UK Blood Disorder Therapeutics Market

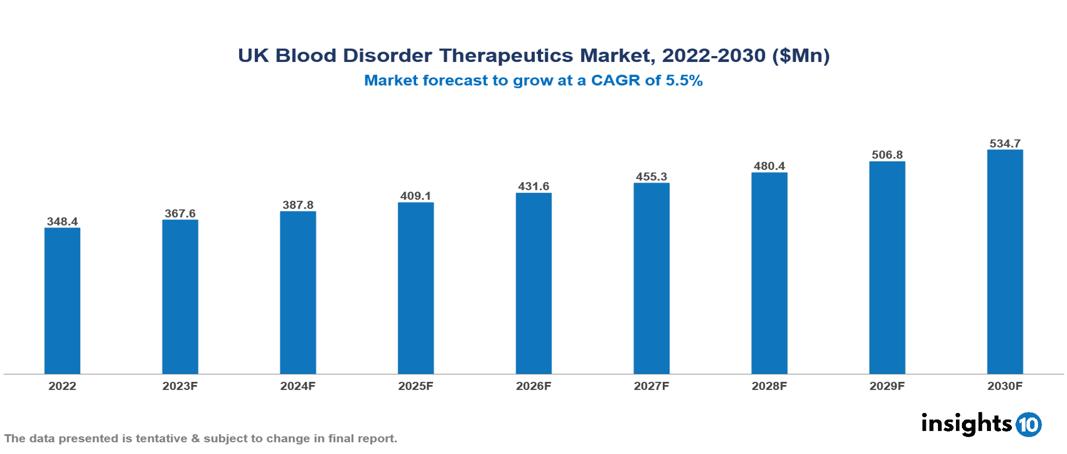

UK Blood Disorder Therapeutics Market valued at $348 Mn in 2022, projected to reach $535 Mn by 2030 with a 5.5% CAGR. Increased disease incidence brought on by changes in demographics and lifestyle, government support for healthcare accessibility, and the significant role patient advocacy groups play in spreading awareness and developing cutting-edge therapies are the main drivers of this industry. The UK Blood Disorder Therapeutics Market encompasses various players across different segments, including Takeda, Sanofi, Novo Nordisk, CSL Ltd, Bayer, Celgene, Global Blood Therapeutics, Novartis, Emmaus Life Sciences, Bluebird Bio, etc, among various others.

Buy Now

UK Blood Disorder Therapeutics Market Executive Summary

UK Blood Disorder Therapeutics Market valued at $348 Mn in 2022, projected to reach $535 Mn by 2030 with a 5.5% CAGR.

Blood disorders are a broad category of illnesses that negatively impact the normal operation of blood components, including plasma, red blood cells, and white blood cells. These conditions frequently lead to a decrease in the number of blood cells, proteins, platelets, or vital nutrients, which compromises their functions. Genetic mutations are the cause of many blood problems, with a hereditary propensity shown in a considerable proportion of cases. Treatment options for blood problems are multifaceted and vary from simple dietary changes to more involved medical measures. Intrusive treatment methods are required in some cases. For example, certain blood problems are treated with chemotherapy and radiation treatment, which target and eliminate aberrant cells. Furthermore, more recent approaches such as targeted drug treatment improve chemotherapy outcomes or target specific components of cancer cells that conventional medications could miss. Another option is stem cell transplants, especially when more direct intervention is required to treat certain blood-related problems.

In the UK, sickle cell disease affects 1/2,000 live births; it is more common in cities and towns than in rural regions. Myeloproliferative neoplasms are a kind of blood cancer affecting about 4,180 people in the UK annually. About 24,000 people in the UK suffer from other hereditary bleeding diseases, such as Von Willebrand disease, platelet abnormalities, and hemophilia A and B, which are uncommon in the general population.

Increased disease incidence brought on by changes in demographics and lifestyle, government support for healthcare accessibility, and the significant role patient advocacy groups play in spreading awareness and developing cutting-edge therapies are the main drivers of this industry.

Large pharmaceutical corporations with established product portfolios and a variety of offers, such as Takeda, Sanofi, and Novo Nordisk, probably hold a sizable portion of the market. With its top-selling drug Oxbryta, Global Blood Therapeutics (acquired by Pfizer) is a formidable competitor in the sickle cell disease industry. Though they may have modest market shares, up-and-coming companies like Hansa Biosciences and MeIvox Therapeutics have the potential to develop significantly in their targeted sectors.

