UK Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Analysis

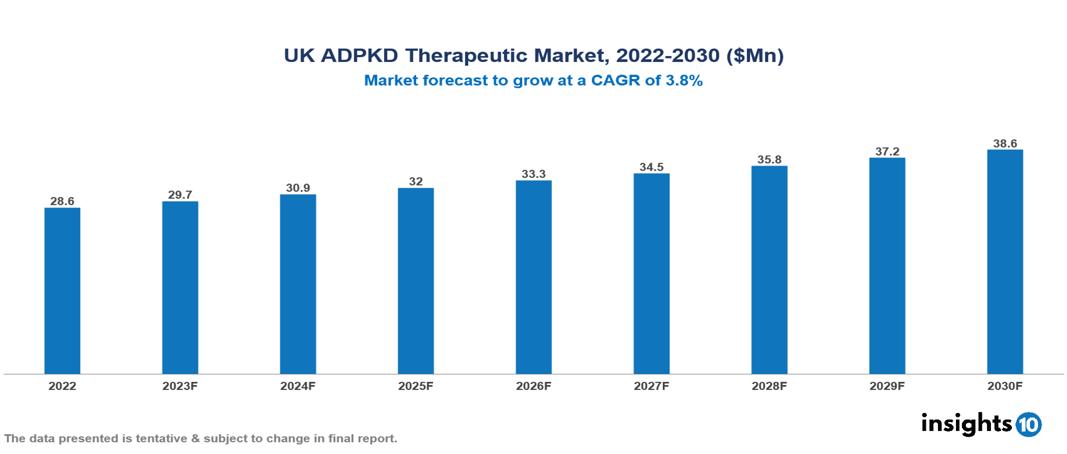

The UK Autosomal Dominant Polycystic Kidney Disease Therapeutics Market was valued at US $29 Mn in 2022 and is predicted to grow at (CAGR) of 3.8% from 2023 to 2030, to US $39 Mn by 2030. The key drivers of this industry include the upward trend in the prevalence of autosomal dominant polycystic kidney disease, unmet needs, government initiatives, and other factors. The industry is primarily dominated by players such as Otsuka, AceLink, Palladio, Reata, Xortx, Regulus, among others

Buy Now

UK Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Analysis

The UK Autosomal Dominant Polycystic Kidney Disease Therapeutics Market is at around US $29 Mn in 2022 and is projected to reach US $39 Mn in 2030, exhibiting a CAGR of 3.8% during the forecast period.

Autosomal dominant polycystic kidney disease (ADPKD) is a genetic condition that affects multiple organs and is caused by mutations in the PKD1 and PKD2 genes. This leads to the development of fluid-filled cysts in the kidneys, causing them to enlarge (renomegaly). In most cases, ADPKD progresses to kidney failure (ESKD). Common symptoms include pain, frequent infections, and fatigue. Although there is no cure for this rare disease, treatment focuses on preventing complications and managing symptoms. Tolvaptan (Jinarc) manufactured by Otsuka Pharmaceuticals, is the only approved drug for ADPKD, acting as a vasopressin blocker to slow cyst growth in some patients. Other treatment options include pain management, lifestyle modifications, and various medications to treat associated conditions such as high blood pressure, which can be managed using ACE inhibitors and angiotensin-2 receptor blockers (ARBs).

The prevalence of ADPKD is around 1/1,000–2,500 individuals in the UK. There is an expected increase in the prevalence of ADPKD in the UK due to advances in diagnostic modalities that reduce the chances of missed detections, a favourable regulatory landscape that allows prompt approval of novel therapeutics, and increased investment in curative and preventive research. The market is therefore driven by major factors like the increased prevalence of ADPKD, the unmet medical needs of the Hug patient pool, technological advancements promoting the development of approaches like gene therapy, and government initiatives in the industry. However, conditions such as high costs of treatment despite NHS coverage, health system disparities, and others hinder the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Surge in the prevalence of ADPKD: The UK National Health Service (NHS) has estimated that around 1 in every 1000 to 1 in every 2500 individuals lives with ADPKD. Kidney Research UK estimates that there are around 30,000 to 70,000 people in the UK with this condition. These numbers are anticipated to result in patients requiring advanced treatments, resulting in the growth of the market.

