UAE Neurology Devices Market Analysis

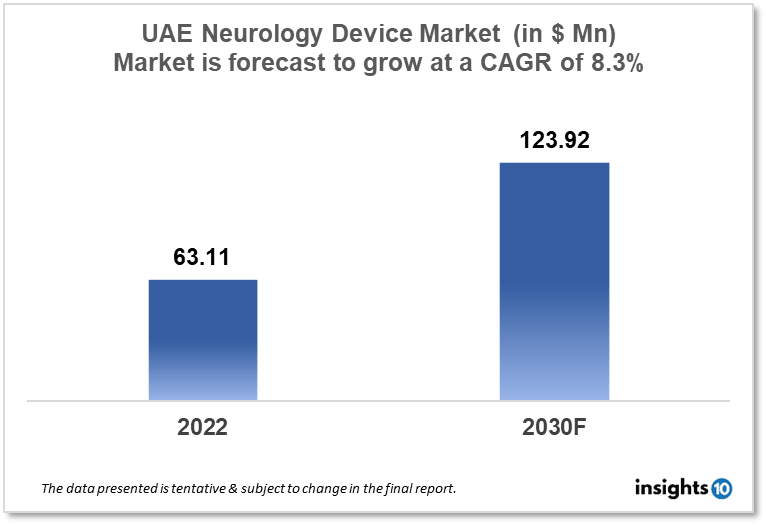

UAE Neurology Device Market size is at around $63.11 Mn in 2022 and is projected to reach $123.92 Mn in 2030, exhibiting a CAGR of 8.3% during the forecast period. Aspiring to be the center of medical excellence in surgical and non-invasive interventions in the gulf region the increasing prevalence of neurological diseases drive the demand. Major players like Abu Dhabi Medical Devices Company, Atlas Medical Group, Al Naghi Medical, and Kiwi Medical Supplies are giants in neurology devices. This report by Insights10 is segmented by product type like neurostimulation, interventional neurology, neurosurgery devices, and neuro-endoscopes, and by the end user.

Buy Now

UAE Neurology Device Market Executive Summary

UAE Neurology Device Market size is at around $63.11 Mn in 2022 and is projected to reach $123.92 Mn in 2030, exhibiting a CAGR of 8.3% during the forecast period. For the past ten years, the United Arab Emirates (UAE) has been the largest US export market in the Middle East and North Africa region, as well as a vital regional hub for 1,500 American companies doing business in the Middle East, Africa, and South Asia. The UAE has a population of around 9.4 million people, with approximately 85% of them being expatriates. The UAE's GDP is forecast to grow thanks to a $13.6 Bn stimulus package led by Abu Dhabi and a slew of initiatives aimed at making doing business easier across the country. The UAE's health expenditures are expected to climb to $18.3 Bn by 2023. In Dubai, the UAE government introduced a new health insurance programme to assist nationals who are not covered by any other government-funded health insurance programme. This scheme provided healthcare to around 130,000 people in and around Dubai at 23 private hospitals and over 500 medical clinics. In June 2016, the Dubai Health Authority (DHA) stated that all Dubai residents will be required to get health insurance, which would be linked to the renewal and issuance of their UAE residence visas. The UAE government wishes to increase the number of medical tourists visiting the country in order to position Dubai as a regional centre of healthcare expertise. The country has a strong transportation and logistics infrastructure and is strategically well-positioned to serve as the hub of a transportation network connecting the economies of India and China to Europe and the United States. These considerations also make the country an appealing location for building a regional medical equipment distribution centre.

Sales of interventional neurology devices used to treat neurovascular illnesses such as aneurysms, arteriovenous malformations, cavernous malformations, and stroke comprise the interventional neurology devices and equipment market. Neurovascular devices are another name for interventional neurology devices. Aneurysm coiling and embolization devices, cerebrospinal fluid management devices, neuro thrombectomy devices, and support devices are the most common types of interventional neurology devices and equipment. The UAE Neurology Device Market is expected to be worth $63.11 million in 2022 and $123.92 million in 2030, with a CAGR of 8.8% during the forecast period. The neuro thrombectomy devices are used to accomplish angiographical mechanical thrombus removal from intracranial arteries. Embolic coils, flow diversion devices, and liquid embolic devices are examples of aneurysm coiling and embolization devices.

