UK Cancer Immunotherapy Market Analysis

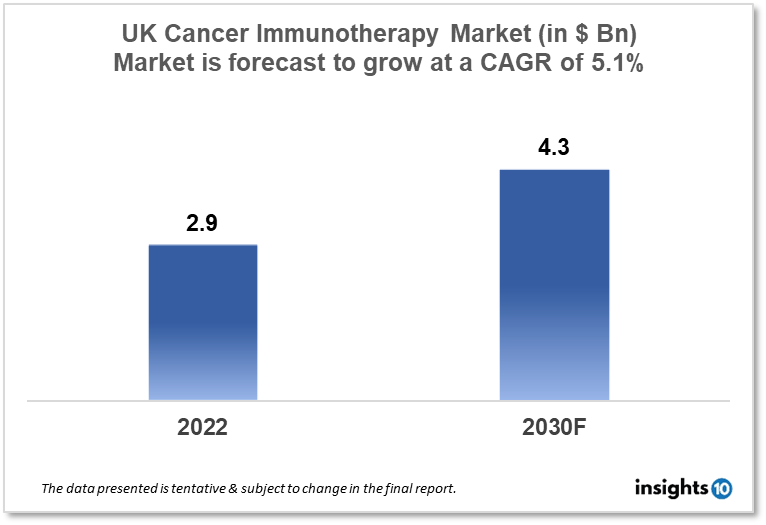

The UK cancer immunotherapy market is expected to grow from $2.9 Bn in 2022 to $4.3 Bn in 2030 with a CAGR of 5.1% for the forecasted year 2022-2030. The new scientific developments in cancer immunotherapies and growing awareness about immunotherapy options in the UK are responsible for the expansion of the market. The UK cancer immunotherapy market is segmented by type, application, and end user. Ervaxx, Immunocore, and Amgen are the major players in the UK cancer immunotherapy market.

Buy Now

UK Cancer Immunotherapy Market Executive Analysis

The UK cancer immunotherapy market is at around $2.9 Bn in 2022 and is projected to reach $4.3 Bn in 2030, exhibiting a CAGR of 5.1% during the forecast period. NHS England receives the vast majority of The Department of Health and Social Care (DHSC) money. The National Health Service (NHS) receives $176 Bn (85%) of the funding for this fiscal year 2023 to 24. Additionally, funding is given to the Office for Health Improvement and Disparities, UK Health Security Agency, and Health Education England. The capital and income budgets for the NHS will not change from what was previewed in the previous autumn. Compared to commitments made in the Autumn 2022 Statement, there is a $0.3 Bn increase in health capital investment for 2023–24, although this is due to a budget underspend in 2022–23 and does not reflect an overall rise.

Just over 25% of all deaths in England occur from cancer on an annual basis. 134,802 persons in England passed away from cancer in 2021. Since 2001, more deaths have occurred—a 6% rise. However, the rate of cancer fatalities has decreased when taking into consideration the fact that England's population is ageing and rising at the same time. Between 2015 and 2019, more than 95% of patients with breast, prostate, or skin cancer survived for at least a year after their diagnosis. Less than 50% of those with pancreatic, lung, liver, oesophagal, lung, and stomach cancer lived for a full year after their diagnosis.

The power of the immune system is used by immunotherapy, a type of cancer treatment, to prevent, manage, and eradicate cancer. Immunology has already produced significant advances in the treatment of a number of diseases, from the preventive vaccine for cervical and liver cancer to the first medication ever demonstrated to lengthen the lives of patients with metastatic melanoma. But because every form of cancer is different, immunology and immunotherapy affect every malignancy in a different way. Keytruda is an immunotherapy that aids in the battle against cancer by stimulating the immune system. Keytruda can alter the way your immune system functions by causing it to attack healthy organs and tissues throughout your body. Sometimes, these issues might develop into grave or fatal issues and cause death. A form of immunotherapy called Keytruda prevents cancer cells from hiding by blocking the PD-1 pathway. Keytruda enables the immune system to identify and combat cancer cells, which is what it was designed to do.