Unmet Medical Need: Owing to the huge patient pool, present treatments for ADPKD primarily centre on symptom management and delaying disease advancement, revealing a considerable gap in curative or more potent therapies. This gap fuels research and development endeavours, potentially culminating in a range of innovative medications and treatment strategies, fostering market expansion in the UK.

Government initiatives: The acknowledgment of ADPKD's impact on healthcare has prompted expanded government funding for research and awareness drives. Moreover, NHS efforts to enhance the management of chronic conditions contribute positively to the ADPKD market.

Favorable regulatory landscape: The MHRA in the UK employs a more streamlined and effective process for approving innovative drugs, potentially hastening the availability of advanced ADPKD treatments and enhancing market expansion.

Technological advancement: Continuing research activities, such as gene therapy explorations and personalized medicine, hold promise for future advancements and draw interest from pharmaceutical firms, stimulating the expansion of the market. Groups such as the PKD Charity UK influence health policies, creating an environment conducive to preventive measures and transforming the market landscape towards advanced therapeutics.

Market Restraints

High costs of treatment: Treatments for ADPKD, such as Tolvaptan, can be costly, causing a considerable financial burden on both patients and the healthcare system. Advanced treatments such as cell therapy or gene therapy and more recent targeted medications are often expensive, potentially surpassing the financial means of many patients and the limits of their healthcare coverage. The gatekeeping mechanism in the UK can further limit the affordability of these therapeutics.

Health system disparities: The inequitable distribution of specialized nephrologists and advanced diagnostic resources across various regions results in uneven patient care and treatment options. The UK NHS works on the basis of Capitation method of payer payments, which limits access of services, results in under-provision of services and can result in cream skimming or quality skimming. These disparities may contribute to unequal patient outcomes and impede market expansion in underserved areas, distorting the growth of the market in the UK.

Delayed and underdiagnosed: Insufficient awareness and restricted availability of advanced diagnostic resources result in underdiagnosis and delays in detecting ADPKD. This can result in missed chances for early intervention and potentially enhance the disease's advancement, affecting market expansion.

Healthcare Policies and Regulatory Landscape

The healthcare policy and regulatory framework in the United Kingdom involve several significant authorities and agencies. The primary entities responsible for healthcare regulations and licensing in the UK include the Medicines and Healthcare Products Regulatory Agency (MHRA) and the Care Quality Commission (CQC). The MHRA is responsible for regulating medicines, medical devices, and associated services, while the CQC oversees the quality and safety of care provided by healthcare providers in England.

Obtaining a license for healthcare products in the UK requires compliance with the regulations established by these authorities. Companies seeking registration and marketing authorization for pharmaceuticals and medical devices must obtain approval from the MHRA, which involves the submission of technical and scientific data to validate the safety, quality, and effectiveness of the products.

The healthcare policy and regulatory framework in the United Kingdom involve numerous authorities and agencies, with the MHRA and CQC playing pivotal roles in overseeing healthcare product regulations. Both the public and private healthcare sectors in the country offer diverse opportunities for companies engaged in the healthcare industry.

Competitive Landscape

Key Players

- Otsuka Pharmaceutical Co., Ltd

- Regulus Therapeutics

- Reata Pharmaceuticals

- Galapagos NV

- Exelixis Inc

- AceLink Therapeutics, Inc

- Sanofi

- Palladio Biosciences

- Xortx Therapeutics

- Pano Therapeutics

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UK Autosomal Dominant Polycystic Kidney Disease Therapeutics Market Segmentation

By Treatment

- Pain & Inflammation Treatment

- Kidney Stone Treatment

- Urinary Tract Infection Treatment

- Kidney Failure Treatment

By Route of Administration

- Oral

- Parenteral

- Others

By End User

- Hospitals

- Speciality Clinics

- Surgical Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.