UAE Physiotherapy Market Analysis

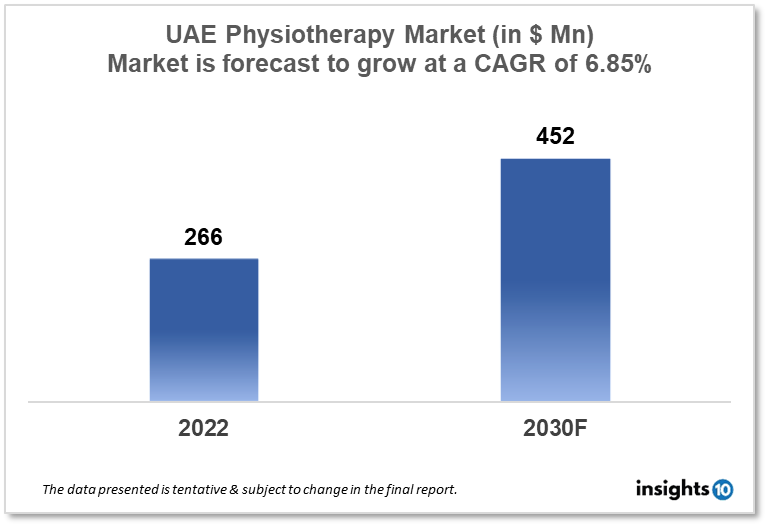

The UAE physiotherapy market size was valued at $266 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 6.85% from 2022 to 2030 and will reach $452 Mn in 2030. UAE physiotherapy market is expected to grow due to an increase in the number of people suffering from chronic conditions such as obesity and diabetes. The market is segmented by Product Type, Application Type, and End User. The major layers in the UAE physiotherapy market Medstar Medical Equipment, Gulf Medical Equipment, Euro Med, Mediplus and others.

Buy Now

UAE Physiotherapy Market Executive Summary

The UAE physiotherapy market size was valued at $266 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 6.85% from 2022 to 2030 and will reach $452 Mn in 2030. As of 2021, the healthcare expenditure in the UAE is relatively high, with estimates ranging from around 4-6% of the country's gross domestic product (GDP).The healthcare system in the UAE is a mix of public and private healthcare providers. The government provides universal coverage for its citizens, and also has a mandate for employers to provide health insurance for their employees. The government also heavily regulates the private sector and sets prices for many procedures.

The physiotherapy services in the UAE can be segmented into two main categories: public and private. Public physiotherapy services are provided by government-funded hospitals and clinics, and are available to all citizens and residents. These services are typically free or low-cost and are generally covered by the government's universal healthcare system.Private physiotherapy services, on the other hand, are provided by private clinics and hospitals, and are typically more expensive than public services. in many gyms and fitness centers as well. Hence demand for the physiotherapy market in UAE will increase in the forecast period.

Market Dynamics

Market Growth Drivers

Growth drivers for the UAE physiotherapy market include, Increasing population and the growing number of expatriates living and working in the UAE. An aging population and an increase in the prevalence of age-related conditions such as arthritis and osteoporosis.

Moreover, an increase in the number of people suffering from chronic conditions such as obesity and diabetes. An increase in the number of people recovering from injuries and surgeries. Furthermore, Growing awareness of the importance of physiotherapy in the prevention and management of chronic diseases.

Market Restraints

UAE physiotherapy market growth also faces some restraints such as limited reimbursement for physiotherapy services by some insurance providers, Shortage of qualified physiotherapy professionals, limited awareness of physiotherapy among the population, high costs of physiotherapy services, which may not be affordable to some people, and limited accessibility of physiotherapy services in remote areas.

Competitive Landscape

Key Players

- Medstar Medical Equipment (UAE)

- Gulf Medical Equipment (UAE)

- Euro Med (UAE)

- Mediplus (UAE)

- EMS Physio Ltd.

- DJO Global, Inc.

- Dynatronics Corporation, Inc.

- Medline Industries

- Performance Health

- Halyard Health

- Patterson Medical

Healthcare Policies and Regulatory Landscape

Policy changes and Reimbursement scenario of UAE Physiotherapy Market

In the United Arab Emirates (UAE), physiotherapy equipment and services are regulated by the Ministry of Health and Prevention (MOHAP) and the Dubai Health Authority (DHA) in Dubai. These agencies are responsible for ensuring that all physiotherapy equipment and services meet safety and performance standards and that they are labeled and marketed correctly.

All physiotherapy equipment and devices must be CE marked to indicate that it meets the essential requirements of the EU Medical Devices Directive before it can be sold in the UAE. The MOHAP and DHA also ensure that all physiotherapy services are provided by licensed physiotherapists and that the physiotherapy services meet certain standards of quality and safety.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

UAE Physiotherapy Market Segmentation

By Product: (Revenue, USD Billion):

Based on product, the physiotherapy equipment market is divided into two major segments, namely, equipment and accessories. The equipment segment accounted for the largest share of the physiotherapy equipment market in 2021. The equipment segment is further segmented into electrotherapy equipment, ultrasound equipment, exercise therapy equipment, heat therapy equipment, cryotherapy equipment, combination therapy equipment, continuous passive motion therapy equipment, shockwave therapy equipment, laser therapy equipment, magnetic pressure therapy equipment, traction therapy, and other physiotherapy equipment (hydrotherapy and vacuum therapy). Owing to the increasing use of electrotherapy equipment in the treatment of musculoskeletal disorders and owing to increasing concerns for patients’ safety and minimal/no side-effects during the physiotherapy treatments.

- Equipment

- Electrotherapy equipment

- Ultrasound equipment

- Exercise therapy equipment

- Heat therapy equipment

- Cryotherapy equipment

- Combination therapy equipment

- Continous passive motion therapy equipment

- Shockwave therapy equipment

- Laser therapy equipment

- Magnetic pressure therapy equipment

- Traction therapy

- Other physiotherapy equipment

- Accessories

- Manual Therapy

- Specialized treatment

- Joint Mobilization Techniques

- Suspension Therapy

By Application (Revenue, USD Billion):

Based on application, the physiotherapy equipment market is segmented into musculoskeletal applications, neurological applications, cardiovascular and pulmonary applications, pediatric applications, gynecological applications, and other applications (including sports and palliative care). The musculoskeletal applications segment holds a dominating share attributed to the increasing adoption of physiotherapies to accelerate recovery of accidental injuries, rising incidence of musculoskeletal disorders, and growth in the geriatric population.

By Applications

- Musculoskeletal applications

- Neurological applications

- Cardiovascular and pulmonary applications

- Pediatric applications

- Gynecological applications

- Other applications

By End-user (Revenue, USD Billion):

Based on end users, the physiotherapy equipment market is segmented into physiotherapy & rehabilitation centers, hospitals, home care settings, physician offices, and other end users (community health centers and elderly care facilities). In 2021, the physiotherapy & rehabilitation centers segment accounted for the largest share of the physiotherapy equipment market due to increasing demand for advanced physiotherapy equipment and their wide usage across the care continuum across these centers.

- Physiotherapy & Rehabilitation centers

- Hospitals

- Home care settings

- Physician offices

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.