UAE Oncology Therapeutics Market Analysis

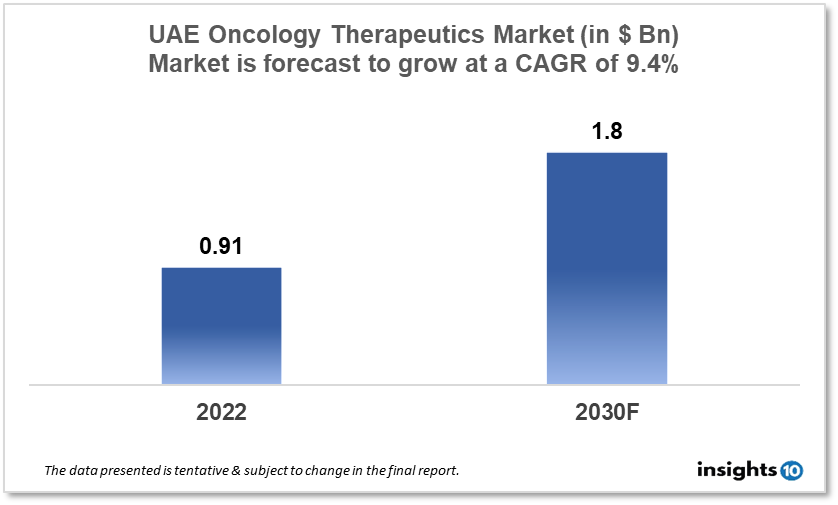

By 2030, it is anticipated that the UAE Oncology Therapeutics Market will reach a value of $1.8 Bn from $0.91 Bn in 2022, growing at a CAGR of 9.4% during 2022-2030. The Oncology Therapeutics Market in UAE is dominated by a few domestic pharmaceutical companies such as Neopharma, Medpharma, and Julphar. The Oncology Therapeutics Market in UAE is segmented into different types of cancer and different therapy type. The major risk factors associated with cancer are diet, alcohol, tobacco, air pollution, and physical inactivity. The demand for UAE Oncology Therapeutics is increasing on account of the rise in initiatives taken by the Government of the country.

Buy Now

UAE Oncology Therapeutics Market Analysis Summary

By 2030, it is anticipated that the UAE Oncology Therapeutics Market will reach a value of $1.8 Bn from $0.91 Bn in 2022, growing at a CAGR of 9.4% during 2022-2030.

United Arab Emirates (UAE) is a high-income, developing country located in the Middle East bordering the Gulf of Oman and the Persian Gulf. Cancer is the UAE's third biggest cause of death; cancer care in the UAE has expanded significantly over the preceding 40 years, from a single centre in Al Ain in 1981 to more than 30 cancer centres and clinics around the UAE today, including at least four comprehensive cancer facilities.

The total number of newly diagnosed cancer cases (malignant and non-malignant) reported to the UAE National Cancer Registry (UAENCR) in 2019 was 4633. Breast, thyroid, colorectal, skin, and leukaemia scored first among all new cancer cases in both sexes. The Emirates Oncology Society (EOS) is the official organisation in the UAE that represents oncology healthcare providers. UAE's government spent 5.5% of its GDP on healthcare in 2020.

Market Dynamics

Market Growth Drivers

Precision oncology, defined as tumour genetic profiling to identify targetable alterations, is rapidly advancing and has reached mainstream clinical practice in the United Arab Emirates. The United Arab Emirates is an excellent regional corporate trading hub. In the UAE, cancer therapies, including the most modern FDA-approved drugs, are widely available. The UAE approval process is short, and many medications are approved soon after they are approved by the FDA. The UAE is committed to reducing cancer mortality by roughly 18% by 2025. Reduced cancer mortality is one of the main performance metrics of the UAE's national agenda as a "Pillar of World-Class Healthcare." These aspects could boost UAE Oncology Therapeutics Market.

Market Restraints

Despite significant gains in medical care, cancer quality control remains inadequate across the UAE, with significant disparities in cancer care across cancer centres. Access to clinical trials is still hampered by a lack of expertise and research infrastructure, as well as a small population, which makes patient recruitment challenging. Instead of the current opportunistic screening technique, a UAE-wide national screening programme with a call-and-recall system covering breast, colorectal, cervical, lung, and prostate cancer is required. These factors may deter new entrants into the UAE Oncology Therapeutics Market.

Competitive Landscape

Key Players

- Julphar: Julphar is a UAE-based pharmaceutical company that produces a range of cancer therapeutics, including chemotherapy drugs and targeted therapies. The company has a strong focus on research and development and has several innovative cancer drugs that are currently in clinical development

- Neopharma: Neopharma is a UAE-based pharmaceutical company that produces a range of cancer therapeutics, including chemotherapy drugs, targeted therapies, and biologics. The company has a strong presence in the Middle East and has expanded its operations to other countries in the region

- Pharma International Company (PIC): PIC is a UAE-based pharmaceutical company that produces a range of cancer therapeutics, including chemotherapy drugs, targeted therapies, and biosimilars. The company has a strong focus on research and development and has several innovative cancer drugs that are currently in clinical development

- Medpharma: Medpharma is a UAE-based pharmaceutical company that produces a range of cancer therapeutics, including chemotherapy drugs and targeted therapies. The company has a strong presence in the UAE and other countries in the Middle East

Notable Recent Deals

January 2023: The worldwide corporation Hikma Pharmaceuticals and the global biopharmaceutical company Celltrion Healthcare Co. have struck a new exclusive licencing deal for the anti-cancer medicine Vegzelma (CT-P16, bevacizumab). Celltrion Healthcare will be in charge of the development, production, and supply of Vegzelma, while Hikma will be in charge of the medicine's sales throughout all of its Mena markets, increasing access to an essential oncology product.

February 2022: Pfizer has expanded its cooperation with the cancer patient organisations Friends of Cancer Patients (FOCP) and Emirates Oncology Society, both of which are based in the UAE, to honour World Cancer Day. The pharmaceutical corporation has renewed its commitment to improving oncology care, boosting early identification, and supporting cancer treatment in the United Arab Emirates.

Healthcare Policies and Reimbursement Scenarios

In the United Arab Emirates (UAE), the administrative body liable for the endorsement and guidelines of remedial items, including disease therapeutics, is the Ministry of Health and Prevention (MOHAP). The repayment of malignant growth therapeutics under the public medical care framework in the UAE is dependent upon the health care coverage framework, which expects occupants to have health care coverage inclusion. The healthcare coverage framework in the UAE is managed by the Dubai Health Authority (DHA) and the Health Authority - Abu Dhabi (HAAD).

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Oncology Therapeutics Segmentation

By Application (Revenue, USD Billion):

- Blood Cancer

- ?Colorectal Cancer

- Gastrointestinal Cancer

- Gynaecologic Cancer

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- ?Others

By Drugs (Revenue, USD Billion):

- Revlimid

- Avastin

- Herceptin

- Rituxan

- Opdivo

- Gleevec

- Velcade

- Imbruvica

- Ibrance

- Zytiga

- Alimta

- Xtandi

- Tarceva

- Perjeta

- Temodar

- Others

By Therapy (Revenue, USD Billion):

- Chemotherapy

- Targeted Therapy

- Immunotherapy

- Hormonal Therapy

- Others

By Route of Administration (Revenue, USD Billion):

- Oral

- Parenteral

- Others

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- ?Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.