UAE Retail Pharmacy Market Analysis

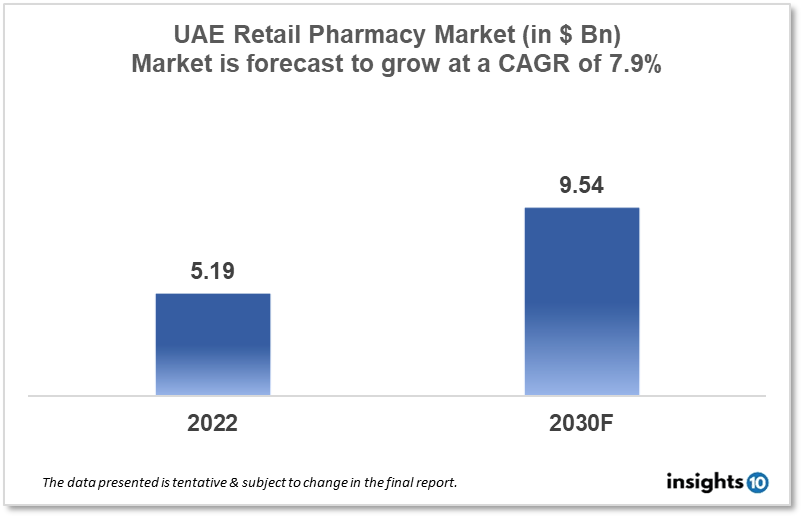

The UAE Retail Pharmacy Market is projected to grow from $5.193 Bn in 2022 to $9.541 Bn by 2030, registering a CAGR of 7.9% during the forecast period of 2022-2030. The market is expected to continue growing at a steady pace in the coming years, with an increasing number of retail pharmacy chains and independent pharmacies opening in the country. Lloyds Pharmacy is a leading retail pharmacy chain in the UAE, with over 70 branches across the country.

Buy Now

UAE Retail Pharmacy Market Executive Summary

The UAE Retail Pharmacy Market is projected to grow from $5.193 Bn in 2022 to $9.541 Bn by 2030, registering a CAGR of 7.9% during the forecast period of 2022-30.

The pharmaceutical market in the United Arab Emirates (UAE) is expected to experience significant growth in the coming years, driven by factors such as an ageing population, increasing prevalence of chronic diseases, and rising healthcare expenditure. The market is segmented into prescription drugs and over-the-counter (OTC) drugs, with the prescription drugs segment accounting for a larger share of the market. The market is also segmented by therapeutic area, with cardiovascular drugs and diabetes drugs being the largest segments.

The government is actively working to improve the healthcare infrastructure in the UAE and increase healthcare expenditure, which is expected to drive the growth of the pharmaceutical market. Additionally, the presence of a large number of international and local pharmaceutical companies in the UAE, along with the availability of advanced medical technologies, is also expected to drive market growth. However, the market may face some challenges such as price controls, regulatory changes, and reimbursement issues.

The retail pharmacy market in the United Arab Emirates (UAE) is a rapidly growing industry, driven by factors such as an increasing population, rising disposable incomes, and a growing focus on preventative healthcare. The market is expected to continue growing at a steady pace in the coming years, with an increasing number of retail pharmacy chains and independent pharmacies opening in the country. The market is highly competitive, with a number of major international and regional players operating in the market. Additionally, the UAE government has implemented several measures to support the growth of the retail pharmacy market, such as implementing regulations to ensure the quality and safety of pharmaceutical products.

Market Dynamics

Market Drivers

The key drivers of the UAE retail pharmacy market include an increasing population, a growing number of tourists, and a rise in chronic diseases. Additionally, the government's efforts to improve healthcare infrastructure and increase access to healthcare services also contribute to the growth of the retail pharmacy market. An increasing focus on preventive healthcare and the availability of a wide range of over-the-counter medications also drive the market.

Market Restraints

The key restraints of the UAE retail pharmacy market include strict regulations and licensing requirements, intense competition among players, and the high cost of pharmaceutical products. Additionally, the presence of a large number of unlicensed pharmacies and the sale of counterfeit drugs also pose a significant challenge to the market. The limited insurance coverage for prescription drugs and the lack of reimbursement for certain medications also act as a restraint on the market. Finally, the limited availability of certain drugs, particularly those that are not commercially viable, can also limit the growth of the retail pharmacy market in the UAE.

