorough evaluation by the MHRA. Applicants are required to submit detailed documentation, including data from preclinical and clinical studies, manufacturing processes, and quality control measures. The MHRA conducts a rigorous review to assess compliance with regulatory standards and ensure that the products meet the necessary criteria for safety, quality, and efficacy.

Competitive Landscape

Key Players

- Amgen

- Bayer

- Novartis

- Johnson & Johnson

- Takeda Pharmaceutical

- Gradalis

- Hikma Pharmaceutical

- Pfizer

- Advaxis

- Cellectar Biosciences

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UK Cancer Induced Bone Diseases Therapeutics Market Segmentation

By Cancer Type

- Breast cancer

- Prostate cancer

- Lung cancer

- Others

By Treatment Type

- Bisphosphonates

- Denosumab

- Radiation Therapy

- Pain Management Medications

- Surgical Intervention

- Targeted Therapy

By Distribution channel

- Hospitals

- Pharmacies

- Oncology clinics

- Others

By Stage of Treatment

- Early stage CIBD

- Advanced stage CIBD

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.