Market Dynamics

Market Growth Drivers

Cancer is becoming more common over the world, particularly in the United Kingdom. As a result, there is now a larger demand for efficient cancer therapies, such as immunotherapies. Recent years have seen tremendous advancements in the field of cancer immunotherapy, including the creation of novel medications and treatments. These scientific developments have increased the efficiency of cancer immunotherapy and broadened the spectrum of patient treatment options. Both the public and corporate sectors in the UK have made significant investments in the study and advancement of cancer immunotherapy. New medications and therapies that are less harmful and more successful than conventional cancer treatments have been developed as a result of this. Patients and medical professionals are becoming more aware of the potential advantages of cancer immunotherapy. The UK cancer immunotherapy market has grown as a result of the rise in demand for these treatments.

Market Restraints

Cancer immunotherapy medications and therapies can be costly, which may prevent some patients from accessing them. Due to cost concerns, consumers and healthcare professionals may be reluctant to accept these therapies, which could be a barrier to the UK cancer immunotherapy market's expansion. While cancer immunotherapy has occasionally produced encouraging results, not all cancers or people may respond well to treatment. As a result, the market's growth may be constrained since patients and healthcare professionals may be reluctant to use therapies that are not very effective. Cancer immunotherapy is a potentially new kind of cancer treatment, but patients have other options as well. Immunotherapy may continue to face competition from more conventional cancer therapies including chemotherapy and radiation therapy.

Competitive Landscape

Key Players

- Adaptimmune (GBR)- Enhance T-cell treatments are created by Adaptimmune to help the immune system recognize and target cancer cells. Its SPEAR T cell technique is intriguing since it can target different solid tumours.

- Autolus Therapeutics (GBR)- Chimeric Antigen Receptors (CARs) and T Cell Receptors (TCRs) are used by Autolus Therapeutics to rewire T cells so they can identify and then destroy tumour cells.

- Crescendo Biologics (GBR)- A bispecific T-cell engager that targets the prostate-specific membrane antigen is the leading proprietary candidate from Crescendo Biologics. Within the tumour microenvironment, it can specifically activate T cells that are unique to the tumour. It is now moving closer to clinical development.

- Ervaxx (GBR)- Ervaxx recently made headlines when it acquired the rights for an innovative new universal cancer immunotherapy that is still in the preclinical stage.

- Immunocore (GBR)- The company's ImmTAC (immune mobilizing monoclonal TCRs against cancer) technology is based on a new class of bi-specific biologics that can cause cancer cells to mount a particular T cell response

- Amgen

- Bayer

- AstraZeneca

- Bristol-Myers Squibb

- F. Hoffmann-La Roche

- Pfizer

- Eli Lily

Healthcare Policies and Regulatory Landscape

The National Health Service (NHS) is primarily in charge of overseeing cancer health insurance and payment regulations in the UK. For qualified patients, the NHS covers cancer therapies, including immunotherapy. The effectiveness and financial efficiency of new cancer treatments are regularly evaluated by the NHS. Treatment may be authorized for coverage by the NHS if it is determined to be both efficient and affordable. Patients in the UK may be qualified for financial assistance programs or clinical trials in addition to insurance coverage, giving them access to cancer therapies like immunotherapy. These initiatives and trials might be supported by public bodies like the NHS or private businesses. The NHS uses a system of fixed prices for medications and medical services when it comes to reimbursement policies. Drug costs are negotiated between pharmaceutical firms and the NHS and are then set for a specific amount of time. Private insurance companies could have their own guidelines for cancer treatment reimbursement.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cancer Immunotherapy Segmentation

By Type (Revenue, USD Billion):

- Monoclonal Antibodies

- Cancer Vaccines

- Checkpoint Inhibitors

- Immunomodulators

- PD-1/PD-L1

- CTLA-4

By Application (Revenue, USD Billion):

- Lung Cancer

- Breast Cancer

- Head and Neck Cancer

- Prostate Cancer

- Colorectal Cancer

- Melanoma

- Others

By End User (Revenue, USD Billion):

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Cancer Research Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Ervaxx, Immunocore, and Amgen are the major players in the UK cancer immunotherapy market.

The UK cancer immunotherapy market is expected to grow from $2.9 Bn in 2022 to $4.3 Bn in 2030 with a CAGR of 5.1% for the forecasted year 2022-2030.

The UK cancer immunotherapy market is segmented by type, application, and end user.