Carotid artery stents and embolic protection systems are two types of angioplasty devices. Micro guidewires and microcatheters are two forms of support devices. Clot retrieval devices, suction and aspiration devices, and snares are examples of neuro-thrombectomy devices. Neurostimulation relieves pain by interfering with the pain impulses that pass between the spinal cord and the brain. In other terms, it outwits your discomfort. As you change positions, the pain can shift and escalate. Using a handheld programmer, you can vary the strength and placement of stimulation to accommodate these fluctuations in pain. For example, if your pain shifts or worsens at different times of the day or during different activities, such as walking, sleeping, or sitting, you can adapt these changes with varied stimulation settings.

A fully implanted neurostimulation system is made up of several components, including a neurostimulator, leads, a physician's programmer, and a patient's programmer. The instrument that produces electrical impulses (placed under the skin in your abdomen or upper buttock), Thin, insulated medical wires that deliver electrical pulses to the epidural space near the spine, a device in your doctor's office that allows your doctor to adjust the neurostimulation system and its settings, and a handheld device you can use to customise the stimulation after you leave the doctor's office. The neurostimulation technology is completely silent. It may feel like a little bump under your skin, although it usually does not appear through your clothes. Spinal cord stimulation has advantages over other chronic pain therapies. Unlike other chronic pain treatments or operations, spinal cord stimulation can be tried to see if it reduces your pain before committing to long-term therapy.

The market for interventional neurology devices is being driven by an increase in the patient population suffering from neurological illnesses. Alzheimer's disease, cerebrovascular diseases such as stroke, migraine, and other headache disorders are on the rise. The main causes of neural disorders are the rapid increase in the geriatric population, high-stress levels in young people, and head injuries from accidents. According to the Brain Aneurysm Foundation, 6 Mn people in the US have unruptured brain aneurysms, more than 50 Mn have epilepsy, and more than 47 Mn have dementia. As a result, the rapid rise in the incidence of neurological illnesses is expected to drive the market throughout the forecast period. The UAE's recent technological advancements in interventional neurology equipment are projected to yield significant outcomes in the treatment of brain aneurysms with embolic coils. The stent system offers excellent support during coiling procedures and was developed to provide the coil support and wall apposition required to accomplish an efficient stent-assisted coiling treatment.

Market Dynamics

Market Growth Drivers

In certain areas, a law enabling 100% foreign ownership of enterprises in the UAE is now in effect. The regulation is intended to make the country more appealing to investors while having a minimal impact on local enterprises. Previously, foreign corporations intending to create an entity onshore in the UAE had to partner with a UAE person who had to own 51% of the company's shares. A rising medical tourism industry is driving demand for sophisticated facilities outfitted with cutting-edge medical technology. Medical device output will remain minimal and limited to basic goods such as different types of syringes and IV sets. The initiative intends to make the UAE more appealing to investors, create jobs, and diversify the economy. There are also free zones within the UAE that provide a wide range of benefits and flexibility to businesses, such as 100% foreign ownership through branches, single or multiple shareholder companies - known as Free Zone Enterprises (FZEs), Free Zone Companies (FZCOs), or Free Zone Limited Liability Companies (FZ-LLCs), no national agent required for foreign company branch offices, and special assistance in obtaining work permits for staff. The majority of people that go to the UAE for healthcare come from the Middle East and North Africa, Thailand, and India, all of which are less expensive than the UAE. In terms of middle-to-high-income patients, the UAE continues to outperform its competitors. The UAE must recruit patients from the wealthy upper classes of Africa, the Middle East, and Asia, which will be difficult given that many of these patients can afford to travel to Europe for treatment. The UAE will be able to outperform European providers by providing culturally appropriate care for Muslim patients as well as high-quality specialised services.