Market Dynamics

Market Growth Drivers

Increased Prevalence Owing to Lifestyle and Demographic Factors: As the UK population ages, blood illnesses including leukemia and anemia become more common, which increases the demand for treatments. The growth in blood-related problems such as sickle cell disease and thrombosis is a result of rising obesity and sedentary behavior rates, underscoring the need for efficient therapies. Better diagnostic tools make it possible to identify blood diseases early and treat them quickly, which supports the industry.

Support from the Government: New blood disease therapies have a solid market because of the UK National Health Service's unwavering commitment to providing all people with access to cutting-edge treatments. Increased government funding for blood disorder research, particularly focusing on rare diseases, stimulates innovation and expands the market. Long-term market stability is influenced by government initiatives that help people with blood disorders and work to improve diagnosis and knowledge of the condition.

Patient Advocacy Influence: Strong patient advocacy organizations devoted to different blood diseases are essential in raising public awareness and increasing the demand for treatment options. These organizations actively assist the development of novel therapies by funding research and development, which directly contributes to market expansion. Patient advocacy groups actively change the market landscape, guaranteeing a favorable environment for blood disease treatments by influencing regulations that increase access to treatment.

Market Restraints

Exorbitant Treatment Costs: The high cost of novel gene therapies and cutting-edge treatments for uncommon blood diseases may prevent patients from receiving them or put pressure on NHS finances. Numerous blood illnesses need continuous care with costly drugs, placing a significant financial strain on both individuals and healthcare systems. Innovative therapeutics may become less accessible to patients due to convoluted payment processes and lengthy approval processes for new treatments.

Restricted Access to Expert Care: Patients living in distant parts of the UK may not have easy access to the best care possible due to the unequal availability of expert hematologists and treatment centers. Staffing shortages are a persistent concern for the UK healthcare system that may affect the prompt detection and treatment of blood diseases. Furthermore, inadequate awareness of blood problems might result in missed chances for early intervention and delayed diagnosis, especially in underprivileged groups.

Ethical and Regulatory Concerns: Although gene therapy for blood diseases shows promise, there are ethical and long-term safety questions that might affect research and approval procedures. Market access and acceptance might be delayed due to worries about the high cost of new medicines and how they will affect the NHS's viability. Patients may experience delays in receiving new medications due to stringent regulatory processes, especially in the case of uncommon blood diseases.

Notable Recent Updates

- November 2023, The MHRA of the UK approved Casgevy, the first drug to be licensed that uses the gene-editing technology CRISPR, the inventors of which received the Nobel Prize in 2020.

- January 2022, Researchers from the University of York in the UK were given a $3.1 Mn grant by the charity Bill & Melinda Gates Foundation to advance research on stem cell gene therapy to treat sickle cell disease.

Healthcare Policies and Regulatory Landscape

The UK's dedication to providing its population with affordable, first-rate healthcare has influenced its healthcare policy. A major player is the National Health Service (NHS), which provides extensive and mostly free healthcare services. Preventive care, public health campaigns, and fair access to medical care are the main focuses of healthcare policy. To maintain these regulations, the Medicines and Healthcare Products Regulatory Agency (MHRA) is an essential organization. The MHRA is the UK's regulatory body that protects the quality, safety, and efficacy of pharmaceuticals, medical equipment, and blood components. It evaluates and approves their use, keeps an eye on their safety after approval, and adds to the healthcare system as a whole by protecting public health via strict control and monitoring. In line with the more general objectives of UK healthcare policy, the MHRA's function is essential to preserving the efficacy and integrity of the healthcare system.

Competitive Landscape

Key Players:

- Takeda

- Sanofi

- Novo Nordisk

- CSL Ltd

- Bayer

- Celgene

- Global Blood Therapeutics

- Novartis

- Emmaus Life Sciences

- Bluebird Bio

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UK Blood Disorder Therapeutics Market Segmentation

By Disorder:

- Anemia

- Hemophilia

- Leukemia

- Myeloma

- Lymphoma

- Rare blood disorders

By Product Type

- Plasma-derived therapeutics

- Recombinant therapeutics

- Gene therapy

- Other therapies

By End User

- Hospitals

- Specialty clinics

- Ambulatory care

- Home healthcare

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.