UK ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Analysis

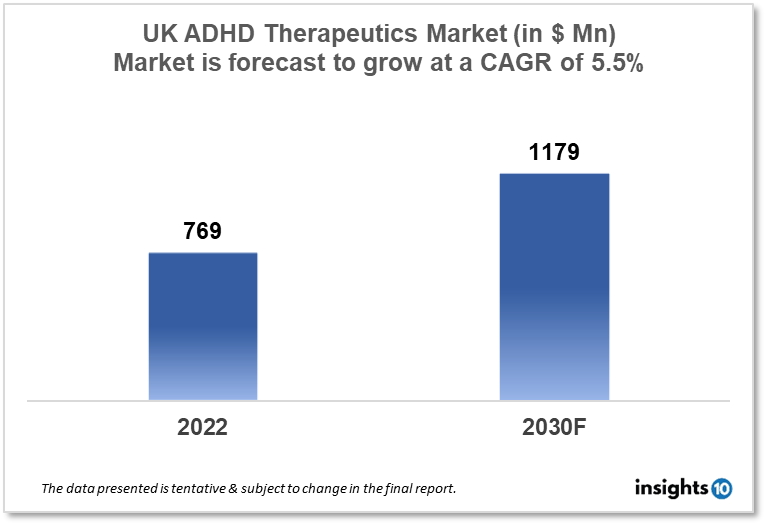

The UK Attention Deficit Hyperactivity Disorder (ADHD) therapeutics market is projected to grow from $769 Mn in 2022 to $1,179 Mn in 2030 with a CAGR of 5.5% for the year 2022-30 as there is an increase in awareness in the diagnosis and treatment for ADHD as well as availability of new therapeutic options in UK. The UK ADHD therapeutics market is segmented by drug, drug type, demographics, and by distribution channel. Colonis Pharma, Shire, and Advanz Pharmaceuticals are the key players in the market.

Buy Now

UK Attention Deficit Hyperactivity Disorder (ADHD) Therapeutics Market Executive Analysis

The UK Attention Deficit Hyperactivity Disorder (ADHD) therapeutics market size is at around $769 Mn in 2022 and is projected to reach $1,179 Mn in 2030, exhibiting a CAGR of 5.5% during the forecast period. The budgeted amount for health care expenditure in the UK in 2023 is $223.80 Bn. According to the 2023 Global Medical Trends Survey, the expense trend for healthcare benefits increased from 8.2% in 2021 to an overestimated 8.8% in 2022. Even in Europe, where expense increases have historically been much smaller, the trend is at record levels. The average growth rate in Europe is predicted to climb to 8.6% in 2023 from 8.0% in 2022. Private medical insurance costs in the UK are predicted to rise by 8.8% in 2023, which is considerably higher than this year's 6.8% increase but only slightly above the average for Europe. The healthcare benefit cost in the UK is projected to grow from 6.8% in 2022 to 8.8% in 2030 according to the Global medical trends survey.

ADHD is characterized by a persistent pattern of inattention and/or hyperactivity-impulsivity that hinders functioning or growth. Inattention, hyperactivity, and impulsivity are the three kinds of symptoms that people with ADHD frequently experience. The estimated range of frequency on a global scale is 2-7%, with an average of 5%. In a study of 10,438 kids in the UK between the ages of 5 and 15, it was discovered that 0.85% of females and 3.62% of boys had ADHD. ADHD changes with age, but the majority, approximately 65%, maintain some impairments in adulthood. Recent press in the UK has focused on the absence of distinct diagnostic pathways and support for ADHD, especially for women and girls. The prevalence of ADHD in adults is typically stated to range from 2.5% to 4%, though this estimate is thought to be conservative. Only 10 to 20 % of people with ADHD will receive treatment. Executive function issues are a daily struggle for people with ADHD, compromising their effectiveness at work. This is due to the fact that executive function deficiencies have a direct impact on a person's capacity to initiate and complete tasks, plan and prioritize work, remember crucial information, avoid distractions, and control impulsivity.

A combined approach of therapy and medication is frequently the most effective treatment for ADHD. Five different kinds of medications, including methylphenidate, lisdexamfetamine, dexamfetamine, atomoxetine, and guanfacine, are approved for the treatment of ADHD. The drug most frequently prescribed for ADHD is methylphenidate. It is a member of the class of drugs known as stimulants, which increase brain activity, especially in regions involved in attention and behavior control. Methylphenidate may be prescribed to adults, adolescents, and kids older than five who suffer from ADHD.