Market Restraints

The UAE has a dearth of qualified medical workers. As a result of governmental and private investment, various hospital construction and refurbishment projects are now underway. According to the Dubai Health Authority (DHA), the UAE requires an additional 8,000 hospital beds by 2025, hence it is pushing for additional private-sector investment. According to estimates, the country now has a deficit of about 2,000 hospital beds, despite a 30% rise in the number of beds in recent years. In the UAE, sub-sectors of medical devices such as hospital beds are limited. The UAE has the Gulf Cooperation Council's lowest hospital bed density (the number of hospital beds per 1,000 population) (GCC). The UAE also has a dearth of medical workers and training opportunities. In 2020, the estimated number of hospital beds was 12,903 or 1.4 per thousand inhabitants. As a result of governmental and private investment, there are various hospitals under construction and restoration schemes underway. A rising medical tourism industry is driving demand for sophisticated facilities outfitted with cutting-edge medical technology. According to the UAE Commercial Companies Law, each business founded in the UAE must have one or more UAE national partners who own at least 51% of the company's capital.

Competitive Landscape

Key Players

- Abu Dhabi Medical Devices Company

- Atlas Medical Group

- Al Naghi Medical Co.

- Kiwi Medical Supplies

- AL MAQM Medical Supplies

- GE Healthcare

- Mindray UAE

- Siemens Healthcare

- Philips Healthcare

- Hitachi Medical Systems

- Shimadzu

- Medtronic

- Johnson & Johnson

- Abbott Laboratories

- Becton

- Dickinson and Company

- Baxter International

Healthcare Policies and Regulatory Landscape

Current UAE medical device regulations are based upon Australian Therapeutic Goods Administration (TGA), and US Food and Drug Administration (FDA) regulations. Products with Europe, Australian, Canadian, and US approval are eligible for a shortened registration process in the UAE. Furthermore, once the exporter company/manufacturer or distributor has been approved by the Ministry of Health and Prevention (MOHAP) committee, a registration number will be given that is valid for five years. The application approval issuance depends on the completion of the required documents by MOHAP. An application to register a medical device in the UAE must be made by the device manufacturer or its local representative or distributor. The local representative or distributor must be formally authorized by the manufacturer to handle the application process and the manufacturer’s legal obligations and responsibilities with regard to placing the medical device on the UAE market. The authorized representative or distributor must be available to liaise between the medical device manufacturer and the MOHAP.

Reimbursement Scenario

The availability of private insurance reimbursement for neurology medical devices in the UAE may depend on the specific insurance policy and the type of device being used. Some private insurance providers in the UAE may cover the cost of certain neurology medical devices as part of their overall coverage, while others may only cover specific devices or types of devices. It's best to check with your individual insurance provider to determine if your particular policy covers the cost of the neurology medical device you are seeking.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Neurology Device Market Segmentation

The Neurology Device Market is segmented as mentioned below:

By Product Type (Revenue, USD Billion):

- Neurostimulation

- ?Spinal Cord Stimulation Devices

- Deep Brain Stimulation Devices

- Sacral Nerve Stimulation

- Vagus Nerve Stimulation

- Gastric Electric Stimulation

- Interventional Neurology

- Aneurysm Coiling & Embolization

- Embolic Coils

- Flow Diversion Devices

- Liquid Embolic Agents

- Cerebral Balloon Angioplasty & Stenting

- Carotid Artery Stents

- Filter Devices

- Balloon Occlusion Devices

- Neurothrombectomy

- Clot Retriever

- Suction Aspiration Devices

- Snares

- CSF Management

- CSF Shunts

- CSF Drainage

- Neurosurgery Devices

- Ultrasonic Aspirators

- Stereotactic Systems

- Neuroendoscopes

- Aneurysm Clips

By End User (Revenue, USD Billion):

- ??Hospitals and Clinics

- Specialty Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.