Competitive Landscape

Key Players

Some key players in the UAE retail pharmacy market include:

- Aster Pharmacy: Aster DM Healthcare has long held a prominent position as the foremost traditional pharmacy chain in the UAE by the name Aster Pharmacy. Under the ownership of Aster DM Healthcare, this enterprise boasts an extensive network of over 200 brick-and-mortar pharmacies. Beyond their retail pharmacy operations, Aster DM also maintains a well-established network of specialized hospitals within the UAE and has recently extended its presence into the Indian market.

- Life Pharmacy: Life Pharmacy stands as another prominent pharmacy group in the UAE, marked by its ambitious expansion strategy. In a striking move, they inaugurated 10 new pharmacies simultaneously in October 2021, propelling their total outlets to over 300 by the close of the same year. In contrast to Aster, often regarded as a conventional pharmacy due to its affiliations with hospitals, Life Pharmacy has positioned itself as a retailer with a distinct emphasis on over-the-counter (OTC) products and sports nutrition. They have dedicated sections within their outlets catering to items such as superfoods, protein powders, bars, and other health-conscious offerings.

- Supercare Pharmacy: Supercare, a well-established pharmacy chain with a long history in the UAE, is an integral part of the expansive GMG group. Currently operating over 50 outlets, Supercare is actively engaged in an expansion initiative, with plans to unveil multiple new stores in the forthcoming months. Distinguished as a premium provider, Supercare strategically selects store locations that align with their premium image. Their product offerings are similarly positioned with pricing that reflects this premium approach. They place a strong emphasis on introducing distinctive brands that set them apart from their competitors in the market.

- HealthFirst Pharmacy: Since its establishment in 2007, Planet Pharmacies has embarked on a remarkable growth journey. Presently, it boasts a widespread presence across multiple countries in the GCC region and caters to a diverse array of healthcare segments. These encompass pharmaceuticals, skincare, beauty products, healthcare items, nutraceuticals, personal care, baby care, sports nutrition, and medical devices. While we remain committed to our aggressive expansion plans, we remain steadfast in our dedication to addressing the specific needs of our customers and ensuring their utmost satisfaction with our extensive range of products and services. At Planet Pharmacies, we firmly believe that our success is intrinsically tied to the satisfaction of our valued clients. It has presence in KSA, UAE and Oman with more than 80, 70 and 20 pharmacies respectively.

- Boots Pharmacy: Established in 1849 by the Boots family, Boots is the UK’s No. 1 health and beauty retailer. M.H. Alshaya Co. first introduced Boots in the Middle East in 2006 with the launch of the first Boots store in Kuwait. Nine years later, Alshaya operates 90 Boots stores across its markets as part of its portfolio of over 2,600 stores across a range of customer sectors: Fashion & Footwear, Health & Beauty, Food, Optics, Pharmacy, Home Furnishings and Leisure & Entertainment.

- Al Ain Pharmacy: Founded in 1976, Al Ain Pharmacy has been an integral part of the ZAS Group for over four decades. It has consistently held a prominent position as one of the UAE's top pharmacy retail chains. With a network of over 50 healthcare and retail facilities spread across the United Arab Emirates, Al Ain Pharmacy serves a daily customer base exceeding 5000 individuals.

- Med 7: Incorporated by seven renowned UAE pharmacies including Faith Healthcare Group, Med7 is a pioneering pharmacy brand in Dubai.

These are some of the major players operating in the UAE retail pharmacy market, however, there are other local and international players also present in the market.

Healthcare Policies and Regulatory Landscape

The UAE retail pharmacy market is heavily regulated by the Ministry of Health and Prevention (MOHAP), as well as other government bodies such as the Dubai Health Authority (DHA) and the Abu Dhabi Department of Health (DoH).

All pharmacies operating in the UAE must be licensed by the MOHAP, and all medications sold must be approved by the Ministry. Additionally, all pharmacists working in the UAE must be licensed by the MOHAP and the Emirates Medical Association.

The government also monitors the prices of drugs and regulates the import, export, and distribution of drugs. The government also encourages the use of generic drugs as an alternative to expensive branded drugs.

The government also implemented a system of insurance coverage for prescription drugs, which helps in increasing the accessibility of drugs for people who are not able to afford them.

The UAE has also implemented strict regulations to curb the sale of counterfeit drugs, and the government actively works to prevent the influx of fake drugs into the market.

Overall, the regulatory landscape in the UAE is designed to ensure the safety and efficacy of drugs and the quality of pharmacy services and to increase the accessibility of healthcare for the population.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UAE Retail Pharmacy Market Segmentation

Pharmacy Product

It mainly includes Pharmaceutical products and it provides information for medical treatments.

- Prescription

- OTC

Pharmacy Type

- Hospital Pharmacy

- Retail Pharmacy

- Chain

- Independent

- Others

- ePharmacy

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.