There are several stimulants and one non-stimulant among the medications approved for ADHD in the UK. The first medications that are typically recommended are the stimulant methylphenidate and, on certain occasions, the more recent amphetamine-based drug lisdexamfetamine (Elvanse). To find the ideal dosage, the medication's dose may need to be adjusted frequently in the beginning (titrated), and regular side-effect monitoring is also required. Atomoxetine (Strattera), a medication that differs from stimulants in its mode of action and is approved to treat ADHD, is referred to as a non-stimulant medicine. Atomoxetine has the benefit of producing steady 24-hour symptom control if it works, which may mean fewer issues in the evening when the stimulants tend to wear off. However, atomoxetine takes some time to function, so more patience is needed than with stimulant medications.

Market Dynamics

Market Growth Drivers

In the UK, there has been an increase in the number of individuals seeking an assessment and treatment for ADHD. Media coverage, advocacy organizations, and educational efforts have all contributed to this rise in awareness.

Over the past few decades, the prevalence of ADHD has significantly increased in the UK. The prevalence of ADHD in adolescents aged 5 to 15 has risen, from 1.5% in 1999 to 5.2% in 2020, according to the NHS. The UK ADHD therapeutics market has expanded as a result of this increase in prevalence.

Recent years have seen substantial improvements in the management of ADHD, including the introduction of new medications and non-pharmacological interventions like Cognitive Behavioral Therapy (CBT). These developments have expanded the choices for managing ADHD, which has fueled the UK ADHD therapeutics market's expansion.

Market Restraints

Despite increased awareness, ADHD still carries a lot of stigma in the UK, which can make it challenging for patients to get a diagnosis and initiate therapy. By lowering the demand for ADHD treatments, can restrain the UK ADHD therapeutics market's expansion.

Despite the fact that most ADHD medications are regarded as safe and successful, there are still certain concerns about their possible side effects, especially in children. The decreased demand for ADHD medicines as a result of these concerns regarding safety may restrict the UK ADHD therapeutics market expansion.

While medication is still a crucial part of treating ADHD, non-pharmacological treatments like CBT and mindfulness-based therapies are becoming more and more competitive. Some patients might favor these interventions, which could restrain the market expansion of ADHD drugs in the UK.

Competitive Landscape

Key Players

- Shire (GBR)- The medication Elvanse for attention deficit hyperactivity disorder (ADHD) from Shire has been approved for use in the UK. The Medicines and Healthcare products Regulatory Agency (MHRA) has approved the single daily dose long-acting treatment, the first stimulant prescription drug to be introduced in Europe, for this behavioral psychiatric disorder that is believed to affect 3.62% of boys and 0.85% of girls in the UK between the ages of five and fifteen.

- Colonis Pharma (GBR)- Colonis Pharma has received approval from the UK's MHRA to treat sleep-onset insomnia in children and teenagers with ADHD.

- Pharmagona (GBR)

- Curium Pharma (GBR)

- Amaxa Pharma (GBR)

- Bohemia Pharmaceuticals (GBR)

- Advanz Pharmaceutical

- Highland Therapeutics

- Janssen Pharmaceuticals

- NEOS Therapeutics

- Noven Pharmaceuticals

Healthcare Policies and Regulatory Landscape

The UK government organization known as the Medicines and Healthcare products Regulatory organization (MHRA) is in charge of making sure that drugs, medical equipment, and blood and tissue components are safe for use by the general public. In order to ensure that they adhere to strict safety, quality, and efficacy standards, it controls medications and medical devices in the UK. In the UK, the MHRA is in charge of overseeing every stage of the life cycle of pharmaceuticals and medical devices, from clinical trials and manufacturing to marketing and post-market monitoring. The organization was established as a result of the 2003 merging of the Medical Devices Agency (MDA) and the Medicines Control Agency (MCA), as well as the 2013 edition of the National Institute for Biological Standards and Control. (NIBSC). Its duties also include supervising UK-notified organizations, controlling clinical trials, ensuring that medicines and medical devices are used according to regulations, and providing technical and regulatory guidance for these goods.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Segmentation

By Drug Type (Revenue, USD Billion):

- Stimulants

- Amphetamine

- Methylphenidate

- Dextroamphetamine

- Dexmethylphenidate

- Lisdexamfetamine

- Others

- Non-Stimulants

- Atomoxetine

- Bupropion

- Guanfacine

- Clonidine

By Age Group (Revenue, USD Billion):

- Pediatric And Adolescent

- Adult

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Speciality Clinics

- Retail Pharmacies

- e-Commerce

By Psychotherapy (Revenue, USD Billion):

- Behaviour Therapy

- Cognitive Behavioral Therapy

- Interpersonal Psychotherapy

- Family Therapy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.